Dumb Money Shorting Stocks Using Funds and ETF's

Stock-Markets / Exchange Traded Funds Sep 09, 2009 - 10:35 AM GMTBy: Mike_Stathis

As I sat at home on this early Saturday morning doing some research, I ran across an article I wanted to bring to your attention. First, I want you to notice the title. Next, I want you to notice the publication. And finally, I want you to ask yourself if the title/claim lives up to its expectations.

As I sat at home on this early Saturday morning doing some research, I ran across an article I wanted to bring to your attention. First, I want you to notice the title. Next, I want you to notice the publication. And finally, I want you to ask yourself if the title/claim lives up to its expectations.

The title of this piece is "How to Sell a Stock Short," published in Smart Money. Once again, we have another journalist who most likely has never shorted a stock in her life, yet acting as some experienced pro.

The title of this piece is "How to Sell a Stock Short," published in Smart Money. Once again, we have another journalist who most likely has never shorted a stock in her life, yet acting as some experienced pro.

The most disturbing thing about this article other than the fact that she didn't show the reader how to short stocks, is the fact that Smart Money is engaging in the facilitation of the stock market casino mentality by even discussing the most risky technique for investors.

As I have stated in the past, under virtually no circumstances should non-professional investors even consider shorting individual stocks. The only possible exception of course is when they are virtually certain of a collapse in share price, which is virtually impossible for anyone to know, professional or non-professional.

I only mention this rare and difficult to determine exception due to the fact that I was able to identify spectacular shorting opportunities for the mortgage, bank and homebuilder stocks back in early 2007 with the release of Cashing in on the Real Estate Bubble.

Seeing this trash really ticks me off because it adds to the momentum out there to popularize shorting, which only introduces extreme risk to non-professional investors. What could be the motive in the article? Well, think about it. Wall Street loves this type of trash because it brings more dumb money into the picture.

I don't expect all non-professionals to understand the full risks of shorting stocks, nor the compliance involved for brokers who wish to short stocks for their clients. But all of you professionals out there know that compliance is extremely rigorous. In the vast majority of cases, most of the big Wall Street firms simply will not permit their brokers to solicit shorting transactions for their clients.

Yet, with just a click of your mouse, you can short virtually any stock using an online broker; why? Because they have set up the perfect business. They essentially have no liability for allowing you to blow yourself up, unlike Wall Street firms. This of course explains why online brokers have sold you this grand epiphany that you can "do it yourself." The only thing for certain you can do yourself as far as investments are concerned is blow yourself up.

Now let's have a look at this article. http://www.smartmoney.com/Investing/Stocks/Active-Trader-How-to-Sell-a-Stock-Short/?afl=yahoo

If this is smart money, I'll take the dumb money.

Let me point out that the reporter departs from her initial teaser (shorting a stock) into an advertisement for short funds. First, she mentions Federated's bear mutual fund without bothering to point out that the performance is miserable. Understand that only since around late 2007 has the fund even yielded decent NET returns.

At this point, perhaps you are thinking to yourself..."I don't see how this article is so atrocious." If I have described you, it means you have no idea how to short stocks.

I am going to send all subscribers to the newsletter a portion from Cashing in on the Real Estate Bubble, where I provide a brief tutorial on the shorting process; not because I want to encourage you to short stocks - quite the opposite. I want to encourage you to never short stocks because it is extremely risky.

Until you have experienced one or more of the many things that can go wrong when taking individual short positions, you really have no idea of the potential danger in this maneuver. Let me save you some money; potentially a lot...never short individual stocks.

I'm going to send this tutorial so you can see just how useless and reckless this Smart Money article is. But I also want to send it to you so you can gain an appreciation of the complexities and uncertainties involved when shorting stocks.

Now, if you appreciated this head's up, do me a favor and a favor to all of your fellow Main Street investors and email Smart Money. Tell them you do not appreciate such an irresponsible article that tries to make the most risky investment maneuver mainstream, nor do you appreciate the uselessness of the article. Tell them to stick to what they were trained to do - report news. And you might want to add that they need to stop with the spins and bias because readers want value, not agenda-filled trash that only benefits their financial industry sponsors.

In Part 2, I will discuss in detail the performance of these funds the author mentions, showing you that they really don't look so good as one might expect. http://www.avaresearch.com/article_details-360.html

Dumb Money (Part 2)

Contrary to the claim that Federated’s Prudent Bear Fund holds more short than long stock positions (according to the fund profile as provided on Yahoo! Finance), if you check the current top holdings, you won't see a single short position.

Upon closer examination, you will note that nine of the top ten holdings consist of precious metals mining stocks; so much for diversification. BUT, the total percent of these nine positions comes to less than 3% of the portfolio.

What this means is that the fund holds potentially hundreds of different securities (do the math). Folks, this is what is known as over-diversification; a method used by fund managers who simply have no idea where to turn. I discuss this in the appendices of The Wall Street

Investment Bible because I feel it’s such an elementary concept that I did not want to waste space in the main body of the book.

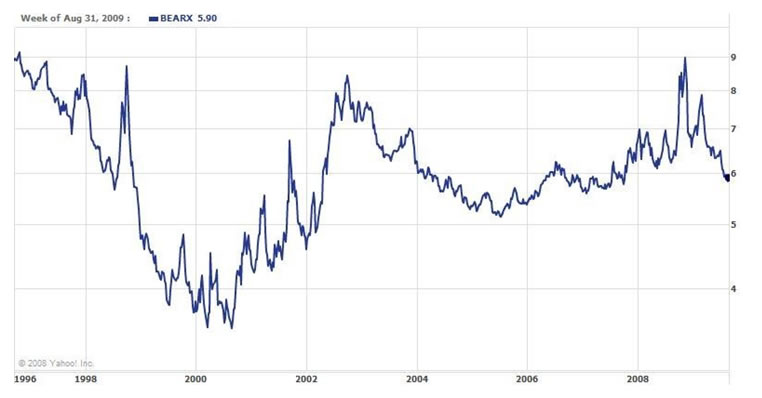

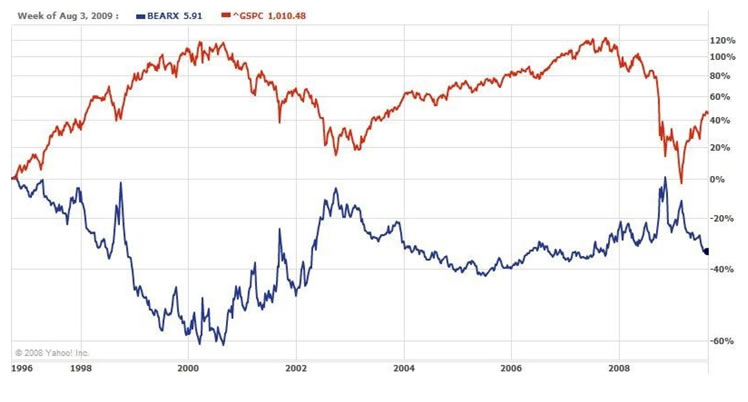

What about the fund's performance? Well, first, consider that the fund began in 1996, during the Nasdaq bubble. Therefore, because it is a bear fund you would expect it to have performed very well since that time since the U.S. stock market has experienced the two largest blow-ups in history.

However, if you check the 3-, 5-, and 10-year/max performance, you will see that after fees, the fund didn't even beat the S&P 500.

Furthermore, when you consider that the fund has been structured to take advantage of market timing and can hold a huge percentage of cash (thus avoiding market collapses), the fund's performance is much more miserable

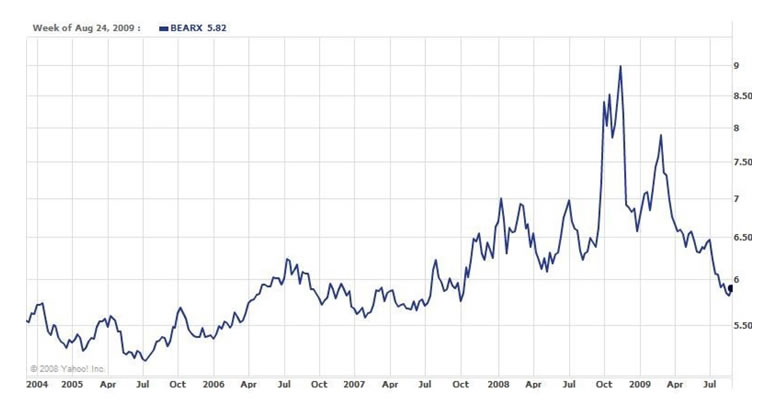

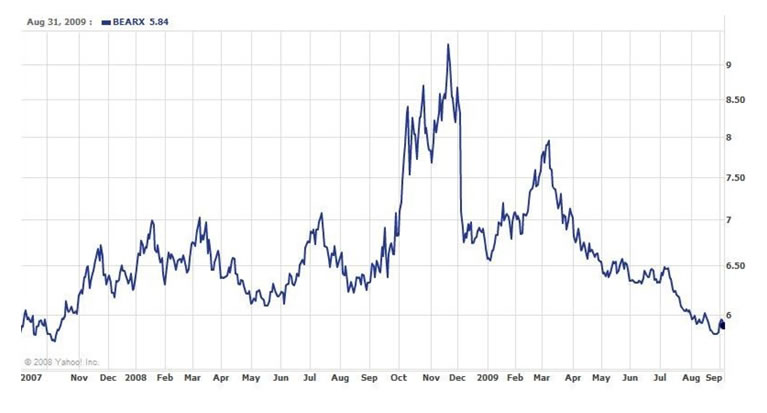

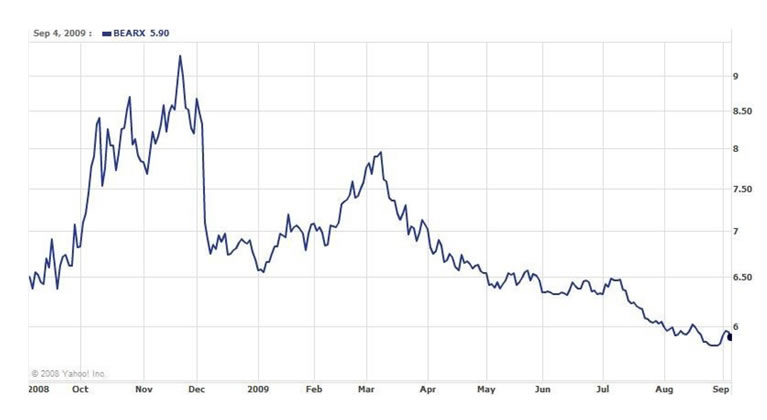

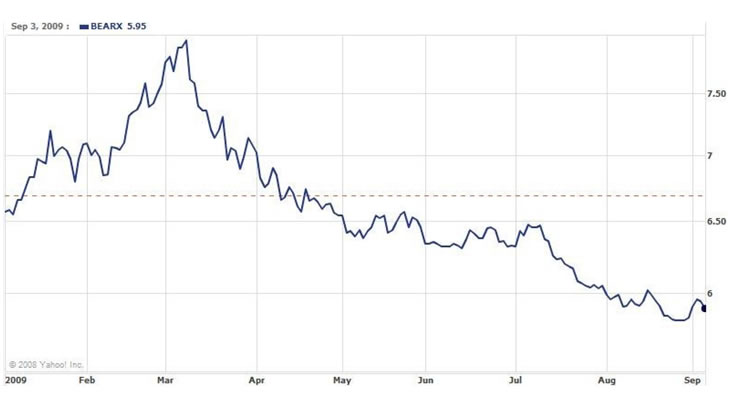

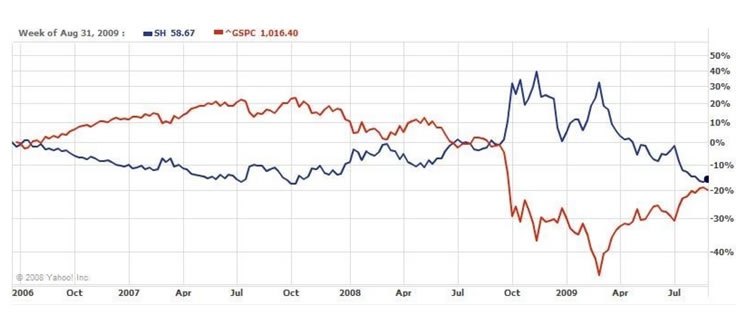

Below I have shown the price chart of the fund over different periods so you can get an idea just how pathetic the performance has been.

Would you want to own this fund? Remember, each year you are getting over 3% (perhaps over 4%) sucked out of your assets in total fees. These fees compound over the years, meaning that the performance is much worse.

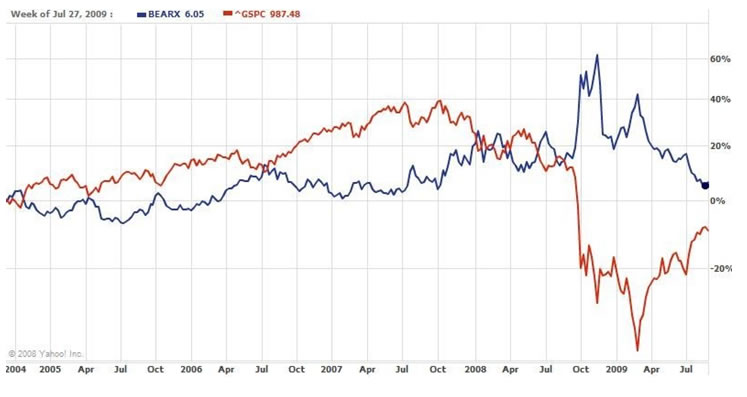

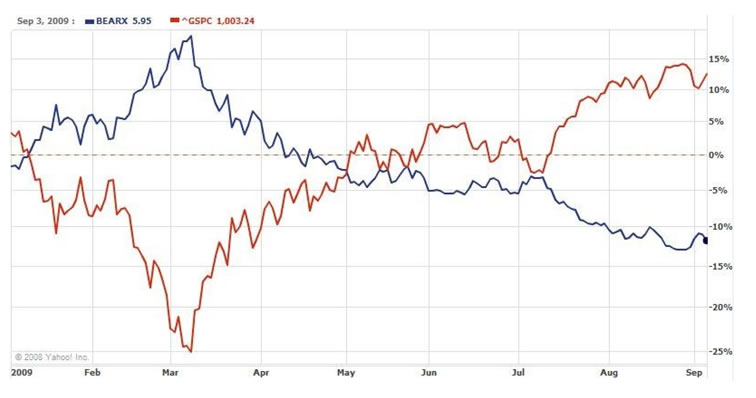

Now I’ve shown the same price charts versus the S&P 500 Index. Once again, the performance of this fund is BEFORE fees.

Notice how the fund has an inverse performance of the S&P 500 Index. Why would anyone want to pay 3-4% annually for crummy performance?? Heck, you’re better off with a buy-and-hold Vanguard fund which has better performance and lower fees! And if you want a short position, just short one of the S&P 500 ETFs like the SPY.

As a few of you might know, Federated bought this “sheep fund” from David Tice, another loud-mouthed extremist who has been preaching doom and gloom since the 1990s. Incidentally, he and Peter Schiff are buddies. You see, both are gold bugs. In fact, you might note that of Schiff's data charts in his book (some 3 charts in total I believe) they were cut and paste from Tice's prudent bear website.

Furthermore, one of the reviews for his book was from his fellow doomer extremist, no other than Tice.

So how was Tice able to get Federated to buy this dog for a couple hundred million dollars? The answer is that Federated was buying assets, not performance. As long as you have investors in a fund, the fund generates a somewhat predictable stream of revenues.

So how was Tice able to draw so many sheep into his fund?

Well, you see Tice was a media ham for CNBC a few years ago. It was from his appearances that he was able to attract the dumb money from the sheep that watch this trash network.

It is for this reason that every scumbag tries to get on CNBC so they can attract the dumb money. And they do whatever it takes to be the next media ham.

The next fund the Smart Money author mentions is the S&P 500 Proshares, which mimics the inverse price performance of the S&P 500 Index.

The author fails to mention that this fund uses a variety of speculative derivatives to mimic the performance rather than actually shorting the S&P 500 index.

Furthermore, the author fails to mention that even with this un-leveraged fund, you will lose money if you hold it long-term.

Many people have become aware of the fact that you can actually lose money by holding inverse leveraged funds even when the market goes down. But you probably haven't heard the same for un-leveraged funds. Well, I am here to show you that, yes you can. The chart below illustrates this.

Still can’t figure it out? Let me help you. Have a look at the same chart below.

I just realized something. I spent far more time and effort in tearing apart this useless Smart Money article (as a public service) than the reporter (who gets paid) did to create this trash. I find that highly pathetic on the part of the reporter. And these guys wonder why their industry is collapsing.

I urge you to email this article to everyone you know, especially if they have mutual funds because it is a perfect example of how so many investors have no idea what they are getting themselves into. They are making these guys wealthy on their dollar.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.