The Financial Crash, U.S. Dollar, Cash and Gold

Stock-Markets / Financial Markets 2009 Sep 16, 2009 - 09:21 AM GMTBy: Tarek_Saab

With the Dow continuing its steady climb into September, economists are giddy with enthusiasm as they usher forth a stream of emotional pontification throughout the news media. Calls for a new bull market and an end to the recession are increasing with the rising levels of optimism (see: MarketWatch). How anyone can be bullish on stocks despite the innumerable economic warning signs is beyond my comprehension.

With the Dow continuing its steady climb into September, economists are giddy with enthusiasm as they usher forth a stream of emotional pontification throughout the news media. Calls for a new bull market and an end to the recession are increasing with the rising levels of optimism (see: MarketWatch). How anyone can be bullish on stocks despite the innumerable economic warning signs is beyond my comprehension.

The recent figures in the Daily Sentiment Index reporting that traders are 89-90% bullish is a testament to human emotion as a market mover and the efficacy of state-run propaganda. Do economists really believe in the power of green shoots? Incidentally, the college term "green shoot" represents a different kind of stimulus. Maybe that explains it.

But one man's bull market is another man's gilded rally, as the mania always peaks at the end.

This mania has been especially intriguing to observe among gold bugs, at the present time vindicated by gold's heroic push into four-figure territory. Some claim gold is "finally" on the verge of breaking out, as though the yellow metal hasn't spent the entire decade breaking out.

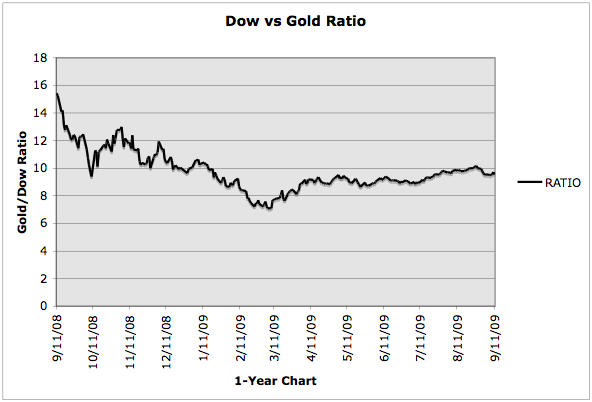

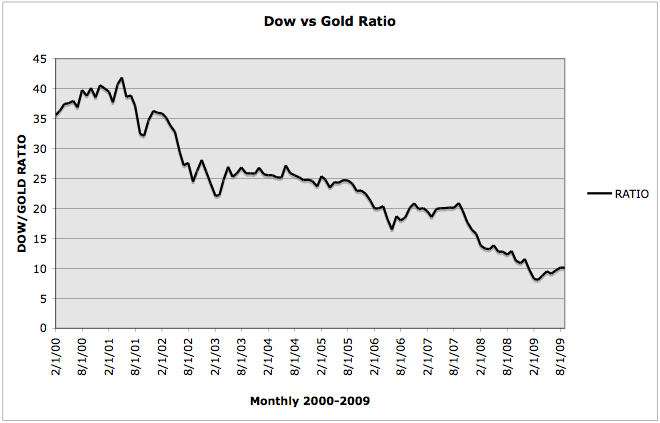

But the dollar price of gold, while important, is only a secondary consideration to its value against all other assets, hence the reason that many, like me, favor a strong gold position in a deflationary or hyperinflationary environment. Since gold is true money, and intrinsically, fiat currency is hardly worth the paper it is written on, then the value of assets in terms of gold is a better barometer of gold's performance than its price in dollars. While gold's push above $1,000 has been exciting for many, it is worth noting, as a rudimentary comparison, that gold has actually lost ground to the Dow in the last six months.

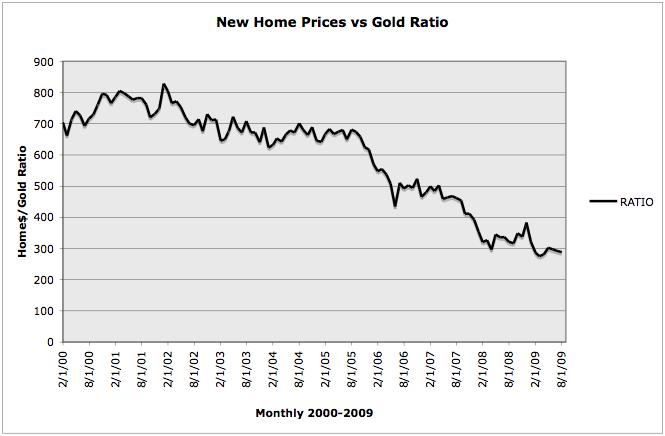

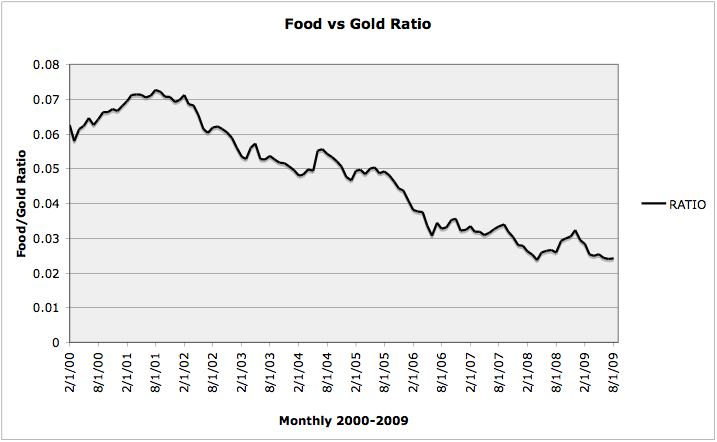

However, when measured over a wider swath of time, we see a clearer picture of gold's formidableness. Gold's performance lays waste to the notion that the economy is "strengthening" or in "recovery," and manifests the stark, decade-long decline of our nation's economy. I have included only three comparisons below to prevent redundancy because all of the comparisons against gold look the same. The US economy is clearly in a depression when measured against real money.

(Bureau of Labor Statistics, US City national average composite of prices: Pasta, Flour, Bread, Ground Beef, Turkey, Milk, Butter, Cheddar Cheese, Apples, Bananas, Potatoes, Lettuce, Broccoli, Sugar)

This silent crash, among other things, is the reason business is a-boomin' for those in the doomsday market. And that is a terrible thing. Surf the web long enough and you will uncover a mini-catalog of downer books like Crash Proof, Conquer the Crash, How to Survive the Collapse of Civilization, and How to Survive the End of the World As We Know It, among many others. You will invariably encounter writers predicting some specie of the Great, Greater, or Greatest Depression. (Yes, that would include me.)

Everywhere we hear of well-meaning citizens prepping with the four "G"s: guns, gold, groceries, and God.

Or the four "F"s: food, funds, firearms, and faith.

Or the four "B"s: beans, bullion, bullets, and Bible.

There exists a stark polarization in mood between the powers-that-be and their "bosses" - the American public. Emerging from the cold war and into the gold war, many patriotic Americans have shifted their panic from foreign to domestic enemies. What does it say about the empire when, in fear of the government, a good segment of its citizens have hunkered down with food and ammo, or when millions of "taxpayers" march on Washington? Is there any way this ends well?

Meanwhile, the US dollar is in need of a new PR firm. According to the Daily Sentiment Index, only 3-4% of traders are bullish on the dollar, meaning a historic number are bearish. Well, dollar bears beware: Those are leading indicators of an imminent change in direction. The sentiment is actually worse than in March of '08 when 5% were bulls. As for a reversal, history speaks for itself.

Meanwhile, the US dollar is in need of a new PR firm. According to the Daily Sentiment Index, only 3-4% of traders are bullish on the dollar, meaning a historic number are bearish. Well, dollar bears beware: Those are leading indicators of an imminent change in direction. The sentiment is actually worse than in March of '08 when 5% were bulls. As for a reversal, history speaks for itself.

Contrary to popular belief, the US dollar, that black sheep of international currency, may once again strengthen its power grip under deflationary pressure - at least in the near term. Now wouldn't that come as a shock the investment world? One might even be inclined to invest in the dollar if one could actually trust the dollar. The threat of debt defaults, the proliferation of SDRs, the loss of reserve currency status - all remain ominous possibilities, and all render that king of deflation to be largely precarious.

We are left with gold. Whether your camp is hyperinflation or deflation (or any of the 'flations), gold is king, regardless of spot price.

'Til next time, that's my Saab Story.

By Tarek Saab

Tarek Saab is a former finalist on NBC's "The Apprentice" with Donald Trump. He is an international speaker, syndicated author, entrepreneur, and the President of Gold&SilverNow. His website is www.goldandsilvernow.com

© 2009 Copyright Tarek Saab is - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.