Gasoline Prices - It's all about the Refineries ... For Now

Commodities / Crude Oil Jun 23, 2007 - 03:52 PM GMTBy: Tim_Iacono

If you've been wondering why gasoline prices have been so high lately with crude oil trading at only $66 per barrel, the answer can be found at the refineries.

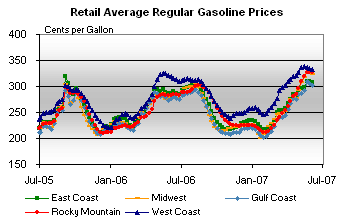

This week's TWIP (This Week in Petroleum) from the Energy Information Administration has some interesting commentary and, as always, abundant charts to tell the story of how retail gasoline prices have fallen for the second consecutive week, down five cents to $3.16 per gallon.

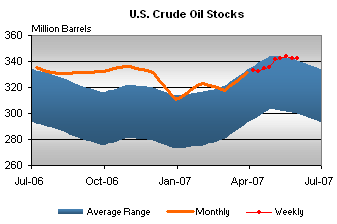

First, it should be clear that this is not an oil problem. U.S. oil inventories, the biggest raw material cost for gasoline (duh!) have been at or above the range considered normal for this time of year. There is no oil problem - that will occur sometime in the future, maybe soon, we'll see.

Yet, prices at the pump remain near record highs, particularly here on the West Coast where special formulation requirements and higher taxes almost always result in higher prices.

Lucky us - at least there's no big brown cloud hanging over the Western U.S. (except sometimes in Phoenix) like the one hanging over parts of developing Asia .

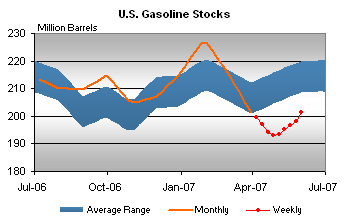

Gasoline stocks are way down, though they've been recovering dramatically in recent weeks as indicated by the current slope of the red-dotted line below. It turned ultra-steep last week in an attempt to make up for lost time and keep up with demand from the summer driving season that just started.

Have the refineries suddenly finished all their yearly maintenance work and flipped all the right switches to boost production?

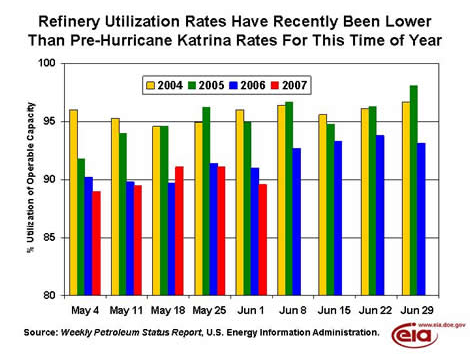

Production has improved in recent weeks but it remains below levels from December of last year - refinery utilization for this time of the year is still below the levels of the last three years.

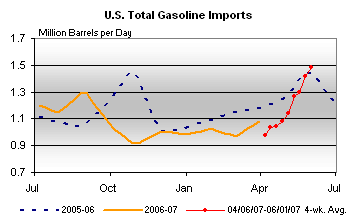

The downward price pressure (if you can call retail prices falling from $3.30 per gallon to $3.16 per gallon price pressure) comes largely from an increase in gasoline imports which have reached new multi-year highs.

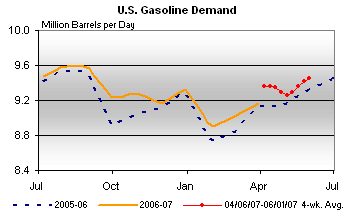

And of course demand continues to increase, current levels of consumption for this time of year again at all time highs despite the higher prices.

Remember what a big deal it was a couple years ago when when gasoline stations couldn't find enough number 3s to put up on their signs out at the curb?

With the precarious balance between the supply and demand for crude oil combined with aging refineries, it seems only a matter of time before there is a new crisis - finding enough number 4s.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.