The Recession has Technically Ended, Is Bernanke Joking?

Economics / Recession 2008 - 2010 Sep 19, 2009 - 12:37 PM GMTBy: Bob_Chapman

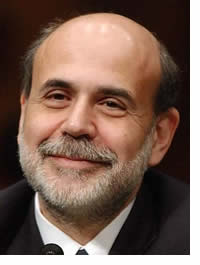

To borrow from an old joke about politicians, we ask our subscribers if they know how to tell when Helicopter Ben Bernanke, the current Fed Head, is lying. Answer: Whenever his lips are moving. Now we hear from the Dollar-Destroyer that our recession has technically ended (heaven forbid that we should call our current Fed-caused calamity a depression, which is what it has been since Obama took office). So we guess that we should take his word for it, seeing that every call he has made during his short tenure as Chairman of the Federal Reserve Board has been 100% wrong.

To borrow from an old joke about politicians, we ask our subscribers if they know how to tell when Helicopter Ben Bernanke, the current Fed Head, is lying. Answer: Whenever his lips are moving. Now we hear from the Dollar-Destroyer that our recession has technically ended (heaven forbid that we should call our current Fed-caused calamity a depression, which is what it has been since Obama took office). So we guess that we should take his word for it, seeing that every call he has made during his short tenure as Chairman of the Federal Reserve Board has been 100% wrong.

Surely you're joking, Mr. Bernanke!!! Apparently, we are just supposed to ignore our tanking dollar, rising unemployment, ever-weakening consumer spending (which only accounts for 70% of our GDP), a moribund real estate market, trillions in losses lying dormant in the zombie bank mark-to-model scam, not to mention all the off-the-books losses in derivatives pawned off on bank customers after Glass-Steagall was repealed as well as a glowing, smoking Quadrillion Dollar Derivative Death Star waiting to go supernova to the tune of tens of trillions in losses that will vaporize the entire world banking system thanks to the total deregulation of OTC derivatives courtesy of the Commodities Futures Modernization Act.

Surely you're joking, Mr. Bernanke!!! Apparently, we are just supposed to ignore our tanking dollar, rising unemployment, ever-weakening consumer spending (which only accounts for 70% of our GDP), a moribund real estate market, trillions in losses lying dormant in the zombie bank mark-to-model scam, not to mention all the off-the-books losses in derivatives pawned off on bank customers after Glass-Steagall was repealed as well as a glowing, smoking Quadrillion Dollar Derivative Death Star waiting to go supernova to the tune of tens of trillions in losses that will vaporize the entire world banking system thanks to the total deregulation of OTC derivatives courtesy of the Commodities Futures Modernization Act.

Then there are the ongoing multi-trillion dollar money siphons in Iraq and Afghanistan, thousands of banks, including all the "anointed" legacy banks, that are buried in derivatives and about to fail, a bankrupt Social Security System, a totally naked FDIC, a Fed printing trillions of dollars out of thin air, in secret, without any accountability, and future multi-trillion dollar budget deficits being incurred to keep a totally comatose economy on artificial, taxpayer-sponsored life support. If that sounds like the end of a recession to the people on planet earth, then beam us up Scotty, we're on a planet full of psychopaths suffering from hallucinations and delusions of grandeur. Oh, and Scotty, make sure you remember to beam our gold and silver up with us. We're certainly going to need it the next time we come back to Planet Earth for an exploratory visit to see if the collective, ongoing phantasmagoric, mushroom-induced hallucinations of its inhabitants have finally run their course.

Note that open interest for the USDX, after rising to a little over 41,000, which is above average, has suddenly collapsed to below 34,000 as of 9/16/09. The dollar is no longer being defended because the Illuminist cabal plans to take the stock markets up to a blow off interim top around Dow 10,000 to 10,500 with a final short-covering rally either this week, or perhaps the middle of next month, as general stock market options expire. They will then attempt to orchestrate a major stock market correction, which is now long expected and long overdue, just as gold and silver really start to take off.

The only question is, how long and how high will they try to take the stock markets before the long awaited correction is allowed to occur as the PPT withdraws its support. The answer, as usual, will be determined by the gold and silver markets, and the strength of their now ongoing rallies. If the rallies in gold and silver get out of hand as hundreds of millions of Chinese and Indians jump on the gold and silver bandwagons while China reneges on its losses in OTC gold and silver shorts, you can count on a major stock market correction immediately. Another tip off will be a large jump in open interest for USDX futures contracts again, this time probably to well above the 50,000 level.

This will be the dollar's and treasury's last hurrah as the Illuminati will be immediately forced to recommence the stock rally or face the defeat of any and all of their proposed legislation on Goldman Sachs' "cap and trade" scam, on the Obama-Kennedy-Kavorkian Euthanasia Plan and on the military expenditures for Afghanistan. After citizens watch their pensions and mutual funds nose-dive toward oblivion for a second time, they will immediately decide that they can't afford to spend another penny. Crashing stock markets beyond a 50% correction would thoroughly discredit Obama's Stimulus Pork Plan and would also put crushing pressure on the Fed. Unless the stock markets recover quickly, the sheople will scream for the Fed's blood and the Audit the Fed bill will become a foregone conclusion.

The Fed is now reeling backwards from a 1.5 million person Tea Party in Washington, and a stock market crash will make people downright venomous toward this cabal of middle class pauper-makers. The Illuminati are now caught between a rock and hard place. If they don't crash the stock markets, the tanking dollar and treasuries will be toast and gold and silver will rip them a new one and expose their mishandling of our money supply and our economy. If they crash the stock markets to put an obstruction in the path of gold and silver, they risk political annihilation, legislative suicide and an audit of the Fed, which will be followed by a hue and cry for its termination when everyone finds out how thoroughly they have been screwed for the past 95+ years. Their options are weak and few. All they can do is play the obstructionist with bogus delay tactics, but in the end they will get buried.

If they fail to take gold and silver down low enough to cover, a distinct possibility, the cartel's shorts will get vaporized, and gold and silver will go on a moon-shot. They are now fighting the combined populations of China, India, Japan, the Middle East, Southeast Asia, Germany and most of Western Europe, as well as the governments of Germany, China (especially the region of Hong Kong) and the Gulf Cooperation Council countries, whose gold they have stolen, leased or encumbered. These nations, who foolishly entrusted their bullion to the US Illuminist cabal, have been left exposed as sitting ducks for a hyperinflationary supernova. These countries are hopping mad about this, and all they have on their minds now is self-preservation and vengeance. Due to the ongoing financial debacles and bailouts going on globally, and the profligate policies of central banks worldwide that are causing fiat currencies everywhere to lose ground against gold, people will be looking to precious metals for an alternative to paper assets denominated in fiat currencies.

We would highly suggest that Buck-Busting Ben Bernanke and the twelve Presidents of the regional Federal Reserve Banks make arrangements for the international banking cabal's version of The Last Supper. We hear through the grapevine that an "Upper Room" is available in the US Capitol Building. You can bet Ben will be running for his helicopter before the crucifixion gets under way! Obama and the twelve members of the Federal Open Market Committee can then do a repeat performance (but without Ben who will be long gone in his helicopter). You can bet Obama will be headed for Air Force One for a one-way trip to Kenya, or Indonesia, or wherever the heck he really comes from! Where is the Border Patrol and ICE when you need them to remove an illegal alien!?

Friday September 18th is the day our government will no longer guarantee money market funds. In anticipation of this event professionals have been moving funds out of these vehicles; some 15% over the past month. What the administration, and particularly the Treasury want to do is try to get those funds directly into Treasuries and into banks. From our point of view neither are safe, nor are credit unions. Those funds should move into gold and silver related assets and for those who must have currency liquidity, those funds should go into Canadian and Swiss Treasuries to profit from the continued fall in the US dollar. You must get your money out of banks, US government debt and anything connected with the US stock and bond markets. The exception being gold and silver shares. All major American banks, which hold 70% of deposits, are broke and so is the FDIC. You have no insurance unless you are willing to accept $0.30 on the dollar. You must be out of all these vehicles.

The money market funds are loaded with suspect corporate debt never mind Treasury debt. We recommended Swiss and Canadian Treasuries some time ago. The dollar has fallen and all these thousands of investors have made money. Get out of money market funds. Already 1/3rd of these funds have had their NAV’s below a dollar since 7/07. They are still holding some very risky paper. Almost 40% is in CD’s of foreign banks, 10% in short-term corporate paper and over 12% in medium-term corporate paper. About 68% is in taxable non-government funds. You will see a great decline in money market fund assets as holders foolishly transfer the funds into FDIC-insured accounts, CD’s and Treasury instruments of one form or another. The only real safe place to go is to gold and silver related assets and if you must Canadian and Swiss Treasuries.

Commercial paper rose $16.1 billion; asset backed CP rose $18.1 billion versus $6.2 billion the previous week. ABCP outstanding was $501.5 billion versus $483.5 billion the prior week. Unsecured financial CP issuance fell $9.7 billion versus $6.2 billion.

Capital from foreign sources was $612 billion in 2007 and $675 billion in 2008. This year in May it was -$54.6 billion; -$57 billion in June, -$56.8 in July and -$97.5 billion in August.

Capital is leaving at an accelerating rate. This means interest rates should be raised. The Fed is monetizing and in all likelihood that will increase and that will lead to a currency crisis. The Fed has said it will ease quantitative easing, but if it does the stock and bond market will fall. If they increase there will be a currency crisis. There is now no question the dollar is being sacrificed. The idea is to allow it to fall incrementally and as slowly as possible.

We have continued to state the Amero will not replace the dollar and that it is and has been a false issue. The dollar will be replaced by another dollar in either 2010, 2011 or 2012. As we explained in early May when the dollar was 89.5 on the USDX, that this was the top. Next stop by the end of October would be 71.18, or at least by yearend. After that comes 40 to 55 and then an official devaluation and default; as all currencies and debt would be dealt with at a special meeting involving all countries.

Debt in the banking system is going to be absorbed by the Fed. Almost all major banks are bankrupt. That is why you do not want to have much money in banks and no CD’s; cash value life policies or annuities. Next year we will witness a second round of debt write offs and a crisis in the derivative market. If the Fed doesn’t monetize the debt the system will collapse, but then again there may be no Fed if HR1207 becomes law. Every problem would then lie in the lap of the Treasury. The American financial system is unsustainable and our foreign wars and occupations will come to a close in 2010 or 2011. The cost will no longer be sustainable. The US stock and bond markets will fall and you will not want to own any US government obligations. It could be that the role-played by the Fed, if the Fed is replaced, could in part be played by Goldman Sachs and JP Morgan Chase. Due to the Fed’s absorption of bad assets it could be that the Fed will self-destruct in the process of being legislatively being eliminated. Recovery of the US economy would then depend economically on tariffs on goods and services to bring manufacturing back to America.

A CBS News blogger named Declan McCullagh seized on the documents, which CEI obtained through a Freedom of Information Act request, and said: "The Obama administration has privately concluded that a cap and trade law would cost American taxpayers up to $200 billion a year, the equivalent of hiking personal income taxes by about 15 percent." He added: "At the upper end of the administration's estimate, the cost per American household would be an extra $1,761 a year."

The Bank Implode-o-meter: Wells Fargo’s Commercial Portfolio is a ticking time bomb.

In order to sort through the disaster that is Wells Fargo’s commercial loan portfolio, the bank has hired help from outside experts to pour over the books… and they are shocked with what they are seeing. Not only do the bank’s outstanding commercial loans collectively exceed the property values to which they are attached, but derivative trades leftover from its acquisition of Wachovia are creating another set of problems for the already beleaguered San Francisco-based megabank, Wachovia, which Wells purchased last fall as it teetered on the brink of collapse, was so desperate to increase revenue in the last few years of its existence that it underwrote loans with shoddy standards and paid off traders to take them off their books.

According to sources currently working out these loans at Wells Fargo and confirmed by Dan Alpert of Westwood Capital, when selling tranches of commercial mortgage-backed securities below the super senior tranche, Wachovia promised to pay the buyer’s risk premium by writing credit default swap contracts against these subordinate bonds. Should the junior tranches eventually default, then the bank is on the hook.

For the past 14 years, the gap between the two measures has grown persistently, with operating earnings topping GAAP earnings by an average of $2.47 a share per quarter.

When using a 10-year trailing average of earnings to erase cyclical gyrations, operating earnings are nearly 24% higher than GAAP earnings, the highest ever.

It isn't clear why the difference has grown so wide. One inescapable conclusion is that, since 1995, either by happy accident or accounting shenanigans, one-time losses have grown more quickly than one- time gains, elevating the operating earnings that Wall Street watches.

The investment implications are many. For one thing, two earnings measures produce two market valuations. The S&P 500 trades at 21 times the past 10 years' GAAP earnings and 17 times operating earnings. Neither is exactly cheap, but one is much pricier than the other.

Japan urges talks on US military base Japan considers revision of a deal with the US to relocate a military base to be a top diplomatic priority, Tokyo's newly appointed foreign minister has told the Financial Times, waving aside concerns that reopening the agreement could undermine the alliance between the countries.

The declaration by Katsuya Okada, a senior member of Japan's ruling Democratic Party (DPJ), highlights the international implications of the party’s determination to set a more independent diplomatic agenda. GQ excerpts Speech-Less: Tales of a White House Survivor by ex-Bush speechwriter Matt Latimer:

We wrote speeches nearly every time the stock market flipped. Meanwhile, the White House seemed to have ceded all of its authority on economic matters to the secretive secretary of the treasury…(In the weeks that followed, Paulson changed his spending priorities two or three times. Incredibly, he’d been given the power to do with that money virtually anything he pleased. All thanks to a president who didn’t understand his proposal and a Congress that didn’t stop to think….)

Chris had just come from a secret meeting in the Oval Office, and without so much as a hello he announced: “Well, the economy is about to completely collapse.”

You mean the stock market?” I asked.

“No, I mean the entire U.S. economy,” he replied. As in, capitalism. As in, hide your money in your mattress.

The Secretary of the Treasury, Hank Paulson, had sketched out a dire scenario. And Chris said we’d have to write a speech for the president announcing his “bold” plan to deal with the crisis. (The president loved the word bold.) The plan… Basically, it could be summed up as: Give me hundreds of billions of taxpayer dollars and then trust me to do the right thing…In some cases, in fact, Secretary Paulson wanted to pay more than the securities were likely worth in order to put more money into the markets as soon as possible. This was not how the president’s proposal had been advertised to the public or the Congress. It wasn’t that the president didn’t understand what his administration wanted to do. It was that the treasury secretary didn’t seem to know, changed his mind, had misled the president, or some combination of the three.

When White House press secretary Dana Perino was told that 77 percent of the country thought we were on the wrong track, she said what I was thinking: “Who on earth is in the other 23 percent?” I knew who they were—the same people supporting the John McCain campaign. Me? I figured there was no way in hell any Republican would vote for that guy. John McCain, the temperamental media darling, had spent most of the past eight years running against the Republican Party and the president—Republicans on Capitol Hill and at the White House hated him. Choosing John McCain as our standard-bearer would be the height of self-delusion.

He [Bush] paused for a minute. I could see him thinking maybe he shouldn’t say it, but he couldn’t resist. “If bullshit was currency,” he said straight-faced, “Joe Biden would be a billionaire.” Everyone in the room burst out laughing.

The latest propaganda on quantitative easing and reining it in reaches us. Evidentially the G-20 meeting in Pittsburgh later this month will put together a roadmap outlining how to reverse previous stimulation of world economics. If that happens the world financial structure will collapse. They know that just as well as we do. The IMF wants the G-20 to coordinate the unwinding of these efforts. Of course, the players all know inflation is on the way and they want to make people think they are going to do something about it. Even the Fed says it is ending quantitative easing at the end of the fiscal year on 9/31/09. We know that cannot be true with the Treasury issuing $2 trillion in bonds in this coming fiscal year.

By way of comparison a year ago unemployment officially was 6.1% and today it is 9.7%. The deficit was $459 billion; this month it will be more than $1.6 trillion. Next year the estimate is another $1.5 trillion. The debt on a short-term basis is no longer $10 trillion; it is $12.3 trillion. In addition there are massive layoffs in towns, cities, counties and states; many of which are insolvent. We ask how can a stock market go from 6,600 on the Dow to 9,800 on such deplorable facts? Mandated programs such as Social Security, Medicare and Medicaid are broke and dealers cannot even get paid for the Cash for Clunkers Program. The answer is that the injection of money and credit has gone into Wall Street, banking and insurance or into financial assets and the same players are back to the same game of massive leverage they were in a year or two or three ago.

They learned absolutely nothing. While this transpires the real economy sinks deeper into the mire. In order to mesmerize and propagandize the dumb American people, our President has barraged them with radio and television addresses with little lasting effect. This was capped last weekend by two million Americans, who can see through the veneer and realize our government is a disaster. Our President and Congress are vying for the lowest approval ratings. 75% of Americans want an audit and investigation of the Fed as does 282 members of the House and 23 members of the Senate. 58% of Americans do not want government health care and cap & trade. They want the deficit spending and the coddling of Wall Street, banking and insurance to stop. Any assistance should be given to the American people not to rich gamblers.

There are no more buyers of Treasuries, only the Fed that makes money up out of thin air and monetizes debt.

Americans are implored to save by buying US government bonds. Hopefully $200 billion worth out of tax returns, which will fund debt for three weeks. That, of course, reduces spending in the economy by a like amount. The $200 billion goes toward interest to pay foreign bond buyers. After inflation the public investor has nothing to show for their investment. All they are doing is fueling a bankrupt system, while Wall Street and banking gambles on with taxpayer funds.

Is it finally any wonder gold is trading over $1,000?

The London G-20 meeting is over and the big show in Pittsburgh is about to begin. We will again hear about the coordinated effort to end stimulus, which will be just more misdirection to make the public think something will really be done to end this nightmare.

These powers behind government, in order to subject people to their new world order and mass slavery, have brought to an end the most prosperous era in man’s history.

Part of this plan set in place on 8/5/71, was to remove gold backing from the American dollar, the world’s reserve currency. This allowed the Illuminists to do anything they pleased fiscally and monetarily. Once the governor of gold was removed from the monetary system all control was lost and as a result we have what we are experiencing today – planned chaos. This is why the G-20 and G-7 meet so frequently. They have to tell the world public over and over again everything will be okay, when they know it won’t be okay.

Historically every time a nation went off the gold standard it headed for eventual bankruptcy. The abandonment of gold was usually followed by war, which in the long run is injurious to any economy. This could be called the imperial approach, which usually consumed each country’s gold. The US went through this after the Second World War and by 8/15/71 it had lost a part of its gold. Gold would no longer be used to settle trade. The foundation for the US monetary system was eliminated. Being that the dollar was the world’s reserve currency it destroyed the monetary base of all nations.

We are currently witnessing a political interlude in which the Fed has been cutting back its policy of quantitative easing in order to get the Chinese to stop getting rid of dollars, which China has been doing for the past eight months. During August bank credit fell at a large 9% annual pace, M2 fell 12.2% and M1 fell 6.5%. M3, the best indicator, has been falling at a 5% rate. In May, June and July bank loans have fallen at a 14% rate. The first quarter fell 2.4% and the second quarter 1.8%. Mr. Bernanke is tempting fate. Raising bank capital ratios in mid-depression could cause the Fed to easily lose control. It is exactly the wrong thing at the wrong time unless the Fed wants a deflationary depression. At this stage if banks de-leveraged there would also be a collapse. Cutting 1% a month under the circumstances is very dangerous, as not only US but also European banks are cutting lending. We have noted Europe’s policy earlier, thus, we believe the policies are secretly coordinated. If the policy is not reversed we will go into deflationary depression. If the policy is reversed all central banks will have to monetize to stay afloat, which will bring hyperinflation. No matter what, all the effect of the stimulus is in fact being neutralized.

Capacity utilization rose from 69.0% to 69.6%.

It is very disconcerting when very important statistics continue to be revised to soften the economic and political impact. As an example, July total net tick figures for flow of funds was revised in June to a loss of $56.8 billion to a minus $97.5 billion in July. June’s original number was a loss of $31.2 billion.

Foreign investors sold US assets for a 4th straight month in July, with private outflows hitting the highest since February. Net capital outflows increased to $97.5 billion in July from a revised outflow of $56.8 billion in June.

Private investors sold $131.3 billion in US assets in July, up from sales of $53.3 billion in June.

International investors bought a net $15.3 billion in July, from June’s $90.2 billion.

China’s holdings of US Treasuries rose to $800.5 billion in July from $776.4 billion in June. Japan’s rose to $724.5 from $711.8 billion in June.

Central banks bought $33.8 billion in US assets, up from sales of $3.5 billion in June.

September 30th is the date all banks worldwide must become Basel II and Basel III compliant. Those who do not will not be allowed to trade outside of their borders with any bank, nor within their borders with a Basel II or III bank. US banks have massive derivative exposure “off balance sheet”, thus they won’t qualify under Basel III. If pursued the world will find out that the US banking system is bankrupt. The world knows the Fed is the lender of last resort and its problems are beyond repair, so is it any wonder gold has broken out to new highs. This is a monumental event and if it has to be adhered too all hell will brake loose in October.

Fed Chairman Mr. Bernanke tells us the recession has probably ended. If that is the case the Fed should end quantitative easing. We know why they’ll be no end to easing and that is because there is no exit strategy. There can’t be any.

The Friday Night FDIC financial Follies saw Irwin Financial Corp.’s bank units in Kentucky and Indiana were closed by state and federal regulators, pushing the U.S. toll of seized banks this year to 94, the Federal Deposit Insurance Corp. said.

Irwin Union Bank based in Louisville was closed by the Office of Thrift Supervision and Columbus-based Irwin Union Bank and Trust Co. was shut by the Indiana Department of Financial Institutions, the FDIC said today in a statement. First Financial Bank of Hamilton, Ohio, agreed to assume $2.5 billion in deposits and take over 27 offices, the FDIC said.

The volume of mortgage applications filed last week fell a seasonally adjusted 8.6% compared with the week before, the result of a drop in both applications to refinance an existing loan as well as those to purchase a home, the Mortgage Bankers Association reported Wednesday.

The average rate on 30-year fixed-rate mortgages rose for the week ended Sept. 11, while rates on 15-year fixed-rate mortgages and one-year adjustable-rate mortgages fell, according to the MBA's weekly survey, which covers about half of all U.S. retail residential mortgage applications. Results were adjusted for the Labor Day holiday.

The drop in applications follows a 17% week-over-week jump recorded the week of Sept.

Refinance applications fell 7.4% last week, compared with the week before; applications for mortgages to purchase a home were down a seasonally adjusted 10.3% last week, compared with the previous week, the MBA said.

The four-week moving average for all mortgages was up 2.9%. Applications were down 18.7%, compared with the same week in 2008.

Refinance applications made up a 61% share of all activity, up from 59.8% the previous week. ARMs made up 6% of all application activity, up from 5.8% the previous week. According to the survey, the 30-year fixed-rate mortgage averaged 5.08% last week, up from 5.02% the previous week. Fifteen-year fixed-rate mortgages averaged 4.41% last week, down from 4.45% the previous week. And one-year ARMs averaged 6.61%, down from 6.69% the previous week. To obtain the rates, the 30-year fixed-rate mortgage required payment of an average 0.98 point, the 15-year fixed-rate mortgage required payment of an average 1.12 points, and the one-year ARM required payment of an average 0.20 point. A point is 1% of the mortgage amount, charged as prepaid interest.

Confidence among U.S. home builders rose for the third consecutive month in September despite continuing to track at a level where pessimism about future sales outweighs optimism.

The National Association of Home Builders on Wednesday said its housing market index rose one point to 19 in September, its highest level since May 2008 but still far from the point at which builder sentiment is more good than bad. The increase marks the sixth this year.

The NAHB index measures builder confidence regarding sales prospects for new, single-family homes. A reading above 50 indicates more builders view sales conditions positively than see them negatively.

The index, based on data collected through monthly surveys, hasn't hit 50 in more than three years. It fell as low as 8 in January.

A broad measure of U.S. international transactions continued shrinking last spring as Americans in the slumping economy bought less from overseas.

The U.S. current account deficit fell to $98.8 billion during April through June, the Commerce Department said Wednesday, retreating to its lowest share of gross domestic product in 10 years. The first-quarter deficit stood at $104.5 billion, revised up from an originally reported $101.5 billion.

The current account is trade of goods and services, transfer payments, and investment income. A deficit signals a nation is investing abroad more than saving at home. The imbalance has narrowed a lot during the past year because of the recession, which meant lower purchases by the U.S. of foreign goods.

Economists surveyed by Dow Jones Newswires forecast a deficit of $92.5 billion in the second quarter. While bigger than expected, the gap marked the smallest deficit since fourth-quarter 2001.

The second-quarter deficit of $98.8 billion amounted to 2.8% of gross domestic product, which was last reported at $14.143 trillion in current dollars for the three months ended June 30. That was the lowest share since 2.8% in first-quarter 1999. The first-quarter current account gap of $104.5 billion represented 2.9% of a GDP of $14.178 trillion. GDP is the broad measure of economic activity in the U.S.

Most of the current account balance is made up of trade in goods and services. An $83.0 billion second-quarter shortfall in goods and services trade was lower than the first-quarter's revised $92.4 billion. The first-quarter gap was initially estimated at $91.2 billion. Second-quarter imports fell to $361.6 billion from $373.4 billion. Purchases abroad of consumer goods, cars, and non-petroleum industrial supplies fell.

Exports also dropped. Second-quarter sales fell to $246.1 billion from $249.4 billion, with decreases in capital goods and consumer products.

While U.S. trade of goods was at a deficit, services trade was at a surplus. The surplus rose, to $32.5 billion from $31.6 billion in the first quarter.

Also contributing to the current-account deficit was a $32.3 billion shortfall in unilateral current transfers. Transfers are one-way payments from the U.S. to other countries and one-way payments from abroad into the U.S. The $32.3 billion shortfall is wider than a $30.3 billion deficit in the first quarter.

Examples of current transfers include U.S. government grants, foreign aid, private remittances to workers' families abroad, and pension payments to foreign residents who once worked in a particular country.

Offsetting the overall current-account deficit was a $16.4 billion surplus of income, down from an $18.3 billion surplus in the first quarter.

The trade report showed that foreigners sold a net $22.7 billion of U.S. Treasury securities during the second quarter, after buying a net $53.7 billion in the prior three months. Foreigners sold $22.0 billion worth of U.S. corporate bonds during the second quarter, after net sales of $12.4 billion the previous quarter. They bought a net $400 million of agency bonds, after selling a net $49.7 billion in the first quarter.

As for equities, foreigners bought a net $35.8 billion of U.S. stocks, after buying $6.1 billion in the first quarter.

Foreign direct investment in the U.S. increased $26.1 billion, after rising $23.9 billion in the first quarter.

Industrial production last month rose 0.8% compared with July, the Federal Reserve said Wednesday.

Use of capacity also increased. Economists had expected industrial production to climb 0.6% in August.

The Fed report Wednesday said August use of capacity by industries grew to 69.6% from July's 69.0%, which was revised from an originally estimated 68.5%. The 1972-2008 average was 80.9%. Overall manufacturing production climbed by 0.6% in August, the report said. Manufacturing capacity utilization rose to 66.6% from 66.1%.

Motor vehicles and parts production rose 5.5%, with motor vehicles, alone, up 11.7%. Capacity use for autos and parts was 47.4% in August and 44.8% in July. Output in the mining industry climbed by 0.5% in August after climbing 0.6% in July. Mining capacity rose to 82.2% in August from 81.7% in July.

Utilities production climbed 1.9% last month, the Fed said. It fell 1.6% in July. Utilities capacity use increased to 78.7% from 77.3% in July.

Reports on industrial production and consumer prices today showed the U.S. economy is emerging from the economic slump without spurring inflation.

Output at factories, mines and utilities climbed 0.8 percent last month, exceeding the median estimate of economists surveyed by Bloomberg News, data from the Federal Reserve in Washington showed. The Labor Department said the cost of living climbed 0.4 percent, and was down 1.5 percent from August 2008.

A Member of Congress proposes to use taxpayer money to fund the development of technology to track motorists as part of a new form of taxation. US Representative Earl Blumenauer (D-Oregon) introduced H.R. 3311 earlier this year to appropriate $154,500,000 for research and study into the transition to a per-mile vehicle tax system.

The "Road User Fee Pilot Project" would be administered by the US Treasury Department. This agency in turn would issue millions in taxpayer-backed grants to well-connected commercial manufacturers of tolling equipment to help develop the required technology. Within eighteen months of the measure's passage, the department would file an initial report outlining the best methods for adopting the new federal transportation tax.

Oregon has successfully tested a Vehicle Miles Traveled (VMT) fee, and it is time to expand and test the VMT program across the country, Blumenauer said in a statement on the bill's introduction. A VMT system can better assess fees based on use of our roads and bridges, as well as during times of peak congestion, than a fee based on fuel consumption. It is time to get creative and find smart ways to rebuild and renew America's deteriorating infrastructure.

In 2006, the Oregon Department of Transportation completed its own study of how to collect revenue from motorists with a new form of tax that, like the existing fuel excise tax, imposes a greater charge on drivers the more that they drive. The pilot project's final report summed up the need for a VMT tax.

Unfortunately, there is a growing perception among members of the public and legislators that fuel taxes have little to do with road programs and therefore should be considered just another form of taxation, the March 2006 report stated. By itself, this situation appears to be preventing any increases in fuel tax rates from being put into effect.

The money diverted from the fuel excise tax on non-road related projects must be made up for with a brand new VMT tax, the report argued. Merely indexing the gas tax to inflation or improvements in fleet gas mileage was rejected as "imprecise." Instead, the report urged a mandate for all drivers to install GPS tracking devices that would report driving habits to roadside Radio Frequency Identification (RFID) scanning devices.

Blumenauer is a long-time advocate of bicycling and mass transit in Congress. Many of his largest campaign donors stand to benefit from his newly introduced legislation. Honeywell International, for example, is a major manufacturer RFID equipment. The company also happens to be the second biggest contributor in the current cycle to Blumenauer's Political Action Committee (PAC), the Committee for a Livable Future. Another top-ten donor, Accenture, is a specialist in the video tolling field.

Washington is caught up in a political scandal centering on former Vice President Dick Cheney. It follows a move by the new CIA director Leon Panetta to cancel a secret plan to find and kill Al-Qaeda leaders.

He says that, while in office, Cheney ordered the agency to withhold information about the anti-terror program from Congress.

According to investigative journalist and RT contributor Wayne Madsen, “This assassination team may have targeted politicians in other countries. One name mentioned was former Pakistani Prime Minister Benazir Bhutto, who may have been a victim of this program. The other name is Jonas Savimbi, the former Angolan UNITA leader, who may have outlived his usefulness as far as Mr. Cheney is concerned.

The White House is considering extending an $8,000 tax credit for first-time home buyers, which has helped to boost sales by more than 1 million this year.

THE UNITED NATIONS Assistance Mission in Afghanistan has a mandate to encourage “free, fair, inclusive and transparent elections.’’ But according to the mission’s number-two official, former US diplomat Peter Galbraith of Cambridge, the United Nations is prepared to accede to fraudulent vote counts in last month’s presidential election. This is deeply wrong. As President Obama faces a decision on whether to send more troops to Afghanistan, the flagrant cheating in favor of President Hamid Karzai, a US ally, is a grim sign that political reconciliation is a long way off.

Galbraith favored a tough stance against fraud, and rightly so. In one polling center Karzai got 4,054 of 4,054 votes cast. In Kandahar province, where 25,000 people voted, more than 250,000 votes were recorded for Karzai. So Galbraith prodded the Afghan election commission - six of whose seven members are Karzai loyalists - to throw out transparently bogus results from about 1,000 of 6,500 polling stations and to recount ballots from as many as 5,000 others. Had the commission done so, Karzai likely would face a runoff against his main challenger, former foreign minister Abdullah Abdullah.

Galbraith returned home to New England after his boss, UN official Kai Eide of Norway, insisted that the mission allow the Afghan election commission to proceed with a pro forma recount of votes from only 10 to 15 percent of polling stations - not the sweeping exclusion of obviously bogus ballots that Galbraith sought. The foreseeable outcome of the United Nations’ capitulation will be a first-round victory for Karzai.

Eide may believe he is helping Afghans avoid political turmoil while also deflecting charges of foreign interference in Afghan affairs. But a fraudulent re-election of Karzai will only increase popular discontent with his government, exacerbate ethnic enmities, and undermine international support for Afghanistan’s fight against the Taliban.

President Obama should do what Galbraith wanted the UN mission to do: forcefully condemn Karzai’s massive fraud and press hard for a clean vote. Peace and stability will never come from an Afghan government that keeps itself in power through fraud. [Peter and I were roommates in the mid 50s when we both served with the Army Security Agency. Bob]

James McDonald, chief executive officer of investment management firm Rockefeller & Co, committed suicide on Sunday in Massachusetts, the Wall Street Journal said, citing people familiar with the matter.

Newport Beach financier Danny Pang died early Saturday at a local hospital, according to the Orange County coroner’s office. The cause of death has not been determined and an autopsy is planned for Sunday, said Larry Esslinger, supervising deputy coroner.

Ex-CEO of Beneficial Corp. Finn H.W. Casperson was found dead in an apparent suicide behind an office building in Westerly, Rhode Island.

Police are investigating the death of the former chief fundraiser for ex-Illinois Gov. Rod Blagojevich as a “death-suicide,” an Illinois mayor said Sunday.

Philadelphia Fed business index has risen to 14.1 points in September from 4.2 in August, beating market expectations of an increase to levels around 8.0. The Euro has bounced higher.

EUR/USD rebound at 1.4695 has extended higher after Philly Fed data, and the Euro has reached levels at 1.4750, with 2009 high at 1.4767.

USD/JPY which had bounced from 90.50, reaching levels around 91.45 ahead of Philly Fed data, retreated to 91.05 minutes after figures were known and the pair trades now at 91.20.

The number of U.S. workers filing new claims for jobless benefits unexpectedly declined, according to a Labor Department report Thursday.

Meanwhile, total claims lasting more than one week increased.

Initial claims for jobless benefits fell 12,000 to 545,000 in the week ended Sept. 12, the department said in its weekly report.

Economists surveyed by Dow Jones Newswires had expected a rise of 13,000. The previous week's level was revised from 550,000 to 557,000.

The four-week average of new claims, which aims to smooth volatility in the data, fell by 8,750 to 563,000 from the previous week's revised figure of 571,750.

The U.S. Securities and Exchange Commission will consider banning flash trading and imposing new rules on credit-rating companies that drew fire for misreading the risks of investing in toxic mortgage securities.

Commissioners are scheduled to vote today on a proposal barring exchanges and trading platforms from letting clients see information about stock orders a fraction of a second before the market. The SEC also will consider stiffer disclosure requirements on Moody’s Investors Service, Standard & Poor’s and Fitch Ratings. The Washington meeting begins at 2:30 p.m.

The SEC is considering the ban on flash orders after lawmakers including Senator Charles Schumer questioned whether it gives some traders unfair advantages. Direct Edge Holdings LLC has used the practice to take market share from NYSE Euronext. Nasdaq OMX Group Inc. and Bats Global Markets voluntarily stopped using flash orders last month.

The SEC’s proposal would require a second vote and a later public meeting to become binding.

The agency is pursuing rules for credit-rating companies after lawmakers faulted Moody’s, S&P and Fitch for assigning mortgage bonds their highest AAA rankings and maintaining those grades after the underlying loans began defaulting in 2007.

The SEC proposals include forcing banks selling securities to disclose any ratings received while shopping among credit- rating companies, according to people familiar with the matter. Such information would tell investors whether a competing ratings firm thought there was a greater risk of default.

August housing starts increase to 0.6M.

John Williams: The Bureau of Labor Statistics (BLS) confirmed again, this morning, that its estimate of new car pricing for August was net of all rebates under the government’s cash-for-clunkers program. Based on reported rebates, auto sales and auto prices, I estimate that the BLS approach underestimated the overall August CPI by roughly 0.28%. Assuming all other new car price factors being neutral, the CPI should have been reduced by 0.28% by the rebates. Instead, the BLS reported the impact of lower auto prices reducing the seasonally-adjust CPI by just 0.06%. The likely difference is that auto dealers either used higher base prices or were able to offer smaller other discounts, in conjunction with the government’s programs, thereby boosting profit margins. http://www.shadowstats.com

John also notes that warm weather and ‘Cash for Clunkers’ boosted August industrial production.

FDIC Strikes First Deal on Toxic Assets

Receiving a big chunk of financing from the agency, Residential Credit Solutions of Fort Worth will purchase a piece of a $1.3 billion loan portfolio from the $4.9 billion-asset Franklin Bank in Houston.

The deal for Franklin, which failed in November, is the first transaction in the government's effort to help sell toxic loans, which was the initial idea for the $700 billion Troubled Asset Relief Program enacted in October 2008.

The deal is substantially different from what regulators envisioned. Under the Legacy Loans Program, a revamped toxic-asset plan launched in March, the FDIC was to hold auctions to help finance the sale of bad loans from open banks. Instead, the plan appears to be primarily a way to help the FDIC purge assets inherited from failed banks.

The TIC Flow data shows foreigners only bought $15.3B of US paper in July; $60.0B was expected.

For the year ending on July 31, 2009, foreigners: Bought (net) $91.01B of US stocks and $314.18B of US govies. Foreigners sold a net $147.15B of US agency debt.

The Obama administration is shelving an Eastern European missile defense plan that has been a major irritant in relations with Russia, a U.S. ally said Thursday. The Pentagon confirmed a "major adjustment" of the system designed to guard against Iranian missiles.

Jan Fischer, the prime minister of the Czech Republic, told reporters that President Barack Obama phoned him overnight to say the U.S. "is pulling out of plans to build a missile defense radar on Czech territory."

The missile defense system, planned under the Bush administration, was being built in the Czech Republic and Poland.

Federal Deposit Insurance Corp. Chairman Sheila Bair said Friday her agency may tap its $500 billion credit line with the U.S. Treasury to replenish its deposit insurance fund, though she appeared cautious about doing so.

We are carefully considering all options including borrowing from the Treasury, Ms. Bair said Friday after a speech in Washington.

Ms. Bair has already warned banks that they may face an assessment increase to bolster the fund.

Friday, she said there are also other little-known options available to the agency, including requiring banks to prepay assessments. The FDIC board of directors will meet at the end of this month to consider how to replenish the fund, she said. Ms. Bair appeared cautious about resorting to the Treasury credit line, saying there are different views on when it should be used. She said some believe it should be reserved for emergencies only, rather than for covering losses that are already known.

Congress acted earlier this year to allow the FDIC to borrow as much as $500 billion from the Treasury if the Treasury, the Federal Reserve and the White House believe it is warranted. Otherwise, the agency can borrow up to $100 billion.

The financial crisis has clobbered the FDIC's deposit insurance fund, forcing the agency to impose a special assessment on the industry to rebuild the fund. Ninety-two banks have failed so far this year. The deposit insurance fund fell by $2.6 billion to $10.4 billion during the second quarter, after 24 banks went bust.

Only one in four Oklahoma public high school students can name the first President of the United States, according to a survey released today.

The survey was commissioned by the Oklahoma Council of Public Affairs in observance of Constitution Day on Thursday.

Brandon Dutcher is with the conservative think tank and said the group wanted to find out how much civic knowledge Oklahoma high school students know.

The Oklahoma City-based think tank enlisted national research firm, Strategic Vision, to access students' basic civic knowledge.

They're questions taken from the actual exam that you have to take to become a U.S. citizen, Dutcher said. A thousand students were given 10 questions drawn from the U.S. Citizenship and Immigration Services item bank. Candidates for U.S. citizenship must answer six questions correctly in order to become citizens.

About 92 percent of the people who take the citizenship test pass on their first try, according to immigration service data. However, Oklahoma students did not fare as well. Only about 3 percent of the students surveyed would have passed the citizenship test. Dutcher said this is not just a problem in Oklahoma. He said Arizona had similar results, which left him concerned for the entire country.

Jefferson later said that a nation can't expect to be ignorant and free, Dutcher said. It points to a real serious problem. We're not going to remain ignorant and free.

As we have predicted for the past six months, the FDIC will tap the Treasury, the taxpayer, to replenish reserves that banks are supposed to be replenishing. The line is for $500 billion, with the first “loan” at $100 billion. Over the next three years, 3200 to 4200 of 8400 banks will go under. The next large victim could be Wells Fargo whose portfolio is a ticking time bomb.

ALT-A mortgages are imploding as are payment option – ARMs, known as pick and pay loans. In addition 52% of foreclosures are in prime mortgage loans. Those are being negatively augmented by mortgage scams. Underwater mortgages are the driving force behind rising defaults and mounting foreclosures.

Back to Well Fargo. Outside professionals are shocked to see the bank’s outstanding commercial loans collectively exceed the property values to which they are attached. Then there are the derivative trades left over from the acquisition of Wachovia.

Global Research Articles by Bob Chapman

© Copyright Bob Chapman , Global Research, 2009

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.