Gold, The Big Score

Commodities / Gold & Silver 2009 Sep 21, 2009 - 01:42 PM GMTBy: Howard_Katz

Well, here we are with the price of gold above $1,000. Since this is the day so many thought would never come, it is time for reflection. I have lived my life in a society in which most of the “experts” have been wrong over and over.

Well, here we are with the price of gold above $1,000. Since this is the day so many thought would never come, it is time for reflection. I have lived my life in a society in which most of the “experts” have been wrong over and over.

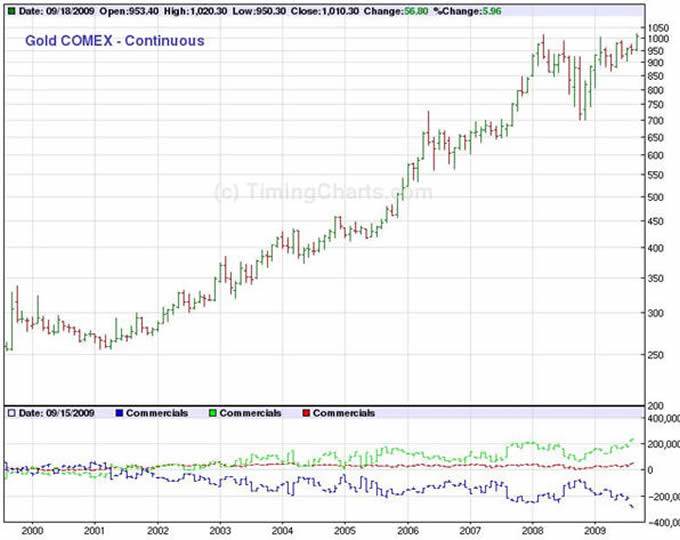

I was a gold bug in 1970, when gold was $35/oz. I turned bearish on gold Jan. 21, 1980, the day it hit its high of $875/oz. I became a stock bug in 1982 with the DJI at 780. Then I predicted Black Monday 1987. I turned bullish on gold again at the end of 2002 with the metal at $325. And I predicted a long term top in the stock market at the beginning of 2007.

In all of these predictions, I was ridiculed by the self-proclaimed experts of the day. Always they were wrong. They were bearish on gold in 1970. They were bearish on stocks in 1982. Black Monday caught them by total surprise. So they turned bearish the day after. They thought that stocks were showing irrational exuberance in 1995 but did not have a clue that anything irrational was going on early in 2000. So when they started telling people that gold could not break $1000, it was par for the course. Fools, incompetents, losers.

But I know why you are here. You are here because you want to make the big score. And I encourage this. The big money is made in the big move. The key to success in the markets is to spot a big move before it occurs. Get in early, and don’t let go.

This is not easy to do. The entire weight of our society is against you. At the bottom in gold in 1970, any establishment type could pull out a long sheet of data showing that gold had been the worst performing economic good in history. Everything else had gone up, but gold had been flat for 35 years. Projecting the trend, they could tell you that gold was going to be the worst performing good in the decade from 1970-1980.

Idiots! In 1970, gold was undervalued. This is what caused it to multiply by a factor of 25 times and turn into the best performing good of the decade. They were able to dig out the data. They just interpreted it upside down. They couldn’t tell the difference between overvalued and undervalued. In commodities, one does not project a trend.

Again, in 1999 gold was $254/oz. Sentiment was so bearish that the gold mines themselves were shorting their own stock. Yet this was the time to buy.

Students of the market have discovered an important principle called contrary opinion. This says that to make money in the markets one must go contrary to the opinion of the vast majority of the people. The majority are usually wrong.

What is the reason for this? Our economic system is basically dishonest and has been dishonest since the nation left the gold standard on March 9, 1933. At that time, the privilege to create money out of nothing was given to the commercial bankers. This is a very valuable privilege for them and their associated vested interests, whom I call the paper aristocracy. In the 1930s and ‘40s, the paper aristocracy moved to influence the Government to do their bidding and the educational system to teach their convoluted economic theories to the next generation. This is why the country is full of economic authority figures who are repeatedly wrong.

For example, in 2008 the paper aristocracy wanted to employ their money creation privilege. Their friends in Government (Henry Paulson) and the media (The New York Times), therefore, began a propaganda campaign (a year ago almost to the day) that the nation was in terrible danger of prices going down. “Financial crisis,” was the headline. What was the crisis? It was expressed in different ways: “The Second Great Depression,” “The Great Recession.” Without being too specific, the point was made that prices were going down, and it was bad.

In any society, there is a phenomenon call the self confirming hypothesis. If everyone in the society thinks that a certain idea is true, it makes them act in a way which makes it appear true. Thus, when the media told everyone that prices were going down, it led speculators to sell, and this, to a certain degree, caused prices to go down. The fact that people believed it was true led them to act in a way which made it appear (at least for a short term) to be true.

I would like to point out that the very ideas of recession and depression are horribly confused. They are closer to the ideas of witches and dragons than to anything real. Think about it. What is a depression? A depression is a period when the whole society gets poor. A recession is a little depression. Now what are the facts?

Well, in the period of the early nineteen thirties the overwhelming majority of Americans were not getting poorer. The overwhelming majority of Americans were getting richer. If you check the fundamental book on statistics for the United States, Historical Statistics of the United States, published by the Commerce Department, it will tell you that the people of the U.S. in the early thirties were switching from margarine to butter; they were eating more meat (from 129 lbs of meat per person in 1930 to 144 lbs. per person in 1934); and they were giving more to charity. The people who were getting poorer in the early thirties were the bankers and their loan customers, the big corporations. But these, of course, are not the whole country. They are a small fraction of it. In short, there was no depression in the early 1930s. It was/is a giant lie.

Now if we fast forward a decade to the early 1940s, then we do find a depression. In the early 1940s, one could not buy a new house. They were not being built. One could not buy a new car. They also were not being built. And if you wanted to go somewhere in your old car, gasoline was rationed to 3 gallons a week. Further, many food items were also rationed. This was, of course, due to the war. One would think that the economists of the country would have no trouble saying that the war made the country poorer. After all, what is war but the destruction of human lives and wealth? Would it hurt an economist to admit that?

And yet you can’t get an economist to admit that 1942-1945 was a depression in this country even if you put him on a torture wrack and turn the screw. You see, the early ‘40s were a period where massive amounts of money were created, and the paper aristocracy made a bundle of money (war profiteers). Because of this all of the conventional economists call the early 1940s a boom. “The war brought us out of the Depression” they teach. This is because the profession of economist consists of people being bribed by the paper aristocracy. When the government creates money, they call it a boom. When the government destroys money, they call it a depression. Practically everything you have been taught about this subject is a lie.

You see, during WWI both the money supply and the price level had doubled. Most Americans in that day had saved for retirement. Their retirement savings fell in half in 5 years (1914-1919). So the Republicans, in 1920, promised to bring prices back down to their 1914 level. Since cigars had gone from 5¢ to 10¢ between 1914 and 1919, this was expressed by the slogan, “What this country needs is a good 5¢ cigar.”

And this is what happened. In 1933, prices were brought down to their 1914 level. Everyone’s retirement savings doubled in value. The banks and the big corporations were hurt, but the common person was better off.

Of course, you have heard a lot of propaganda about unemployment in the 1930s. Here are the facts. As prices came down, wages came down also, but they did not drop as fast. Thus the buying power of wages rose. In other words, you got less pay in money terms but more wealth (food, clothing, shelter) in real terms. Indeed, there is a song from the period made famous by Eddie Cantor. The lyrics went:

“Potatoes are cheaper.

Tomatoes are cheaper.

Now’s the time to fall in love.”

Eddie Cantor was pointing out what every ordinary American knew. Even though nominal wages were lower, real wages were higher. Now these higher wages caused unemployment. Business couldn’t afford to pay them. BUT ALL THIS HAD HAPPENED BEFORE. There was another credit contraction very much like the 1930s. It happened in 1873-79. There was a lot of unemployment, and prices declined. That, in fact, was the time that the word “unemployment” entered the American language, and this is why the British word for the phenomenon (“redundant”) is different from the American. The Republicans of 1920 knew that their policy of reducing prices would cause unemployment. They had lived through it in the 1870s. But they also knew that the unemployment would be temporary. And they knew that far and away the most important thing was to restore the value of the retirement savings of the ordinary person.

When prices came down (approximately 30% from 1930-33), the paper aristocracy took it on the chin. Their stocks declined. Their profits declined. For them it was a depression, not for the rest of the country. 75% of the people retained their jobs. They got higher real wages, and their retirement savings gained in value. The 25% who were unemployed were probably living on their gain in real savings and hanging tough for higher nominal wages. Indeed, there was one employer who figured it out. He needed workers and could afford to pay $40 per week ($680 per week in 2009 dollars). So he offered $50 per week with a $10 kickback. That is, when the employee received his $50 at the end of the week, he had to kick back $10. There were these stupid employees receiving $40 per week (not a bad wage in real terms) but thinking they were $50 men. They could hold up their heads in their community.

And what did the President of the time do to fight this depression (which was in his imagination)? He adopted a policy to kill pigs and plow under crops. That is, he thought that the country was suffering from a lack of wealth, and the way he chose to fight this shortage of wealth was to destroy wealth. If you think that this insanity goes beyond the bounds of human stupidity, then reflect. Today’s President is doing the same thing. Surely you have heard of the cash for clunkers program. Perhaps you are not aware that in order to qualify a “clunker” must have its engine destroyed. Only minor parts are salvaged. That is, the way that Barack Obama is fighting what he calls the current financial crisis is to destroy wealth.

I should mention that they had some trouble in the ‘30s. The jackasses who pulled the plows had been taught to walk between the rows. But with the new plowing under program the jackasses were made to trample on the crop. This didn’t make sense to the jackasses, and they rebelled. The jackasses knew more economics than the economists.

In words of one syllable. the economists of today are nuts. In words of two syllables, they are stupid, crazy and insane. In words of three syllables, they are lunatics. And four syllables is beyond their vocabulary.

Now why are the economists of that day and this so incredibly stupid? Well, it is easy to be stupid when the paper aristocracy is paying you off. Money talks. Truth gets booted out the back door. From almost every newspaper, TV show or magazine all you hear are lies.

This is why it is so hard to make money in the financial markets. As noted, I turned bullish on gold at the end of 2002. My subscribers are making the big score. But every step of the way up there has been a tidal wave of anti-gold propaganda. The paper aristocracy can’t win unless you lose. For the government to follow its (the paper aristocracy’s) policies, the majority of the people must be deceived.

By Howard S. Katz

I am a bad boy. I want to bring people the truth. To this end, I publish a newsletter, the One-handed Economist ($300/year), which analyses the markets. Right now I am a gold bug, true and blue. I expect gold to start to move after Labor Day and for $1,000 to topple soon thereafter. If you are interested in learning real economics, then check out my web site, www.thegoldspeculator.com. If you want some good economic thinking at no cost, visit my blog site, www.thegoldspeculator.blogspot.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.