When Will the Fed Start Raising U.S. Interest Rates?

Interest-Rates / US Interest Rates Sep 22, 2009 - 02:36 AM GMTBy: Mike_Shedlock

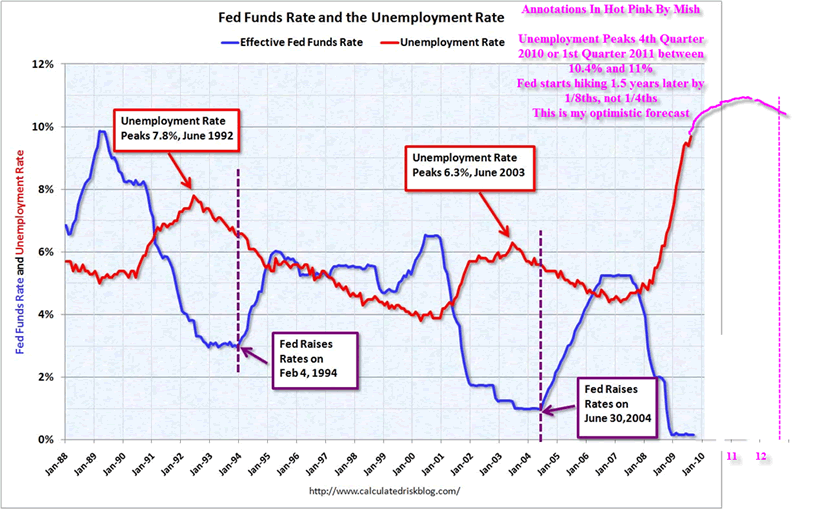

Calculated Risk has an interesting chart and discussion on the unemployment rate and Fed rate hikes.

Calculated Risk has an interesting chart and discussion on the unemployment rate and Fed rate hikes.

Unless inflation picks up significantly (unlikely in the near term with so much slack in the system), it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

I think CR is a little optimistic on the recovery. However, I certainly agree with him on the inflation front. Please see Is Pent-Up Inflation From Fed Printing Waiting On Deck? for details.

Here is Calculated Risk's chart. My annotations are in hot pink.

Look for unemployment to rise until late 2010 at a minimum. Mid-to-late 2011 is a distinct possibility as is an unemployment rate north of 11%. Of course real unemployment is already approaching 20%.

Assessing the Odds of a Double-Dip Recession

It is rare that I agree with Paul Krugman, even more so when I like his assessment more than Paul Kasriel's. However, I agree with Krugman's assessment that unemployment will not peak until 2011 and a double dip recession is a possibility.

Please consider this snip from Assessing the Odds of a Double Dip Recession for details.

Unemployment in the United States will peak only in early 2011 because of a slow and painful recovery from the global economic crisis, Nobel Prize-winning economist Paul Krugman said on Wednesday. He said the global economy seems to be stabilizing at a level that is "unacceptably poor" and added it is possible that the recession will be a double-dip one.

In this recession, assuming one believes it has ended now, unemployment is likely to keep rising for another 18 months. Yes I know that unemployment is supposed to be a "lagging indicator" but "lag" does not do justice to what happened in 2001 or what I think is likely for 2007-2011.

Greenspan had the wind of consumption at his back. Bernanke is on the backside of Peak Credit with a breeze of frugality blowing briskly in his face.

Given we are following the path of Japan, the economy is likely to slip in and out of recession or at least flirt with it a number of times over a period of several years as described in Case for an "L" Shaped Recession.

Fed Will Be "Patient"

When it comes to hiking, "patient" is likely an understatement. Moreover, when the Fed does start hiking they may do so in eighths rather than quarters.

Expect to hear the words "fragile recovery" because that is what we are in. Here are more phrases to look for: "slipped back into recession" and "flirting with recession again".

A double or triple dip recession or a pathetically weak L-shaped "recovery" is a very strong possibility if not a given. Unfortunately, it's very likely we will have Structurally High Unemployment For A Decade.

No matter what one calls the recovery (or lack thereof), Krugman has the right idea when he says the "recovery is likely to feel like a continuing recession." That to me is an "L".

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.