Crude Oil Prices - Politics and Inflation

Commodities / Crude Oil Jun 26, 2007 - 09:25 AM GMTBy: Mike_Hewitt

Oil is the commodity that the majority of people are most aware of. A 10% increase in the price of crude oil makes the headline news. One cannot drive down Main Street without seeing a sign for the latest gas price.

But how many are aware that lead has risen 155% over the last year? During that same time, tin has gone from US$3.48 a pound to US$6.49 – an 86% increase. Nickel was already surging before last summer but using the same timeframe shows an increase of 122%.

All commodities have price swings. The purpose of this article is to use oil to highlight a significant, but often omitted, reason for these price swings – which curiously enough always tend to show an upward bias.

Political Reasons for the Change in Oil Price

Below is a chart provided by the Energy Information Administration. It shows the price of a barrel of crude oil from 1970 to 2005 in CPI (Consumer Price Indexed) adjusted 2005 dollars.

It shows the various political events that have occurred starting with the 1973 Arab Oil Embargo that supposedly started this whole roller coaster.

The 1973 Oil Embargo

After the Six Day War of 1967, the Arab members of OPEC formed a separate, overlapping group, the Organization of Arab Petroleum Exporting Countries, for the purpose of unifying policy and exerting pressure on the West over its support of Israel. The Yom Kippur War of 1973 solidified Arab opinion.

On October 19, 1973, the Arab oil producing countries imposed an oil embargo against the United States. Later, the embargo was extended to the Netherlands, Portugal, Rhodesia and South Africa. The embargo lasted until Mar 17, 1974 with the exception of Libya that continued the embargo against the United States.

These events lead to a quadrupling of the price of crude oil and subsequently had a major impact on the economies of the West. In a similar fashion, all of the major political events in the Middle East have had corresponding price changes. So it seems evident that these events do indeed have an impact.

However, what was happening with the price of oil before 1970?

Impact of Monetary Inflation

Economagic.com has retrievable data that goes back further. Additionally, it has CPI data that can be mapped unto the same time frame. Below is a chart that goes from 1950 to June 2007 of the price of oil in June 2007 dollars.

Two things immediately stand out:

1) There is significant difference between the 2005 dollars in the first chart by EIA and the June 2007 dollars of the second chart as evidenced by the scale of the y-axis.

2) Oil prices appeared to be relatively stable prior 1973. It is suggested that oil prices were stable for most of the 100 years before 1973 at well under US$5 a barrel.

Why is it that the oil price was relatively stable for decades up until the 1970's? To answer that question we need to roll back the clock…

The Bretton Woods Agreement

The United States emerged from WWII with the world's strongest economy. In 1945, the U.S. produced half the world's coal, two-thirds of the oil, and more than half of the electricity. Its manufacturing capability had been spared the destruction of the war. Militarily, it still had a large army and was the sole possessor of the atomic bomb. European nations involved in World War II were deeply indebted to the U.S. and transferred large amounts of gold for repayment. At one point, the U.S. vaults contained an estimated 80% of the world's gold!

In the aftermath of WWII, the world leaders agreed to a new monetary paradigm. The U.S. dollar would become the reserve currency of the world. It was to be the only currency backed by gold, with one troy ounce priced at US$35. The dollar was said to be “as good as gold,” and convertible to all foreign central banks at this rate.

Temptation for the government to print more dollars than were backed by gold proved to be too much. Printing money to pay the bills was a lot more popular than taxing or restraining unnecessary spending. This eventually led to the equivalent of a run on the U.S. gold reserves. The French and others in the late 1960s demanded that the U.S. fulfill their promise to exchange one troy ounce of gold for each $35 they delivered to the U.S. Treasury.

This came to an end on August 15, 1971, whereby Richard Nixon unilaterally closed the gold window. This made U.S. dollars non-redeemable for gold. From this point forward, no currency in the world has been backed by gold.

There seems to be a strong correlation between the stable oil prices while the U.S. dollar was on the gold standard. While this factor does not account for all of the volatility, it certainly needs to be considered in any discussion regarding the price of oil. Next to follow is a discussion as to why there seems to be an upward trend regarding the price of oil.

The US Money Supply

In order to have a complete picture of what is happening with the price of oil (and every other commodity) one needs to consider the other unit of measure involved within the trade – that being the U.S. dollar. Below is a chart showing the growth of M1 money supply of the United States. Data was taken from the Federal Reserve of St. Louis website. Unfortunately, it does not extend before 1975. (For a discussion of the definitions regarding the various methodologies for measuring the money supply click here ).

What is of critical importance when determining a trade is to determine the supply and demand of both items being exchanged – this includes the paper money as well . We can see from the above graph that the U.S. Federal Reserve has been busy expanding the amount of currency in circulation. Unavoidably, this will result in its depreciation and higher prices for all commodities, including oil.

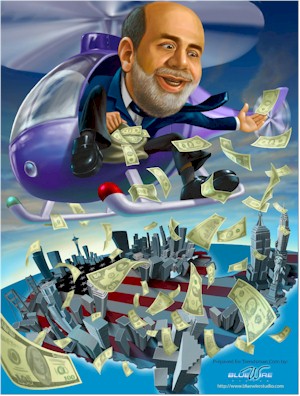

The current Fed Chairman, Ben Bernanke, is on record stating that:

“Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services.”

Such a comment rightfully gave him the title of “Helicopter Ben”

Cartoon courtesy of BlueWire Studio .

Concluding Remarks

Many people seem unaware of the consequences of paper money being unlinked to gold. Indeed, many still believe that governments still back up their currencies with the bullion from their Central Bank gold reserves. Maybe, if the timelines for historical price charts of commodities such as oil were extended before the 70's more people would ask questions about our money.

Recommended Reading

1973 Oil Crisis by AllExperts.com provides an informative reference for events surrounding the 1973 Oil Embargo.

The End of Dollar Hegemony by Congressman Ron Paul. An insightful essay on the role of the U.S. dollar in the modern world and U.S. foreign policy in the Middle East. Has particularly powerful statements such as, “Since printing paper money is nothing short of counterfeiting, the issuer of the international currency must always be the country with the military might to guarantee control over the system.” and “It is an unbelievable benefit to us to import valuable goods and export depreciating dollars.”

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of http://dollardaze.org a site about the current fiat monetary system and how to best position oneself using hard assets such as gold and silver along with shares of resource companies.

Mike Hewitt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.