A Very Interesting Gold Price Chart

Commodities / Gold & Silver 2009 Sep 26, 2009 - 07:51 AM GMTBy: Brian_Bloom

From a trader’s perspective, gold is currently pulling back from an overbought situation.

From a trader’s perspective, gold is currently pulling back from an overbought situation.

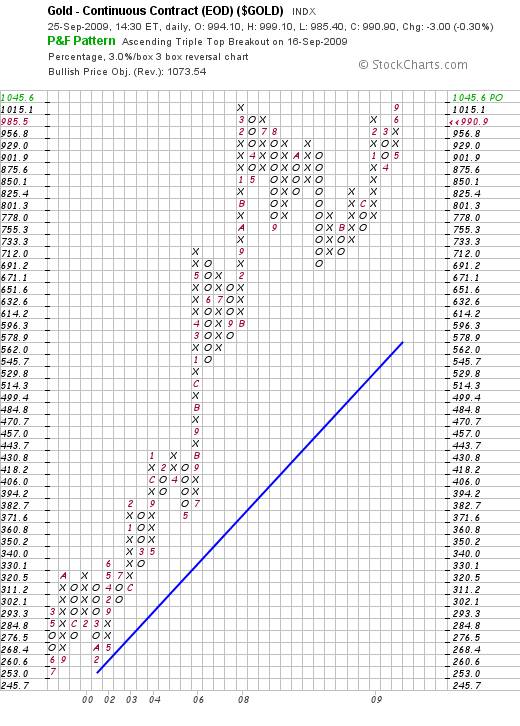

But the Point and Figure chart below has some intriguing implications.

The “fact” is that this chart is showing a Double Top – which is potentially very bearish.

The “theory” says that when the gold price broke above $1000 it had a target destination – which has not yet been reached – of $1,045.60/ounce. “Theory” says that the $1,045.60 target will be reached and, if/when it does, the gold price should rocket upwards thereafter.

But, the G20 will do everything in its power to “cause” $1,015.10 to come in as a double top – from which the gold price might pull back sharply.

Again, “But”, and this is a very serious but, at any price above $596.30 an ounce, the gold price will remain in a Primary Bull trend.

It is highly unlikely that the G20 will be able to change the direction of the Primary Trend of the gold price. Therefore, all that the G20 will achieve is that they “may” buy time.

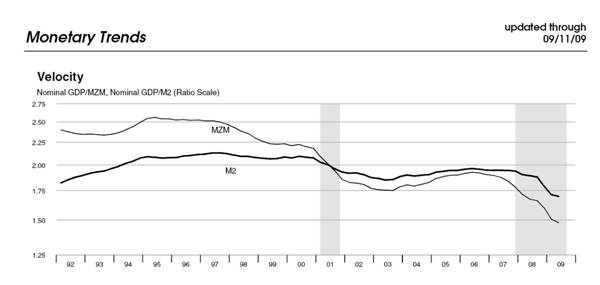

If it wasn’t for the second pesky chart below, time might be just what we need. Unfortunately, time is the enemy at present. The second chart shows quite clearly that the trend of the velocity of money is “down”. Under those circumstances, the more time that elapses, the more the underlying economy will deteriorate. Unfortunately, the policies of the financial authorities are not giving rise to an acceleration of the velocity of money. The more they pump, the faster the air is leaking out of the system. Why? Because the economic rubber has become perished with age. We need a new energy paradigm. Without it, we will be trying to pull the 60 carriage (economic) train with a team of tired old (yesterday technology) cart horses.

The falling velocity of money has arisen because the authorities have been trying to treat a migraine with an aspirin. The question is: What’s causing the migraine? We have to address the root causes of our economic problems before the economy unwinds beyond our ability to heal it.

Unfortunately, at the end of the day, the politicians will do that which they perceive will get them re-elected. I am getting less hopeful by the day.

Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.