U.S. Dollar the One Investment That Might Be About to Bottom

Currencies / US Dollar Sep 29, 2009 - 03:47 AM GMTBy: Graham_Summers

As I’ve noted several times on these pages, the US stock market and US dollar are trading at a near perfect inverse correlation. With stocks extremely overbought and reaching a critical point of potential resistance, any bounce in the dollar could kick off a rapid collapse in the US stock markets.

As I’ve noted several times on these pages, the US stock market and US dollar are trading at a near perfect inverse correlation. With stocks extremely overbought and reaching a critical point of potential resistance, any bounce in the dollar could kick off a rapid collapse in the US stock markets.

Which is why I’ve noted with great interest that the dollar is showing signs of a potential short-term bottom. The below chart details the US dollar (black line), S&P 500 (purple line), and their respective 21- and 55-day moving averages.

First and foremost, I want to point out that the S&P 500 could easily fall to test its 21-day moving averages (1,060) and the dollar could rally to test its 21-day moving average (77.34) in the very near future. This would certainly fit will with my theory that we will see a brief correction in stocks in the next week.

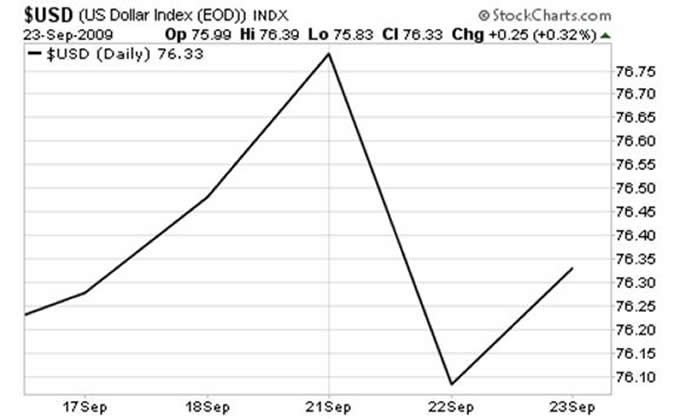

However, one item that really interests me is the fact that the dollar actually rallied both INTO and AFTER the Fed’s FOMC meeting.

As you can see, the US dollar rallied strongly from September 16-21. You’re probably wondering how I can claim the dollar was rallying when it collapsed on September 21. Well, you should know that the collapse that occurred on the 21 came from an article that Reuters’ forex columnist wrote based entirely on his OPINION, not any real announcements.

On Tuesday, Reuters reporter Neil Kimberly wrote a piece stating that President Obama will push for more dollar depreciation in the G20 meeting currently taking place in Pittsburgh. I want to point out first and foremost that the article is cited as Kimberly’s “opinion” not fact. I also should like to note that even Kimberly himself states that there will be no “explicit” call for dollar debasement.

Last week I commented that we are reaching a point of “desperation” for stocks: a time in which investors are so desperate to believe the “bull story” that they will spin any and all news items to reinforce their beliefs. The Neil Kimberly article and subsequent collapse in the dollar illustrate this fact like nothing else. Here we have an “opt-ed” piece by a reporter who has no factual basis for his claims of further dollar debasement and yet the dollar tanked and stocks rallied.

The desperate side of this story comes from the fact that the dollar had begun a four-day rally prior to Kimberly’s piece. And it quickly reversed and rallied the day AFTER the article came out. Even more importantly the dollar rallied AFTER the Fed’s FOMC announcement in which it stated it would continue to fight the financial crisis with a “wide range of tools.”

Put another way, despite the Fed clearly stating it will continue to pump money into the system and maintain various anti-dollar policies, the dollar actually RALLIED. If that is not a sign of a potential bottom, I don’t know what is (remember bottoms come on bad news, just like tops come on good news).

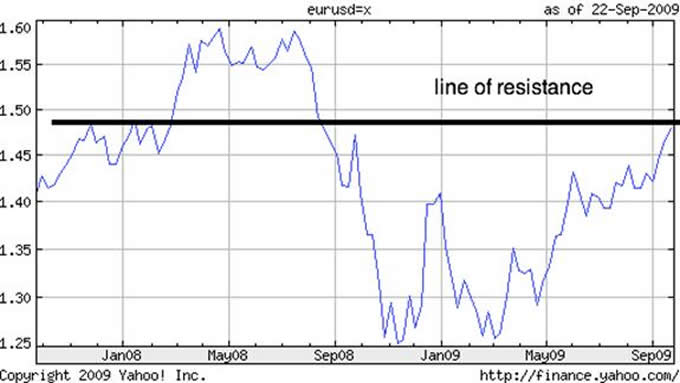

Looking strictly at the dollar index chart can be misleading because it represents the dollar’s value against a basket of world currencies. For more specific directional insights, we need to consider the dollar’s individual chart against specific main currencies like the Japanese Yen and the Euro.

Well, the dollar/yen is showing signs of potentially having broken out of its downtrend…

Similarly, the euro/dollar chart is closing in on a line of historic resistance.

Both of these charts (as well as the overbought nature of US stocks) bode well for the dollar. I’ve said time and time again that Bernanke will have to sacrifice stocks or the dollar. We’re now literally within a week or two of seeing which investment class will roll over. Either stocks will be rejected at their 88-weekly moving average and the dollar will rally (kicking off a wave of risk aversion) OR the dollar will sink to potentially test its low of 71 on the dollar index and the S&P 500 will explode higher to 1,200.

With only 3% of investors bullish on the dollar, the stage is set for a real surprise here. I think we could very well see the dollar rally and stocks collapse.

I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only protect your portfolio from the coming carnage, they’ll also show you enormous profits: they returned 12%, 42%, and 153% last time stocks collapsed.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.