This Stock Market Sentiment Indicator Always Works

Stock-Markets / Stock Market Sentiment Sep 30, 2009 - 11:37 AM GMTBy: Q1_Publishing

Last Friday the folks at Fox Business News invited your editor on to talk about gold (view clip here – I come on at about the 21 minute mark).

If you watch the video, it won’t take long to see Fox Business probably won’t be having me back on anytime soon.

Last Friday the folks at Fox Business News invited your editor on to talk about gold (view clip here – I come on at about the 21 minute mark).

If you watch the video, it won’t take long to see Fox Business probably won’t be having me back on anytime soon.

The reason I won’t be back is not because I did a terrible job or anything like that. It’s because of something else. It’s because of something 99% of investors don’t know, but if they did, most of them would instantly become better investors and, in this case, reveal to them exactly how to maximize their gains from the ongoing gold bull market. Let me explain.

The Truth about TV

The media industry is different than any other.

Media companies are simple businesses. They make money by keeping viewers tuned in. They provide the information the masses want, whether that is good information at the right time or not. That’s why they chase after “hot” news stories just like most investors. It’s more exciting. It’s more fun.

That’s why with gold passing $1,000 an ounce and holding up, the herd wants more information about gold. They want predictions. They want to hear someone say gold is going to $500 or someone who’s going to say gold’s going to $5,000. And from the media company’s perspective, the more outlandish the prediction the better (outlandish = entertaining/interesting = viewers staying tuned).

Why I Won’t Be Back

Take my Fox Business spot about gold for instance. We went over what are the potential prices of gold, the different ways to value it, and the key things that need to happen before gold prices take the next big step forward.

The general tone of everything was the big run in gold is going to take a lot longer than most folks expect.

The U.S. dollar has been the world’s reserve currency for decades and it’s not going to unwind in a year or two.

Also, there still needs to be a shift in most investors’ perspective towards gold. Although gold has gotten quite a few headlines over the past year, it’s still far from a “mainstream” investment. When most investors think safety, they think of large-cap stocks like Wal-Mart, GE, and IBM. Not hard assets like gold, silver, and oil. Although the hard asset camp is certainly growing, it’s still very small compared relative to the large-cap stock camp.

All that leads into the real reason I probably won’t be back anytime soon: because I’m boring.

Most mainstream investors don’t want to hear about the best opportunities in gold (more on them below). They just want to hear some predictions, a two minute “elevator pitch” on why they should buy gold, and then buy the major gold stocks or some gold or gold related ETF. Meanwhile, they’ll gloss right over the safest and highest potential opportunities in the gold sector and get the timing completely wrong on top of it all. That, again, is why most investors are not successful even though this market environment is potentially the most lucrative in the world..

When to Buy Gold Stocks

A few months ago we looked at the three stages of market sentiment. After all, if you pay close attention to sentiment, you can significantly increase your upside potential and reduce your risk. You’ll achieve that by focusing on the micro-cycles within the long-run bull cycles.

Just like in the long-run gold bull market, there are three stages in the shorter cycles as well. For instance, back in July we identified how the temporary dip in gold stocks was a great time to buy as gold was entering the three stages.

From the Prosperity Dispatch, July 10 2009:

Stage 1: We went through the first stage about a month ago. At the time gold was in all the headlines, hedge fund manager John Paulson was buying gold, his move made gold “cool” again. Gold was hot and a “this will be the last opportunity to buy gold stocks” mentality was taking hold. As usual, the euphoria didn’t last.

Stage 2: This is the period when commentators start focusing on the long-term case for gold. They start saying things like “gold is going to take a while” and “if you’re going to buy gold, you better be in for the long term.” We looked at gold the same way, but we were doing it throughout the first stage and looked into how Paulson’s trades, although very profitable, usually take a couple of years to play out.

Stage 3: This is when Gold stocks fall out of favor, deflation fears dominate, and Wall Street moves onto another hot sector. And it’s the third stage which is the time to buy.

September 29, 2009:

Stage 1: Earlier this month gold climbed past $1,000 an ounce and kept going. There was a real urgency to buying gold before it runs much, much higher. The herd was chasing after it. Goldseek.com, one of the most popular gold web sites in the world, set a new traffic record.

Stage 2: All signs point to us being in the latter parts of the second stage. Most pundits have calmed down a bit and started focusing on the long-term and the fundamentals for gold (which we always try to do), gold prices have corrected, and there are even a few analysts advising to get out of gold.

For example, the National Bank of Canada, which has been bullish on gold since 2005, has recently changed course on gold earlier this week. The National Bank’s Matthieu Arseneu said, “In our opinion, all the factors that contributed to the recent upswing in the price of gold are set to reverse.”

This type of call (from a major bank no less) does not happen in the euphoric Stage 1.

Stage 3: Gold’s out of favor. There are no more headlines. Wall Street has moved on. Right now, with your editor on Fox Business to talk about gold, we’re not quite in this stage yet. But it’s not far away.

Finding good entry points and tracking sentiment are just part of the equation when investing in gold successfully. An equally big part is what stocks to buy.

Stepping Over Dollars to Pick Up Nickels

Still, despite the recent run-up in gold and lots of big money chasing after the major gold mining stocks, there are still exceptional values in the junior gold stocks.

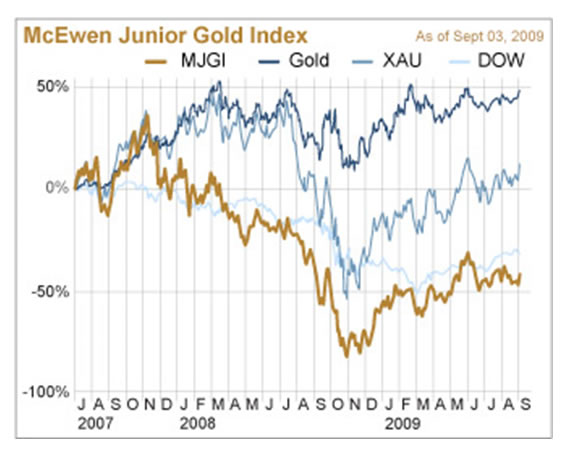

For instance, the chart below tracks gold, major gold stocks (XAU), the Dow, and the McEwen Junior Gold Index:

Clearly, the “juniors” are still the best value in gold stocks around. Going back to 2007, gold’s up almost 50%, major gold miners are up 10%, and junior gold miners are down 40%.

So whether you’re looking to time your entry points, use market sentiment to your favor, or just get the most bang for your buck in the gold bull market, take a look at what’s actually going on in the market.

The media may be entertaining, interesting (as long as it’s not your editor featured), and somewhat useful if you know why they do what they do, but it’s not going to make you a more successful investor.

That will come from taking a step back, paying attention to market sentiment, and looking for the most undervalued opportunities which offer the best risk/reward propositions.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.