Gold Overvalued Against Crude Oil? Long and Short-Term Analysis

Commodities / Gold & Silver 2009 Oct 23, 2009 - 02:26 PM GMT The crude oil market has lost most of its popularity since it is no longer near $150 per barrel (no longer do oil-related topics dominate the main financial websites), but nonetheless I’m sure that nobody can deny crude oil’s importance in today’s globalized economy. It is vital for both businesses and individual consumers, as fuels are derived from it. Most of us need to drive and purchase goods that also need to be transported to us directly or indirectly.

The crude oil market has lost most of its popularity since it is no longer near $150 per barrel (no longer do oil-related topics dominate the main financial websites), but nonetheless I’m sure that nobody can deny crude oil’s importance in today’s globalized economy. It is vital for both businesses and individual consumers, as fuels are derived from it. Most of us need to drive and purchase goods that also need to be transported to us directly or indirectly.

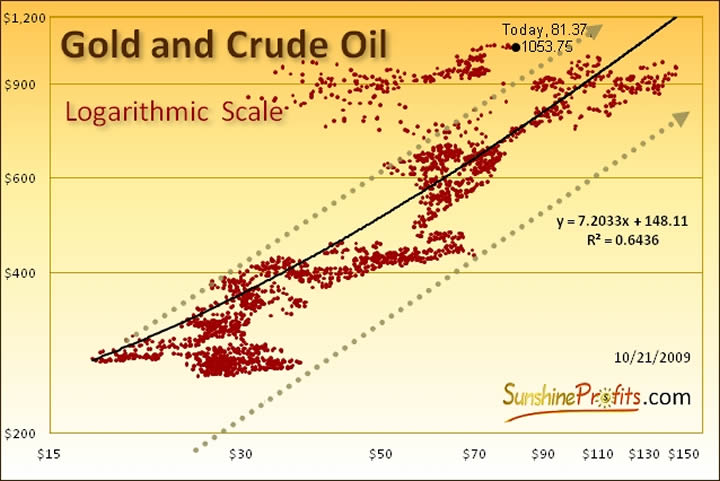

Since crude oil is so vital to the modern economy, it should not surprise anyone that it influences many markets, and virtually none of them can be completely free from oil’s influence. Therefore, this week I will analyze this particular market, from the precious metals perspective. I will use the scatter chart in order to focus on the trend and the average shape of the correlation.

As you may see on the above chart, the price of gold/oil has been trading considerable above the dotted trend channel in the past few months. The reason was that most commodities were reacting to the deflation scare that was being hyped by the media about a year ago, and crude oil was no exception. Gold did not suffer that much. One of the reasons might have been that it was perceived as a form of money and during deflationary periods “cash is king”. I’m not suggesting that we are in one right now –this is just a brief reminder of what was popularly heralded in the mass media. I’m not saying that this was done on purpose so that the powers that be could get away with printing more and more money, but that is definitely a food for thought.

Anyway, crude oil dropped much more than gold and the gold/oil price combination moved far from the trend channel on the chart above. Generally, prices sooner or later tend to reverse to their means, and I don’t expect this time to be much different.

However, this time, I do not expect gold form a long consolidation while crude oil soars. To the contrary, I believe that the fundamental and technical factors are in place for a substantial rally in the metals. So, if the relative value of crude oil to gold is to rise, and go back to the previous trendline (it would mean oil at about $130 given today’s gold price), I would see this process to take place by oil slowly catching up, in a similar way to what we see today. Consequently, the gold/oil ratio rose significantly, and is now moving lower, which has important implications for PM stocks, but I will leave this part of the analysis to my Subscribers.

Another possibility is that metals are going to take off regardless of the situation on the crude oil market. This is probable, but most likely will not take place untill we are in the third stage of the bull market – please keep in mind that this is what took place in the previous bull market – PMs outperformed other commodities.

Before summarizing, I would like to comment on the short-term situation (charts courtesy of http://stockcharts.com) in gold.

The situation did not change much since the previous week. We are still in a trading range after a significant rally, and I still view the short-term correction after a brief rally as the most probable scenario for the following weeks. The red-rectangle marks the probable topping area. It is based on the size of the rally predecing the September consolidation (history tends to repeat itself, particularly during the ABC upswings/downswings), and the Phi (1.618) multiplier used on it.

The question that I’m often asked recently is how low would the correction take us. The answer is that although the September correction did confirm the breakout, the size and significance of the move suggests that a one more re-test of the previous high of $1,033 is likely, but nobody can rule out a decline to $1,000. The media buzz that was caused by gold breaking into four digits caused many momentum chasers to enter the market that don’t want to stay in it for longer. As soon as the rally runs out of steam (for instance we will see declining volume during days when PM rise), they will dump their gold and silver positions thus igniting the decline.

The history often repeats itself, but even more often it rhymes, meaning that the analogy is not ideally precise, but is still present. This is why I marked the whole area, instead of focusing on just one point.

The dollar is in the lower part of its trading range while precious metals are likely to move a little higher before the post-$1000-breakout rally runs out of steam. Since the U.S. Dollar is one of the most important drivers of PM prices in the short run, the temporary effect a small upswing would indicate a decline in gold and silver, however that is not in tune with what gold chart is suggesting at the moment.

My best guess is that we may have a very quick (few days at most) drop in the value of the USD Index – below the short term support line, but it fails to close below that level for three consecutive days and once again rallies above this level to test the upper border of the declining trend channel. Should this take place, I don’t expect the resistance – the upper border of the trend channel – to be broken. As mentioned in one of the previous essays, I expect USD to trade sideways before finally breaking much lower. This action would correspond to a decline after a brief rally in gold.

Summing up, although many commodities declined sharply in 2008, we are still in the secular bull market in the commodities. The most important commodity – crude oil – has also been hammered and – contrary to gold – did not pass it’s previous highs yet. Although oil’s underperformance to gold might put the commodities‘ bull market into question, I believe the situation is slowly moving back to the normal state. In other words, I don’t think that one must be worried about the fundamental situation in gold, nor in the crude oil.

The precious metals market has been trading sideways this week, and points raised in the previous Premium Update are still relevant today. The most likely scenario for the coming weeks in my view is that gold and silver would move briefly higher and then correct the post-$1000-breakout rally.

To make sure that you get immediate access to my thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great and profitable week!

P. Radomski

Editor

Sunshine Profits

Interested in increasing your profits in the PM sector? Want to know which stocks to buy? Would you like to improve your risk/reward ratio?

Sunshine Profits provides professional support for precious metals Investors and Traders.

Apart from weekly Premium Updates and quick Market Alerts, members of the Sunshine Profits’ Premium Service gain access to Charts, Tools and Key Principles sections. Click the following link to find out how many benefits this means to you. Naturally, you may browse the sample version and easily sing-up for a free trial to see if the Premium Service meets your expectations.

All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments.

By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw RadomskiArchive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.