Rising Gold Dances but Won't Die with the U.S. Dollar

Commodities / Gold & Silver 2009 Oct 24, 2009 - 03:23 AM GMTBy: The_Gold_Report

With all the 'strong dollar' rhetoric coming from the Fed and broken-record Bernanke, it's a wonder any investors are making money. But one we know and trust is. . .because he's not listening. "The U.S. will continue to take a laissez faire approach to the dollar," says John Doody, Economics Professor for nearly two decades and current author and publisher of Gold Stock Analyst. In this exclusive interview with The Gold Report, John explains how he measures gold's price performance, why he believes most investors don't have enough gold stocks in their portfolios and which companies he's making money on right now.

With all the 'strong dollar' rhetoric coming from the Fed and broken-record Bernanke, it's a wonder any investors are making money. But one we know and trust is. . .because he's not listening. "The U.S. will continue to take a laissez faire approach to the dollar," says John Doody, Economics Professor for nearly two decades and current author and publisher of Gold Stock Analyst. In this exclusive interview with The Gold Report, John explains how he measures gold's price performance, why he believes most investors don't have enough gold stocks in their portfolios and which companies he's making money on right now.

The Gold Report: John, why hasn't the mainstream media caught on to what's going on with gold?

John Doody: The CNBC types are always talking their own "book," which is mainstream stocks. If no one buys the broad market stocks, there are no jobs for the talking heads, et al., at CNBC. They're always pooh-poohing gold and love saying that gold at the current price, $1,060, hasn't really done much from the $850 high in 1980. That's a false comparison. If you want to use that, then why not point to the S&P high in the 1500s or the Dow high in the 14,000s as a measure, instead of the March 2009 lows?

The gold price was controlled from the 1930s until March 1968 by eight Central Banks (CBs) that were the gold cartel and fixed the price of gold at $35 an ounce. That ended in March 1968 when market forces overwhelmed the CBs. Unable to enforce $35/oz, they let gold's price float in the free market. Between themselves, they still traded at $35 and then, of course, all of that fell apart when Nixon went off the gold standard entirely in '71.

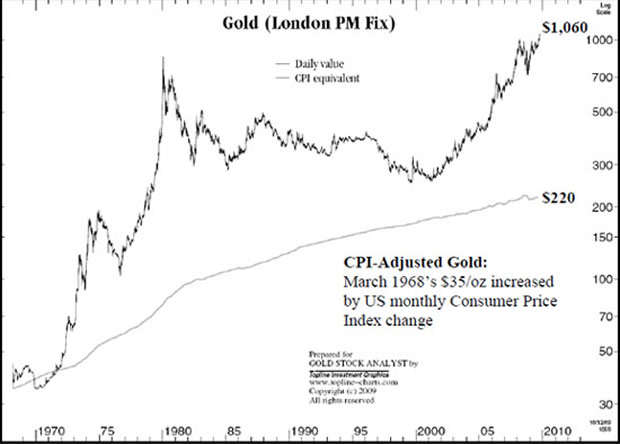

The appropriate measure for me as to how gold has performed is to go back to when the price was set free, March 1968. If you take the $35 gold price and adjust it for 41 years of the U.S. CPI increases, the gold price would be about $220 an ounce, increasing at an average compound rate of about 4.5% a year. But since being set free in 1968, the gold price is now $1,060. So gold has provided great inflation protection, and growth. From $35 to $1,060 — that's about an 8.5% compounded annual rate per year. That's the true measure of gold's value for inflation protection. (See chart.)

TGR: So what's driving the price of gold? Is it just the devaluation of the U.S. dollar?

JD: Well, that's part of it; but gold is still about 10% below the all-time high in other currencies, such as the euro or the yen. So part of the growth of gold price is due to all fiat currencies falling, but it's mostly due to the dollar going down because it's a dollar-denominated commodity and that's what people want to escape—the dollar's declining value. Gold provides appreciation and a safe haven.

TGR: How long do you expect this trend to continue?

JD: It could go forever. I don't think we're going to see the hyperinflation of Zimbabwe or the Weimar German Republic. The falling dollar will eventually cure the trade and current account deficits because we'll stop buying foreign-made goods. They'll just be too expensive. Currencies go through these ebbs and flows of value. In the '80s we had high interest rates and the dollar was too strong. Central Banks met at the Plaza Hotel in 1985 to knock down the buck's value, and they were successful. Now I'm not so sure, because foreign exchange markets and the dollar amounts are so big that the Central Banks can really change the dollar's direction. Like a tugboat changing the direction of a battleship, they can nudge it a little bit in the short term; but long term, it's the economic fundamentals that control. The U.S. will continue to take a laissez faire approach to the dollar. They talk a good game, they talk strong dollar, but they don't do anything to defend it and that's because they want a weak dollar. A weak dollar stimulates U.S. exports and job growth.

TGR: What's your long-term target for the gold price?

JD: I really don't have one because my investing strategy is to find undervalued gold stocks at every gold price. So it's not necessary for me to say that the stocks I recommend are going to go up because gold's going to go up. My Top 10 Stocks should go up because they are not properly valued vs. others of comparable stature based on the three metrics I use: 1) market cap per ounce of reserves, 2) market cap per ounce of production, and 3) operating cash flow multiple. My Top 10 so far this year is up 124% and that's with one stock being flat. So the other nine have, on average, more than doubled. That's vs. gold at $1,060 up 22%, and the XAU up 45%.

This appreciation is why you should own the stocks more than the metal. Every dollar of price increase gives you a dollar more profit from current production, and it makes all the ounces that you've got in the ground that haven't been mined each worth a dollar more. Typically, a mining company has 10 times the reserves in the ground vs. what it's currently producing. So that 10 multiple—it's even higher for some—that's where you get the leverage from a gold price.

TGR: At a certain point, of course, stocks become overvalued. In your recent newsletter you said that they're fairly valued at a gold price of $997. We're now at $1,060. Are we getting close to being overvalued?

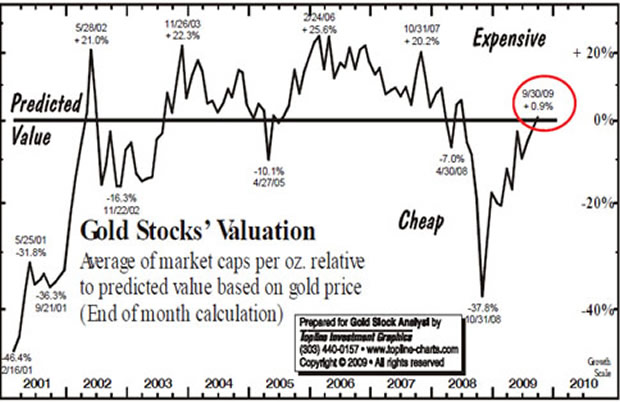

JD: Not yet, because the gold price of $1,060 now justifies higher values than at last month's $997 gold price. What I'm looking for is the market to go to overvalued, as it's done in the past. I measure overvalued and undervalued based upon past relationships between the market cap per ounce values we calculate every month vs. gold price at that time. Right now we're at a fairly valued situation. But there's been four instances, in 2002, 2003, 2006 and 2007, when gold stocks were 20% or more overvalued based on my market cap/oz. metrics. It's investor enthusiasm that creates these overvalued situations, and as can be seen in the chart, we're not there yet.

People bid up the prices of the stocks so that the market cap per ounce we calculate goes to overvalued levels vs. where they've been in the past. So, even if gold did nothing from here and just stayed around this $1,050–$1,060 area, investor enthusiasm could drive the stock prices higher to make the stocks 20% overvalued.

So I see a lot more upside from here and I think this is evidence that we don't have a big retail participation in this market yet. People have been thinking there's a $1,000 an ounce ceiling and they don't realize that it's become the floor. Maybe it's going to take a few months hanging over $1,000 or maybe we're going to have to get to $1,100. At some point investors are going to realize this gold bull market has much further to go and as they pile into the small gold sector with only a $250 billion market cap, they'll drive stock prices much higher.

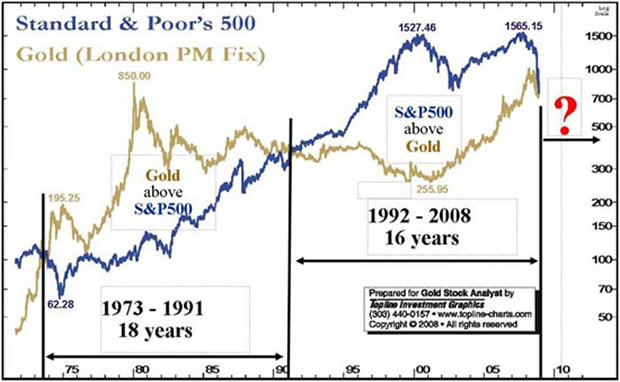

One rationale for more investors coming to gold can be found in studying the S&P500 vs. gold price. As seen in the chart below, from 1973 to 1991, the gold price was higher than the S&P. From 1992 to 2008, the S&P 500 was higher than the gold price. Now we're back in the area of uncertainty where the gold price and the S&P price are about the same. As you look forward, I can't make any argument for the S&P going higher. I think that it's overpriced now and that analysts are building in earnings numbers for the S&P that aren't going to be earned. The consumer's tapped out. So the banks have come back some, but they've got a lot of bad debt still to write off from credit cards and commercial loans The consumer is 70% of the economy. Without them aggressively participating, I just don't see any driver for the S&P 500 to even support this level. But I can see lots of drivers to support a higher gold price. Just look at monetary and fiscal policy, printing and borrowing too many dollars The years ahead, in my opinion, have to be good for gold and not so interesting for the S&P 500 and I think as people realize this, we're going to get more retail investors coming to the gold sector.

TGR: So your Top 10 list that you came out with last January is up 124%. Nine winners and one flat one. Do you come out with another Top 10 list in January 2010?

JD: We do it on an ongoing, not an annual basis. We calculate the results on an annual basis, which is very unique in this industry. Nobody else does this unless they're a mutual fund. Every other newsletter wants to tell you what their results were based upon when they first recommended the stock, which might be five years ago. But we track the Top 10 the way any private investor would their portfolio and we put a monthly statement in the newsletter. We've had one sell in 2009. We took one off that was up 58%. It hit our target price and we didn't see a reason to raise the target price. We sold it and we had 10% cash for about four months, and we just found a new company, Terrane Metals Corp (TRX: TSX.V), which we put on the Top 10 list in September.

We put Terrane Metals on at 50 cents. It's 80 cents now and our initial target was $1.50, but we said if a feasibility study update comes through as we expect—and we expect it to see a 30% increase in the reserves — that would make our target price $2.50. Well, yesterday the feasibility results were released and we've raised our target price to $2.50. The stock's still at 80 cents.

Of my Top 10, the flat one is Royal Gold Inc. (TSX:RGL, Nasdaq:RGLD), which started the year around $49 and that's where it is now. It was the only winner of any note last year in 2008. It was up 60% and I think that 2010 is Royal's year because it has two big mines coming on line. On Goldcorp’s (TSX:G) (NYSE:GG) Penasquito it gets a 2% royalty that's worth about 78 cents a share in royalty revenues and another big mine, the Andacollo mine, owned by Pacific Rim Mining Corporation (TSX:PMU, NYSE/AMEX:PMU), will be coming on line towards the end of next year to add almost $1.00 a share. Stocks have cycles, and sometimes we sell and try to buy them back, but sometimes we just stay with them because we know it's hard to buy some, particularly since Royal's only got 40 million shares outstanding.

TGR: John, I believe you said to your subscribers, if Royal Gold gets below $40, back up the truck.

JD: I did and it did.

TGR: It did, absolutely, and those subscribers who listened to you have got a nice 30% gain because that did happen.

JD: Well, you know, these all can trade up and down. They're volatile. Sometimes you get a new fund manager that doesn't like the story and so he dumps whatever's in the fund that he doesn't like. They're going to get judged on what they buy, so they buy the stories they like. I'm not saying that's what's happened to Royal, but it does happen with these stocks, where all of a sudden you can get a 20% or 30% selloff. I tell investors they should keep a mental 20% trailing stop. But then if the stock falls 20%, is that a reason to sell or buy more? And, more often than not, it is a reason to buy more. Sometimes if something basic changes, we'll take the stock off the Top 10 and tell people to sell. But if nothing basic changes, it becomes a back-up-the-truck opportunity.

TGR: Many of your stocks are starting to approach your target price, yet you still sound pretty optimistic that there's a lot more upside.

JD: Yes, and we have to change the target prices. We'll probably do that in the November issue. The target prices were basically set when gold was $900. That's been my working price for the year and for the first six months, the average price was $912, so that was a good enough number. Now we're getting not only to the end of the year and we've got a much higher gold price, but we're also starting to look forward to what production is going to be next year. One of the things we look for, in addition to the three main metrics, is growth in production. So we'll start looking at what higher production will do for the stocks next year. We raised the target prices for two stocks in the October mid-month update, and because the November issue updates our reports on four of the Top 10, we'll probably be raising more targets.

TGR: Are there some other stocks that are in your Top 10, or ones that you're watching that you can share with our readers?

JD: Sure. Goldcorp (TSX:G) (NYSE:GG) has been a Top 10 stock. It's up 36% so far this year and, basically, I think the market's waiting to see that its Penasquito Mine, which is also important to Royal Gold and Silver Wheaton Corp. (NYSE:SLW, TSX:SLW), comes on line as planned. Mines don't always start up smoothly. They're not like buying a television and you just turn it on. It's more like buying a computer that doesn't work when you start it up. It doesn't mean they can't be fixed, but usually there are issues and little glitches and it takes a while to ramp them up.

The Penasquito Mine won't be fully operational until sometime in 2011. That's almost a two-year ramp up, but it's a huge mine. The revenues at these prices are going to be about $1.6 billion a year. It produces a half a million ounces of gold, 31 million ounces of silver, and millions of pounds of lead and zinc a year. It's going to be the biggest mine by far in Mexico in terms of revenues and in terms of gold production. And I think the market is waiting to see that this is coming on smoothly for Goldcorp to begin to reflect it in its price. And the stock's 36% increase so far this year is still about double that of gold.

I expect that everything's going to work fine and that Goldcorp's big year may be 2010 and that's the same for Royal Gold, as I said. It's got a big royalty on the site. At current prices, the revenues of the site are $1.6 billion, Royal Gold's 2% is $ $32 million a year; close to 78 cents a share.

Silver Wheaton is producing right now about 18 million ounces and it's really a royalty stream situation, much like Royal Gold . Silver Wheaton's royalty is 18 million ounces a year times the difference between silver price and the $4 per ounce it pays miners. If silver averages $16 in 2009, that's $12 net times 18 million ounces for $216 million in royalty income. The silver stream increases by 7 million ounces when Penasquito comes on line fully. So Silver Wheaton is a great way to play silver, though there was a great deal just made today by Pan American Silver Corp. (TSX:PAA; NASDAQ:PAAS), who, in my mind, is the best operating silver miner in the business by far. They're buying Aquiline Resources Inc. (TSX: AQI) for $600+ million. There's 700 million ounces of silver, with more expected. This is exactly what Pan American has been missing, in my opinion, as a stock. It's had a number of smaller mines that add up to about 20 million ounces a year, but the Aquiline deposit is going to give the potential to add another 10 million ounces right on top of that or more and give it the real flagship it lacked.

Another stock that has done well this year is Yamana Gold Inc. (NYSE:AUY), up 63%. And, again, this has been a situation of bringing on line a new mine in Argentina. It's now operating on a commercial basis and seemingly running fine. If Yamana makes a good jump up in production next year and 2012, the market will soon begin to factor it into the stock price.

Minefinders Corporation (TSX:MFL, NYSE.A:MFN) has doubled this year. It's up 104%. And, again, it's not fully up and operational on its new Dolores Mine. It's not until January of next year that it begins to hit its full recovery for silver. It's already hit its recovery rate for gold, but silver still is to come. So there's going to be plenty of basis to raise its target price.

European Goldfields Ltd. (TSX:EGU, AIM:EGU) is up 130% this year. They got a key permit just the other day in Greece and European has 9 million ounces of reserves, almost $200 million cash in the bank. It's got three mines that it's building and the one base metal mine that's currently operating. European has had a $6 stock target, which it hit and I've raised the 2010 target. When all of the permits are issued, which should be early 2010, I think the stock could be a long-term triple from here.

My philosophy is you've got to buy 10 because if you buy one stock and it's got a permit or similar issue and it doesn't get it, you're going to get killed. But if you've got all 10, you can take that risk. But too many investors think that they've got gold exposure with one or two stocks. And then when I ask them what the one or two are, they're exploration plays. That doesn't give you any gold exposure at all. That's just exploration exposure.

At the gold shows I speak at, such as the coming one in San Francisco, people show me their portfolios. Most of them suffer from not having enough gold stocks. They have a big enough percentage, the proverbial 10% or 15% of the portfolio. But too often it's all in a couple of stocks and that's too much risk. You need to diversify your risk. In the old days when it cost you $200 commission, it was expensive to own 10 stocks. But now with $10 internet commissions it's no big deal. Or they own too many and the risk of that is that you're just going to mimic the market at best. The typical gold mutual fund has 40 stocks in it and that's why they can't do so well. There aren't 40 gold stocks worth owning.

TGR: John, you offer a trial subscription, correct?

JD: Yes, you can subscribe for three months, and there's a free issue on the Gold Stock Analyst website, which you can download. It's not the current one, but it's free, and you'll get an idea of the detail of our work. It takes seven issues to cover all 75 stocks, plus we have the mid-month update of two to six pages. And we often make changes to the Top 10 in the update. The main monthly issue features reports on all the stocks we cover. The updates focus more on what's going on in the gold market and what's happening at just the Top 10.

TGR: John, thanks once again for your input. This has been great.

DISCLOSURE: John Doody

I personally and/or my family own shares in all the companies mentioned in this interview.

I personally and/or my family am not paid by the any of the companies mentioned in this interview. GSA is entirely subscriber supported.

John Doody brings a unique perspective to gold stock analysis. With a BA in Economics from Columbia and an MBA in Finance from Boston University, where he also did his Ph.D.-Economics course work, Doody has no formal "rock" studies beyond "Introductory Geology" at Columbia University's School of Mines.

An Economics Professor for almost two decades, Doody became interested in gold due to an innate distrust of politicians. In order to serve those that elected them, politicians always try to get nine slices out of an eight slice pizza. How do they do this? They debase the currency via inflationary economic policies.

Success with his method of finding undervalued gold mining stocks led Doody to leave teaching and start the Gold Stock Analyst newsletter late in 1994. The newsletter covers only producers or near-producers that have an independent feasibility study validating their reserves are economical to produce.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

The GOLD Report is Copyright © 2009 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.