Pig Farmers and China Monetary Inflation Are Making Brent Nervous

Economics / China Economy Oct 24, 2009 - 04:28 AM GMTBy: The_Gold_Report

Before getting into to the relationship between copper and pork products, I want to draw your attention to one paragraph from a commentary by Paul van Eeden that offers a contrarian, and undoubtedly unpopular view amongst the Kitco readership, of the gold market:

Before getting into to the relationship between copper and pork products, I want to draw your attention to one paragraph from a commentary by Paul van Eeden that offers a contrarian, and undoubtedly unpopular view amongst the Kitco readership, of the gold market:

"Earlier we reached the conclusion that US interest rates could potentially start increasing and cause the US dollar exchange rate to strengthen, which, in turn, would cause the gold price to fall. We can now add that the massive inflation of China's money supply can cause the renminbi to collapse and send another currency crises rippling through financial markets. A collapse of the Chinese renminbi could also result in a stronger dollar and lower gold price."

Continuing with today's contrarian theme and what makes me nervous, have a look at these photos from China. They are excerpted from a China Central Television Channel (CCTV) program documenting private speculation and hoarding of metals throughout the country. According to an associate of mine at an Asia-focused hedge fund who was just in China, "It's pervasive; people are piling this stuff up in their backyards."

("It's pervasive")

- Wang Chao lived in Anxin county of Hebei province (rural area). He is in charge of a metal scrap collecting company. He used to purely take commissions for collecting scrap. Since 1H 2009, he started stocking scraps. He told CCTV his business now is like 'gambling.' Not only him, Mr. Wang said many people in his town have stocked a lot of metal at their home.

- They told CCTV they believe the metal prices will 'certainly rise', and they have 'a lot of' stocks. For example, he said, in Laohetou county, every household has dozens to hundred tonnes of copper. Nobody wants to sell. They believe copper price will goes back to Rmb70,000/tonne from currently Rmb40,000/tonne.

- Traders in Wenzhou city of Zhejiang province: A business man told CCTV, they use a lot of bank loans and bought a lot of metals for stocking. For one warehouse, he stocked at least 15 Kt to 20 Kt of copper. For his total personal metal inventories, he invested Rmb1-2 bn. He believe all metal prices will surge with inflation.

- A non-ferrous metal warehouse manager, Mr Qin Baoqing in Wusong District of Shanghai. He said many metals cannot be put in their warehouse, so they have to leave them in the backyard. Many stocks have not been moved for 3 months now. For example, he said, they have many aluminium stocks from Lanzhou Aluminium, Guizhou Aluminium, etc.

- He Jinbi from Maike (metal trading company). He told CCTV they saw many farmers in Guangdong province stocking more than 100 tonnes of aluminium at home. These people used to raise geese for living.

- Because the interest rate is too low in China. Many farmers could make hundreds of RMB profits per tonne, with dozens of Rmb per tonne cost of interests. They use their existing inventories to borrow more from banks. Banks are very 'happy' to lend to them.

- [a side bar here: China's 4 trillion stimulus package equals about 15% of GDP and according to the Financial Times, bank loans are up ~140% this year to ~8.6 trillion Yuan and official State investment accounts for 88% of GDP growth. What we are witnessing is Chinese savers experiencing negative real interest rates in their savings accounts: much worse than in the US. At the same time they are able, in fact motivated, to borrow money at rates that are less than the inflation rate. Hence, the massive government stimulus combined with unlimited cheap money has fueled a soaring stock market, real estate prices, and as presented here, commodity speculation. Approximately 60% of the stimulus money is estimated to have gone into these speculative sectors.]

- On the other hand, many stock brokerage firms in China have become futures trading companies this year. Stock brokerage firms are very rich of cash. Private investors plus those brokers have at least invested Rmb20-30 bn in metal futures market. In 2008, only 50 bn Rmb were in the Shanghai futures market. This year, the number has increased to 80 bn Rmb. Everyday, he said, there are more money flowing into the market.

(Making room for copper. These are the guys driving global markets?)

A September 17 Bloomberg story by Singapore-based Glenys Sim reports that "Private investors in China, the world's largest metals user, have stockpiled 'substantial' quantities of copper as the government ramps up stimulus spending to spur the economy." The article points out that pig farmers and other speculators have amassed in the order of 50,000 tonnes of copper. That is about half the level of inventories tallied by the Shanghai Futures Exchange.

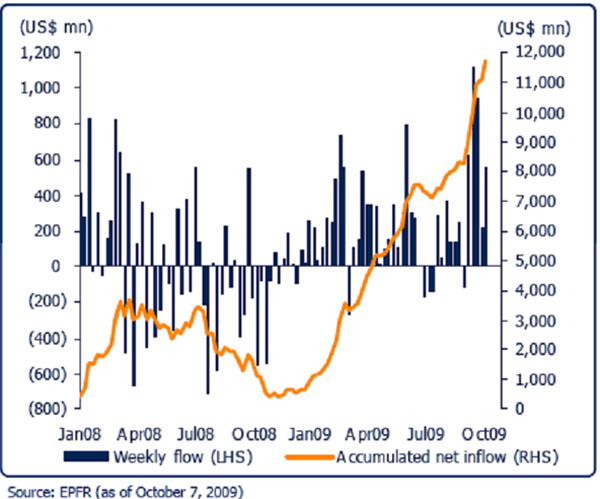

As the chart below shows, commodity speculation is not a China-centric phenomenon. Since the beginning of the year, global fund flows into commodities have been strong estimated at ~US$12 billion as of October 9th.

(Weekly fund inflows into commodities and materials)

Now I do not know if Paul's thesis on gold is accurate or not: if it is it could still take many years to play out. Likewise, I do not know how or when the base metal prices will re-equilibrate to the reality of end demand—whatever that is. What is obvious is that gold and now base metals have become speculative investments that in addition to being bought as hedges against inflation and a falling US dollar are the latest get rich quick scheme. The end result is that absent the faith that metals and markets are all headed higher, we here at Exploration Insights are finding it difficult, although not impossible, to find value in junior mining and exploration companies.

Hot money on the other hand is not.

Over the past few months we have witnessed bought-deal equity financings for individual mid- to junior tier gold companies in the 10's to 100's of million dollars. These are being bought at nearly the absolute 52-week highs by funds that I know have not looked into the mining, metallurgical, social or political intricacies that make or break a mine. This fearless hot money jumping into the sector worries me. It always precedes a market bubble and correction: sometimes serious, sometimes temporary- sometimes by weeks, sometimes by years.

Adding to the absence of fear and proper due diligence in the market, my recent discussions with corporate financiers confirm that both large and mid-sized gold companies are being offered substantial unsolicited bought-deal financings—no questions asked. At the same time, some of the very same companies being offered the quick money are being hit with heavy selling when a fund manager becomes "concerned" because there has been no news for a couple of weeks or gold backed off $15.

Hand in hand with heavy fund demand for new metals investment ideas most of the major research firms have increased their commodity price assumptions to reflect the "new reality". The primary advantage afforded by the commodity price revisions is that previously overvalued mining companies can instantly become "Buys". Recall that the last major upward revisions from many of these same research firms came as the new reality of higher prices set in 2008.

The problem is that greed is driving the market and so any small hiccup or change in sentiment and the hot money tends to bolt. As last year taught us (remember last year?) when the fast money going in is the liquidity, there ain't no liquidity getting out.

I remain cautious and somewhat concerned by what appears to be hot and fickle money jumping into a sector that is apparently taking its cue from pig farmers.

That's the way I see it.

Brent Cook

www.explorationinsights.com

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

The GOLD Report is Copyright © 2009 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.