SDR Global Currency Power Shift Underway

Currencies / Global Financial System Oct 28, 2009 - 01:23 PM GMTBy: Doug_Wakefield

On Monday, November 2nd, it will have been seven months since the G20 met in London to expand the international currency known as the Special Drawing Rights. If you want to brush up on the background of this international currency, our November 2008 newsletter, states:

On Monday, November 2nd, it will have been seven months since the G20 met in London to expand the international currency known as the Special Drawing Rights. If you want to brush up on the background of this international currency, our November 2008 newsletter, states:

Consider the history of SDRs from the IMF’s own website.

The Special Drawing Right (SDR) was created by the IMF in 1969 to support the Bretton Woods fixed exchange rate system.

After the collapse of the Bretton Woods system in 1973, the SDR was redefined as a basket of currencies, today consisting of the euro, Japanese yen, pound sterling, and U.S. dollar. The U.S. dollar-value of the SDR is posted daily on the IMF's website.

As we read the IMF’s website further, we learn that the IMF has been trying to expand the number of SDRs in circulation for years.

There are two kinds of allocations:

General allocations of SDRs have to be based on a long-term global need to supplement existing reserve assets. General allocations are considered every five years, although decisions to allocate SDRs have been made only twice. The first allocation was for a total amount of SDR 9.3 billion, distributed in 1970-72. The second allocation was distributed in 1979-81 and brought the cumulative total of SDR allocations to SDR 21.4 billion.

A proposal for a special one-time allocation of SDRs was approved by the IMF's Board of Governors in September 1997 through the proposed Fourth Amendment of the Articles of Agreement. This allocation would double cumulative SDR allocations to SDR 42.8 billion. Its intent is to enable all members of the IMF to participate in the SDR system on an equitable basis and correct for the fact that countries that joined the Fund after 1981 — more than one fifth of the current IMF membership — have never received an SDR allocation. The Fourth Amendment will become effective when three fifths of the IMF membership (111 members) with 85 percent of the total voting power accept it. As of end-March, 2008, 131 members with 77.68 percent of total voting power had accepted the proposed amendment. Approval by the United States, with 16.75 percent of total votes, would put the amendment into effect.

When we consider the fact that the quantity of this international currency remained unchanged between 1979 and 2009, we begin to realize that the April 2nd meeting was truly a historic moment. On this day, with the stroke of a pen and the benefits of modern electronic banking, the G20 nations conjured another 250 billion in SDRs and gave the IMF an additional $750 billion to lend. Rightly did the October 6, 2009,Council on Foreign Relations piece, The IMF’s Growing Powers, state:

The IMF has gone from a $250 billion institution to a $1 trillion institution. So the fund is much more relevant and central than it was three years ago.

Additionally,

The late September G-20 summit in Pittsburgh called for the International Monetary Fund (IMF) to take on a major role in “promoting global financial stability and rebalancing growth.”

To the extent that that [the fund] suggested that the United States or Germany or China policies are out of line or the overall policies are out of line, then [the G-20] would have a discussion about that. Everything is tricky because you're dealing with sovereign nations, especially to the extent that you're focusing on the balance between domestic demand and foreign demand. (Parenthesis and brackets his)

The writer notes, “Everything is tricky because you’re dealing with sovereign nations.” To me, it seems the real “trick” has been getting people to believe that it is only by handing over more power to fewer people that “progress” can be achieved. With the creation of the US Federal Reserve in 1913, the Bank for International Settlements in 1930, the IMF and World Bank in the 1940s, and the G7 leaders in the 1970s, we have seen financial instability increase. So, why should we look to these same groups to achieve what has thus far eluded their grasp? Does more government (debt) spending equal “recovery?” Should any nation relinquish its financial sovereignty to those who are not elected by, and therefore accountable to, its citizens?

We can contemplate the myriad times excessive debts have destroyed various economies, or we can keep repeating the lie until we convince ourselves that, this time, it will work.

As you recall, when Treasury Secretary Geithner told a group of Chinese students that China’s investments in the U.S. were “very safe,” and that the U.S. is “putting in place the foundations for restoring fiscal sustainability,” the students laughed. Think about it. A group of students in China could see the utter insanity of the political rhetoric that our own experts, pundits, and financial authorities are so certain of.

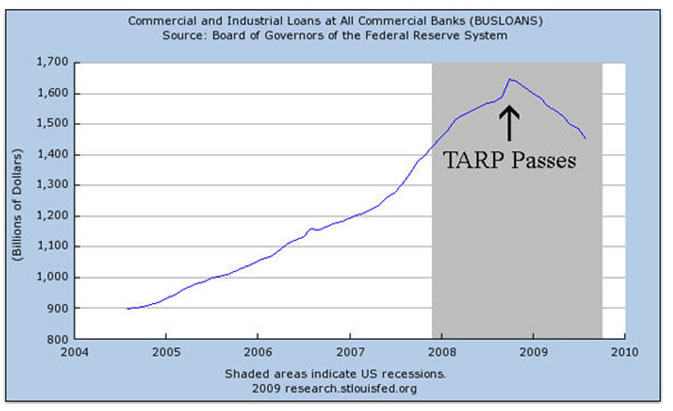

(Chart found in Mises Daily article, Year After TARP: $700 Billion Down Drain)

As you can see in the chart above, the hundreds of billions given to the largest global banks in the world have not even been able to alter the deflationary forces of contracting credit in the most rate and loan sensitive areas of the US economy. If business continues to slow at the same time a nation’s government spending plans produced a $1.4 trillion deficit – almost 3 times the 2008 deficit of $459 billion – should we conclude that investments in that country’s debt are safe?

So, if U.S. debt continues to spiral out of control, while business, academic, and government pundits repeat the mantra, “the stimulus is just starting to kick in,” wouldn’t a wise person monitor the developments of the IMF’s expansion of its own currency – Special Drawing Rights?

Ellen Brown, author of Web of Debt, recently wrote The Dollar Needs to be Devalued by Half, in which she references Jim Rickards’ views on the IMF:

According to Jim Rickards, director of market intelligence for scientific consulting firm Omnis, the unannounced purpose of the G20 Summit in Pittsburgh on September 24 was that “the IMF is being anointed as the global central bank.” Rickards said in a CNBC interview on September 25 that the plan is for the IMF to issue a global reserve currency that can replace the dollar.

“They’ve issued debt for the first time in history,” said Rickards. “They’re issuing SDRs. The last SDRs came out around 1980 or ’81, $30 billion. Now they’re issuing $300 billion. When I say issuing, it’s printing money; there’s nothing behind these SDRs.”

This hypothesis fits well with the history of this international currency. Hundreds of millions, around the world, have yet to understand the currency shift that has been unfolding in front of our eyes over the last several months. As the October 1, 2009 Asia Times article, China Moves into Position, attests, creditors are always better positioned than debtors:

When the IMF decided on July 1 to issue $150 billion in SDR [Special Drawing Rights] bonds, the BRIC nations bought in, with Russia and Brazil purchasing $10 billion each, and China taking the lion's share, an additional $50 billion…

This is the first IMF-issued bond that is sensitive to the dollar. Beijing's purchase of IMF bonds represents a shift by openly reducing dollar assets. The BRICs' underwriting of this SDR bond issue is a clear step toward creating a global reserve currency. By buying one-third of the issue, China becomes a creditor of the IMF, and gets more say in the institution….

China’s economic leaders agree that the SDR should one day replace the dollar as global reserve currency, even though the debate over when this occurs continues.

China has given the developing world a new response profile. Rather than argue with the IMF policy, make the IMF your debtor. The IMF has little choice but to listen. At any rate, the United States and Europe cannot afford to purchase the IMF's new SDR-issued bonds. China can. (Italics mine)

While the U.S. Dollar has moved down dramatically since March of this year, hitting a daily sentiment of 3 (100 is all bulls: 0 is all bears) several times in the last few months, history doesn’t happen overnight. With sentiment at such lows, the US Dollar should strengthen in the near term.

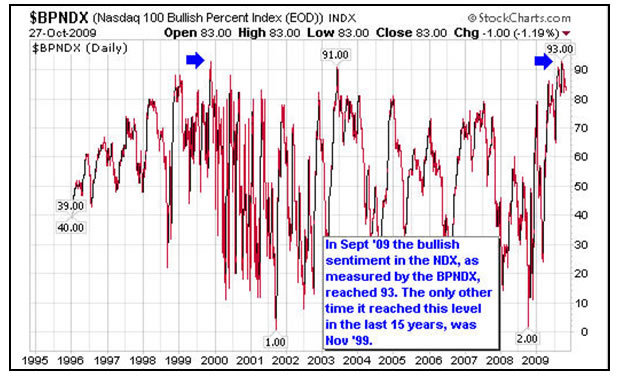

And if the Dollar is set to strengthen while the NASDAQ 100 shows behaviors similar to late 1999, should investors take this as a warning shot across the bow?

Now that it has retraced 50% of its massive decline in 2008, if the Dow Jones World Stock Index starts selling of, hundreds of billions could be looking for a way out of the equity markets and into shorter-term Treasuries.

Could a sharp decline in equity markets be the excuse global political leaders use to push for an even greater expansion of the IMF’s political and financial clout? If so, what can we learn from the creditor-debtor relationships between nations that have worked with the IMF over the last 30 years? What trends should investors follow? With the enormous price swings in our markets, does the buy and hold strategy open investors to additional risk? In an attempt to stay ahead of the ever changing, highly volatile trends that are unfolding around the globe, we will look at these, and other, questions in our November newsletter.

If you are interested in picking up ideas from a wide range of topics and experts, brought together in a “connect-the-dots” format, consider our research publication, The Investor's Mind: Anticipating Trends through the Lens of History.

By Doug Wakefield

President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2009 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.