Eastern European Currency Crisis Could Send Gold Soaring Despite a Rising Dollar

Currencies / Gold & Silver 2009 Oct 30, 2009 - 12:41 PM GMTBy: Mike_Shedlock

In Gold And The Watched Pot Theory I versed the following opinions on currency fluctuations:

In Gold And The Watched Pot Theory I versed the following opinions on currency fluctuations:

Might the US dollar blow up? Yes it might. But so could the RMB if China floated it, and so could the British pound. No one seems to see the crisis brewing in Japan with a huge demographic problem, a shrinking population, falling exports, and no way to pay back its national debt.

There is seldom a mention of the problems in European banks who foolishly lent money to the Baltic States in Euros or Swiss Francs and now those Baltic country currencies have collapsed and the loans cannot be paid back. European banks also lent to Latin America and those loans are also suspect. Arguably, European banks are in worse shape than US banks, but no one talks about it, at least in the US.

A watched pot may boil, but it's not likely to explode, especially when everyone watching the pot expects an explosion any second. Somewhere, something is going to blow sky high, but from where I sit, it's as likely to be in the Yen, the Swiss Franc, the British Pound, or something no one is watching at all as opposed to the US dollar specifically. Watch Eastern Europe For Possible Fireworks

While most eyes have been on the US dollar, I am not alone in thinking a crisis might start elsewhere.

Professor Mark Bloudek offered this opinion on Thursday.

I am having flashbacks to the late months of 2006 when I was watching the ABX index for signs that the subprime loan crisis was beginning. I remember the lowest rated tranches of the ABX being worth 100 and checking everyday to see if/when they would crack.

Why am I having flashbacks? Because the Eastern European currencies (Ex. Hungarian Forint, Czech Krona, and Polish Zloty) remind me of the subprime loans of 2006. A crisis here likely will start a flu that will spread ultimately to the major countries. Why do I draw the analogy between Eastern Europe and subprime loans? Because subprime borrowers were the weakest type of borrowers and the least able to deal with adverse consequences (They defaulted first as a result).

This is similar to the Eastern European countries who are the most fragile countries in terms of staying power on the fiscal front right now (Witness the massive budget deficits in those countries).

I bring this up today, because the Eastern Europe currencies are under a lot of pressure today (Approx. 2%). Keep a close eye here Minyans as this is likely the candidate that could start the crisis fire anew IMO.

Inquiring Minyans might be wondering where and how to watch those currencies. RatesFX is one possible answer.

Here are some charts that show what Professor Bloudek described.

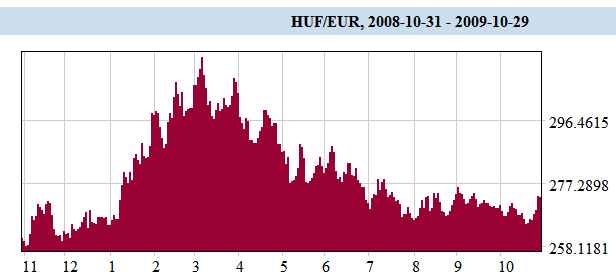

Hungarian Forint vs. Euro

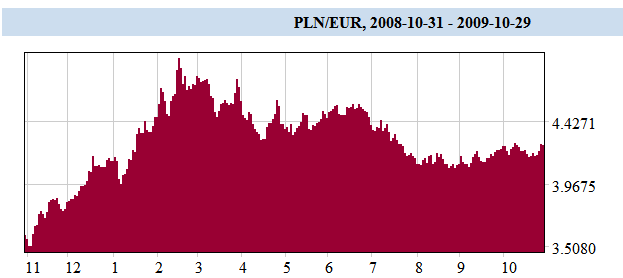

Polish Zloty vs. Euro

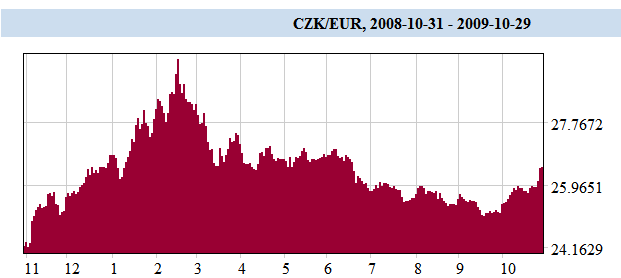

Czech Krona vs. Euro

Look closely at those charts. They all have one thing in common. See what it is?

There was a major currency crisis that reversed in February or March coinciding with the bottom in the S&P 500 and a relative top of the US$.

We might be early watching these Eastern European Currencies but this is clearly a potential flashpoint, one that few others are watching. A strong move in the Forint, Krona,or Zloty could put pressure on the euro and in turn push the US$ higher if a European banking crisis ensues.

The same logic applies to the Baltic state currency pegs. If those pegs blow up, then we could really see some fireworks with the US$ strengthening and the stock markets collapsing.

Why did gold rise with the dollar January-February? Those three charts above offer a possible answer.

$XEU - Euro vs. US$

The Euro bottomed against the US$ at the same time the crisis in the Hungarian Forint, Czech Krona, and Polish Zloty subsided vs. the Euro.

Although we would likely see weakness in gold if the dollar rallies, toss that relationship out the window if there is a currency crisis in Eastern Europe, or Asia. This could be another situation where gold rises with the dollar, as it did in the first quarter this year when the stock market collapsed.

Over the longer term, gold's move is a symptom of a flight from fiat currencies and various credit stresses in general, not just the dollar. If you are watching the US$ only, you are watching an incomplete picture. There are significant problems elsewhere.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.