Gold NOT in Bull Market, Nadler Nonsense?

Commodities / Gold & Silver 2009 Nov 03, 2009 - 01:43 AM GMTBy: Mike_Shedlock

I have sided with Nadler on gold issues in the past, but his claim that gold is not in a bull market is just plain nonsense. Please consider Gold Is Not in a Bull Market

I have sided with Nadler on gold issues in the past, but his claim that gold is not in a bull market is just plain nonsense. Please consider Gold Is Not in a Bull Market

Recently, gold appears to have entered The Mother of All Bull Markets. Even though gold has backed off of its $1,072/oz record from two weeks ago, as of Thursday's close, the market was still up 18 percent for the year and climbing. Interest in the yellow metal—from both individual and institutional investors—has never been higher.

But don't be fooled, says Jon Nadler, metals market analyst and PR head for Kitco Metals, Inc. The precious metals expert says the current bull market in gold is all an illusion—one that the fundamentals can't support for long.

Recently, HAI associate editor Lara Crigger discussed gold fundamentals with Mr. Nadler, including what investors should look for in a gold bull market, why gold supply and demand are so out of whack with prices, and what two events should kick off a price correction.

Lara Crigger: You've written before, "Gold is not in a bull market. The dollar is in a bear market." How do you know? What telltale signs indicate a gold bull market?

Jon Nadler: This phenomenon here has largely been a dollar-driven, dollar-based story, but the requirements for a bull market in gold extend beyond a simple anti-dollar relationship. There are four factors that truly make a gold bull market.

First and foremost, you have to have demand that far outstrips supply. Like any commodity in higher demand than supply makes available, you'd obviously see a price reflection.

Secondly, you'd have to have a falling stock market. The old adage is that gold is an inverse asset to currencies, stocks and other assets—so where's the bear market in stocks? Stocks have been up 50 percent-plus this year.

Third, you'd have to have an actual, tangible inflation level, and the threat of much higher inflation on the horizon as well. We don't see that either, which we'll talk about later.

And fourth, you'd need an increase in the price of gold across all major currencies—no exceptions. You can't have Aussie dollars and the South African rand going one way, while the euro and U.S. dollar is going the other.

Crigger: But isn't gold supposed to be this ideal anti-dollar play?

Nadler: It's not that simple. In fact, statistically speaking, if you look at the correlation between gold and the dollar since 1971-72, it's -0.27. In plain English, that means if you are betting gold as an anti-dollar play, you're likely to lose money 73 percent of the time.

......

Statistically Speaking

Let's start with a look at two claims made by Nadler, back to back.

Nadler Claim #1: "Gold is not in a bull market. The dollar is in a bear market."

Nadler Claim #2: "Statistically speaking, if you look at the correlation between gold and the dollar since 1971-72, it's -0.27. In plain English, that means if you are betting gold as an anti-dollar play, you're likely to lose money 73 percent of the time."

Somehow gold is rising because the dollar is in a bear market, while statistically speaking there in a negative correlation.

Peculiar Definition of Bull Market

Nadler has a mighty peculiar definition of a gold bull market with four stringent conditions.

1) "Demand has to exceed supply"

The plain fact of the matter is the intersection of supply and demand determines price. Supply and demand will always find equilibrium. Right off the bat one can determine Nadler's definition is complete silliness.

2) "To have a bull market in gold the stock market has to fall"

That is like saying to have a bull market in soybeans the price of paper clips must fall.

3) "You'd have to have an actual, tangible inflation level, and the threat of much higher inflation on the horizon as well"

Nadler does not say why we have to have inflation for gold to be in a bull market; we just have to take his word for it. It would make about as much sense to suggest that to have a bull market in gold, sea turtles must lay a record amount of eggs.

Historically speaking, gold does well in times of credit stress, not in times of inflation. There was inflation every step of the way from 1980 to 2000 and gold fell every step of the way.

However, take a look at periods of credit stress. Nixon closing the gold window was arguably a period of credit stress, and gold certainly did well. We are clearly in a period of global credit stress right now, not just in the US, and gold is doing well.

The great depression was a period of credit stress and a period of deflation as well, and gold did well. This point alone disproves Nadler's contention that gold needs inflation to rise.

4) "You'd need an increase in the price of gold across all major currencies—no exceptions. You can't have Aussie dollars and the South African rand going one way, while the euro and U.S. dollar is going the other."

While there is some merit to suggest the price of gold needs to rise in other than dollar terms, it is another to say it has to be rising against every currency, and still another to define the South African Rand a "major currency".

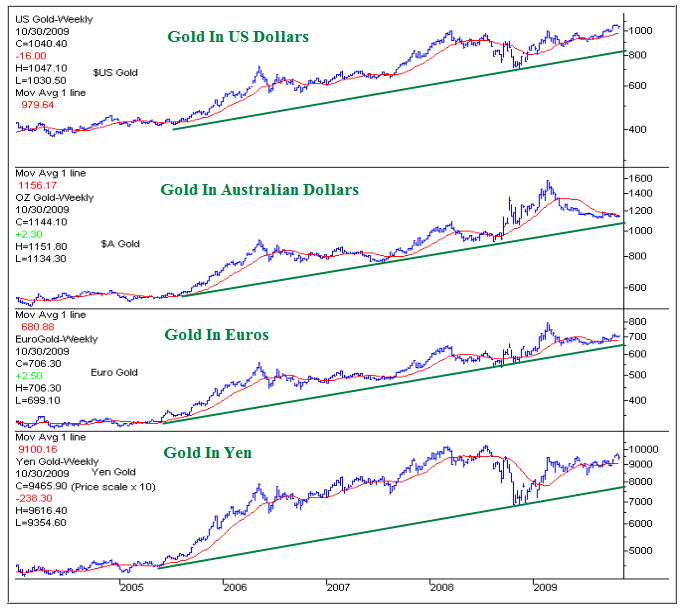

Gold In Euros, $US, $A, Yen

Chart courtesy of The Privateer

Nadler can believe what he wants, but that looks like a bull market to me.

Indeed the only long term bull markets with no broken trendlines that I can find are gold and US Treasuries. After 30 years, treasuries do not have much left to give, although they will likely be a safe haven against the next stock market collapse.

Conclusions

- I find it peculiar that the PR head for a metals firm has managed to define bull markets in such a way that gold can never be in one.

- Nadler's definition is so preposterous that my conclusion is his definition is purposely preposterous.

- I will leave it to others to hypothesize why that is the case.

The Stock Market, Gold, the US Dollar, Sideline Cash, China

I was on King World News with Eric King discussing Gold, the Stock Market, the US Dollar, Sideline Cash, China, and US real estate. Inquiring minds will want to listen in.

To hear the podcast please click on King World News Mish Podcast.

That is part 1. Part 2 will be coming this Friday.

To hear Eric King's interview with Ron Paul, Rick Rule, Ted Butler and others, please click on the King World News Home Page.

By the way ...

I will be on the panel of speakers at the appropriately misnamed Chicago Natural Resources Conference in Rolling Meadows, Illinois on November 6th & 7th.

For all you deflationists, I would like to point out there is no cost for those who preregister for the conference. Click on the link for details about the exhibitors, speakers, and to register. See ya there.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.