What is Money and How Does One Measure It?

Economics / Fiat Currency Nov 03, 2009 - 11:23 AM GMTBy: Mike_Shedlock

Money is a difficult subject. There is much confusion as to what it is. There is even more confusion as to the best way to measure it. Yet, before we can measure it, we have to define it.

Money is a difficult subject. There is much confusion as to what it is. There is even more confusion as to the best way to measure it. Yet, before we can measure it, we have to define it.

Here is a description I pieced together from a few re-ordered sentences of Rothbard's classic text: What Has Government Done to Our Money?

Money is a commodity used as a medium of exchange.

Like all commodities, it has an existing stock, it faces demands by people to buy and hold it. Like all commodities, its “price” in terms of other goods is determined by the interaction of its total supply, or stock, and the total demand by people to buy and hold it. People “buy” money by selling their goods and services for it, just as they “sell” money when they buy goods and services.

Money is not an abstract unit of account. It is not a useless token only good for exchanging. It is not a “claim on society”. It is not a guarantee of a fixed price level. It is simply a commodity.What Is The Proper Supply Of Money?

Continuing from the book ...

Now we may ask: what is the supply of money in society and how is that supply used? In particular, we may raise the perennial question, how much money “do we need”?

Must the money supply be regulated by some sort of “criterion,” or can it be left alone to the free market?

All sorts of criteria have been put forward: that money should move in accordance with population, with the “volume of trade,” with the “amounts of goods produced,” so as to keep the “price level” constant, etc.

But money differs from other commodities in one essential fact. And grasping this difference furnishes a key to understanding monetary matters.

When the supply of any other good increases, this increase confers a social benefit; it is a matter for general rejoicing. More consumer goods mean a higher standard of living for the public; more capital goods mean sustained and increased living standards in the future.

[Yet] an increase in money supply, unlike other goods, [does not] confer a social benefit. The public at large is not made richer. Whereas new consumer or capital goods add to standards of living, new money only raises prices—i.e., dilutes its own purchasing power. The reason for this puzzle is that money is only useful for its exchange value.

[Thus] we come to the startling truth that it doesn’t matter what the supply of money is. Any supply will do as well as any other supply. The free market will simply adjust by changing the purchasing power, or effectiveness of the gold-unit [monetary-unit].The online book is a great read and I highly recommend reading it in entirety.

The key point above is that an increase in money supply confers no overall economic benefit. Over time, money simply buys less and less.

At any point in time, however, when demand for money increases (people want to hold it as opposed to buy goods and services) prices of goods and services decline decline. This can happen even as money supply increases. It is happening now.

Money vs. Credit

In a gold based economy, a measure of money would be a measure of the supply of gold. However, in a fractional Fractional Reserve system (even one based on gold) more credit can be extended (more gold lent out via paper receipts supposedly "as good as gold") than their is actual gold.

Clearly this is fraudulent.

Even in a fiat system where money is amazingly backed by nothing, more credit can be extended than there is actual fiat currency. This is fraudulent as well, and sooner or later a credit crisis erupts caused by inability to pay back with interest what has been lent.

Indeed the entire banking system in insolvent right now. It is physically impossible to pay back all the credit that has been extended on the fiat base money supply that actually exists.

How Does One Measure Money?

The mainstream monetary measurements are:

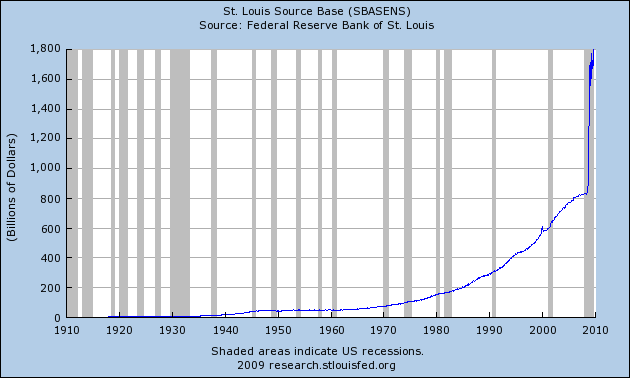

Base Money Supply

M1

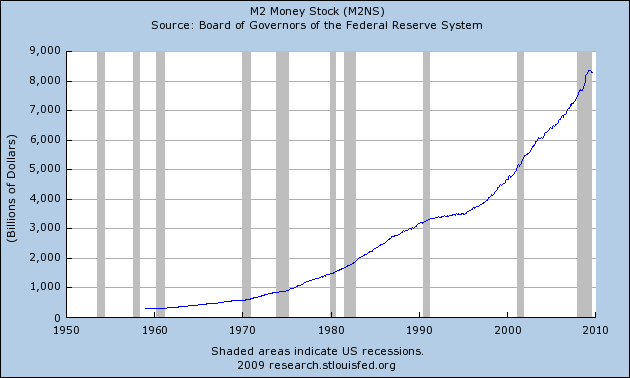

M2

M3 (discontinued in 2006)

MZM

Base Money Supply

M2

Clearly we can see from the above charts there is a huge difference between base money supply and M2. There is an even larger difference between base money supply and M3.

Do any of the above measures represent "money"?

Money AMS and True Money Supply

Hoping to clarify the distinction between money and credit, Austrian economic followers have two additional measures, one called True Money Supply, the other Money AMS (Austrian Money Supply). I have a monetary measure called M Prime (M') but that is a representation (as best as I can put together) of Money AMS.

At the heart of the entire debate is the question "How Does One Distinguish Credit Transactions From Money?"

Please consider Money, Credit, Inflation and Deflation by Steve Saville.

In an article posted earlier this week, Mike "Mish" Shedlock weighed in on the TMS vs. M3 discussion. Mish's article supports our view that TMS (the "True Money Supply" developed by Murray Rothbard and Joseph Salerno) is a more appropriate measure of money supply than M3, although he prefers a measure called "M Prime". The main difference between TMS and M Prime is that TMS includes savings deposits whereas M Prime does not.

Our view is that savings deposits must be included in any measure of the total money supply, for the reasons spelled out on pages 2 and 3 of Joseph Salerno's article at http://www.mises.org/journals/aen/aen6_4_1.pdf. According to Salerno:

"Savings deposits, whether at commercial banks or thrift institutions are economically indistinguishable from demand deposits and are therefore included in the TMS. Both demand and savings deposits are federally insured under the same conditions and, consequently, both represent instantly cashable, par value claims to the general medium of exchange. The essential, economic point is that some or all of the dollars accumulated in, e.g., passbook savings accounts are effectively withdrawable on demand by depositors in the form of spendable cash. In addition, savings deposits are at all times transferable, dollar for dollar, into "transactions" accounts such as demand deposits or NOW accounts."

Mystery of the Money Supply Definition

The above argument by Saville might sound convincing. However, let's consider what Austrian economist Frank Shostak has to say in Mystery of the Money Supply Definition, also in a Mises Journal.

According to popular thinking, the inclusion of savings deposits into the money supply definition is justified on the grounds that money deposited in saving accounts can always be withdrawn on demand. But the same logic should also be applied to money placed with an MMMF [Money Market Mutual Fund]. The nub, however, is

that savings deposits do not confer an unlimited claim. The bank could always insist on a waiting period of thirty days during which the deposited money could not be withdrawn.

Savings deposits should therefore be considered credit transactions with depositors relinquishing ownership for at least thirty days. This fact is not altered just because the depositor could withdraw his money on demand. When the bank accommodates this demand, it sells other assets for cash. Buyers of assets part with their cash, which in turn is transferred to the holder of the savings deposit. The same logic is applicable to fixed-term deposits like CDs, which are credit transactions.

I concur with Shostak in regards to savings accounts.

Think of it this way: Savings accounts are really lending accounts. You deposit money in a bank (transferring the claim on the money to the bank) in return for an agreed upon interest rate.

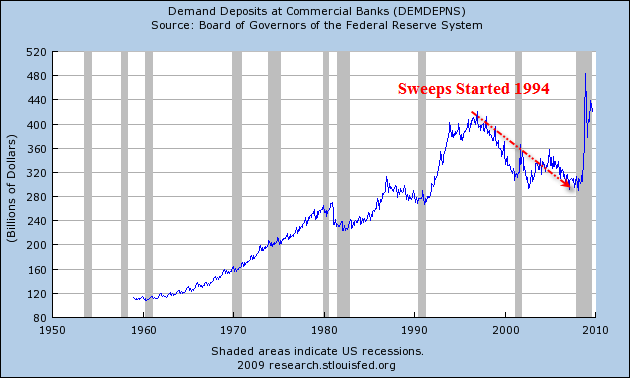

With demand deposits (checking accounts) there is no transfer of claim. Nonetheless, thanks to Greenspan's allowing of banks to "sweep" customers' checking accounts into savings accounts nightly, money that should be available on demand isn't.

What are Sweeps?

Sweeps are automated programs that "sweep" funds from one type of account into another type of account automatically. In this case we are talking about programs that allow banks to "sweep" funds from checking accounts to other types of accounts such as savings accounts that allow money to be lent out.

There are no reserve requirements on savings accounts.

Sweeps were initiated by Greenspan in 1994. Take a look at the following chart to see what has happened since then.

Except for the monetary stimulus of the Fed fighting the last two recessions, demand deposits have generally been in decline since 1994. It is the only monetary component in a sustained (albeit artificial) downtrend. The point being, in measuring demand deposits, one must add in sweeps.

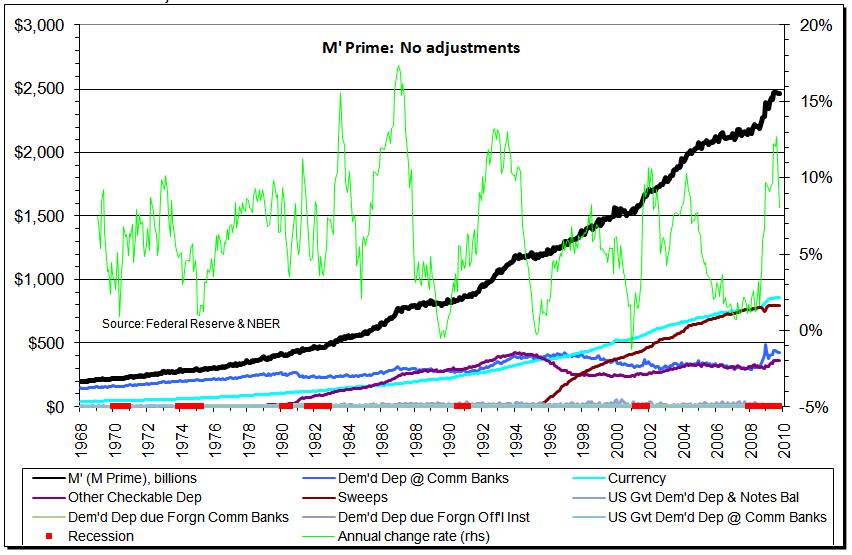

It has been a long time since I have updated M Prime, but thanks to my friend "TC" I have a couple of new charts.

M Prime

M Prime consists of all money that is readily available on demand.

Here are the components:

- Currency

- Demand Deposits at Commercial Banks

- Sweeps

- US Government Demand Deposits and Notes

- Demand Deposits due Foreign Commercial banks

- Demand Deposits due Foreign Official Institutions

- US Government Demand Deposits at Commercial banks

The last 4 components are so minor they barely register, appearing as a single line at the bottom of the chart.

M Prime CPI Adjusted

Money AMS

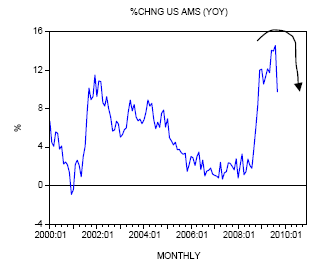

Here is a chart of Shostak's Money AMS:

M Prime is nearly an exact match of Money AMS. I cannot account for the few subtle differences. One can construct M Prime from the components I mentioned above.

The Fed hides sweeps data in an obscure online publication called swdata.

Note that sweeps data is seldom less than two months old. I have no idea why it takes the Fed 2-3 months to post this data. I suppose we should be grateful they publish it at all. For the missing months, we simply extrapolate forward.

A quick look shows that nearly $800 billion dollars that should be in checking accounts is missing in action. Money, supposedly available on demand, is just not there.

Given there are no reserves on savings accounts, as much as $4.5 trillion people think is in their savings accounts is not there either. Moreover, the duration mismatch on savings accounts, sweeps, and likely even CDs is massive.

If even 20% of the people tried to get their money out the system would freeze up.

The banking system is clearly insolvent. Such is the folly of fractional reserve lending.

For a further discussion of money, derivatives, and invisible debt, and the monetary crisis we are facing, please see Janet Tavakoli on Financial Meth Labs.

This concludes the first half of the discussion. Thanks again to "TC" for the charts, and a huge thanks to Frank Shostak for Money AMS and also to Steve Saville for their parts in the discussion.

In the second component we will take a look at which, if any money supply measures are a valid measure of inflation.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.