The Significance of the IMF India RBI Gold Sales

Commodities / Gold & Silver 2009 Nov 04, 2009 - 06:46 PM GMTBy: Tim_Iacono

Much has been written in the last two days about the surprising purchase by the RBI (Reserve Bank of India) of some 200 tonnes of gold bullion, valued at about $6.7 billion, from the IMF (International Monetary Fund).

Much has been written in the last two days about the surprising purchase by the RBI (Reserve Bank of India) of some 200 tonnes of gold bullion, valued at about $6.7 billion, from the IMF (International Monetary Fund).

Is this really a significant event?

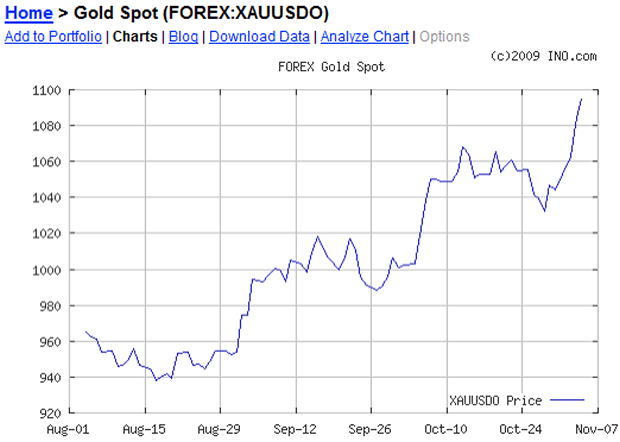

Judging by the price of gold since the announcement was made - up about $50 an ounce and showing no signs of stopping anytime soon - it certainly must have been significant.

Judging by the price of gold since the announcement was made - up about $50 an ounce and showing no signs of stopping anytime soon - it certainly must have been significant.But why?

The folks at the IMF, who, having long sought to rid themselves of some of their huge stash of gold bars in order to (purportedly) help balance their books and provide aid to underdeveloped countries, made a rather glib announcement about having put their financial house back in order, apparently unaware of how markets might react.

Being a fly-on-the-wall at IMF headquarters over the last few days would surely have provided some insight into this particular matter, however, it could well be that none of the economists and resident experts at the IMF even look at the price of gold, this metal having long ago lost its relevance in the minds of most bankers in a world full of paper money, fast computers, and sophisticated economic models that all failed so spectacularly over the last year.

Of course, the way the yellow metal is viewed by bankers and economists varies greatly depending upon what part of the world you are in. Surely, the Reserve Bank of India employs at least a few economists and they must have weighed in on the purchase.

Like the Chinese, they found the idea of more gold holdings to be irresistible.

We'll probably never know the many details that went into this decision, however, it certainly appears to be much more significant than the IMF conveyed in their press release.

A few thoughts as to why this is so are offered here.

The Delicious Timing of the Transaction

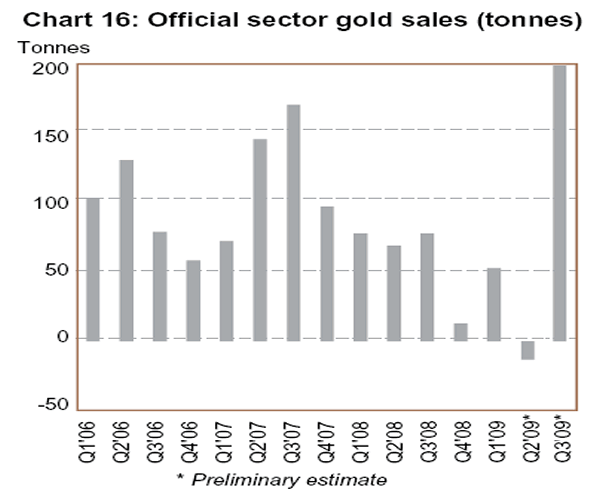

Had this deal been done, say, in March of next year or even during the last month or two of this year, markets would probably not have reacted as they did. As it was, within a few weeks of the IMF gold sale agreement being finalized in September, the gold sales began, wiping out an impressive half of the total authorized sale in very short order.

Since the IMF gold sales come under the umbrella of the recently renewed five-year European central bank gold sales agreement with a reduced cap of 400 tonnes per year (down from 500 tonnes per year in the prior agreement due to a dearth of sellers), the sale to India accounts for half of the entire 2009-2010 sales.

This is shown below in chart form, the IMF sales appended to the right of the graphic that appeared in the latest Gold Investment Digest from the World Gold Council.

After steady declines in recent years as European banks have reduced their gold sales, in comes the IMF to fill the void and - surprise! - the gold price skyrockets.

Prior to the sale, there was much speculation that China would be the first buyer but, obviously, the RBI beat them to the punch and, while the IMF may not have realized it, this was one of the key reasons why markets are now in a tizzy.

This is a clear demonstration of how anxious at least one central bank is to exchange their paper money for something more tangible and the RBI neatly side-stepped the problem that any large buyer always has - driving up the market price while making their purchases.

To their credit, the RBI ended up driving prices higher after they were done buying.

India Purchased the Gold at Market Prices

A back-of-the-envelope calculation shows that the Indian central bank is now already up more than $300 million since buying their 200 tonnes of gold.

This is probably not what the IMF folks thought would happen and you can imagine the raised eyebrows of the staff when working out the deal where they probably figured they had hit the exact top of the gold price surge and what suckers the Indians were.

Press reports indicate that the RBI made their purchases between October 19th and 30th at an average price of $1,045 an ounce and, though it looks like they paid too much based on the chart below, they're still way ahead.

The relatively simple math is as follows: A gain of $50 an ounce is about a five percent rise in the gold price and a five percent rise in the RBI's $6.7 billion is a gain of about $335 million.

Of course, the gold price could go up or down from here, but any smirks that appeared on the faces of IMF staff as they were signing the paperwork were, obviously, premature.

But, more importantly, what does this transaction say about the "value" of paper money and gold if a major central bank is so anxious to spend billions of dollars of the former to buy the latter at over $1,000 an ounce?

If the RBI felt strongly about boosting their gold reserves, why didn't they do it when gold traded at $400 or $500 an ounce a few years back, or even last year when it could be bought for between $800 and $900 an ounce?

European central banks have been selling the stuff for years at much lower prices and surely the Indian central bank could have boosted their reserves then. Why, they could even have bought some of the U.K.'s gold back in 1999 that was dumped on the market at $275 an ounce. Recall that Gordon Brown sold about half of England's 600 tonnes of gold at what is now known as the "Brown Bottom".

Removing the Sword of Damocles

Probably more important than any other factor in the IMF-RBI gold sale is the fact that the proverbial "Sword of Damocles" has been removed from the gold market after hanging there for years, suspended in mid-air, waiting to drop on any buyer of gold who was dumb enough to buy dumb 'ol gold coins when the IMF was about to flood the market with the stuff.

Probably more important than any other factor in the IMF-RBI gold sale is the fact that the proverbial "Sword of Damocles" has been removed from the gold market after hanging there for years, suspended in mid-air, waiting to drop on any buyer of gold who was dumb enough to buy dumb 'ol gold coins when the IMF was about to flood the market with the stuff.

For years, Jim Rogers has been pointing to the looming IMF gold sales as the reason he thought the metal would underperform other commodities.

Well, it's still early, but initial indications are that, not only did the IMF gold sales not cause the gold price to plunge, these gold sales actually caused the price to soar.

Who would have known that, when the IMF gold was finally offered up for sale that half of it would be gone within weeks and, more importantly, the buyer turned out to be someone other than the party that most market analysts were expecting.

For years, the prospect of European central banks and the IMF selling off their huge stockpiles of gold in the open market has been a big reason why buyers were understandably cautious. Analysts have been saying, "Even if the central banks stop selling, the IMF gold will be there to sate the appetite of buyers and that should keep a lid on prices."

So, the central banks have essentially stopped selling and now half the IMF gold is gone within weeks and China is probably already signing paperwork to buy the other half.

The Sword of Damocles is now gone, if it ever really was there.

A Sea Change in Central Bank Thinking

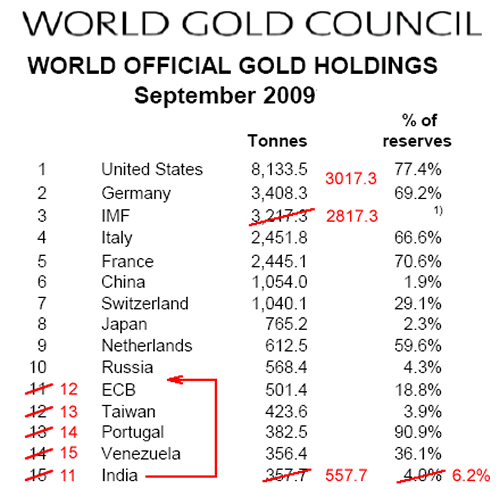

Perhaps the most provocative question that this gold sale has raised in the minds of other central bankers around the world is, "If India's buying, maybe we should be buying too".

As shown below, there are many countries that have woefully small gold reserves and, for better or worse, these same countries are also loaded to the gills with U.S. dollar denominated assets, some of which they'd now be more willing to exchange for gold bars after India has.

China, Japan, Russia, Taiwan and many other countries - mostly in Asia - are now sitting up in their chairs looking around at the other central banks in the world wondering who's going to be next to buy gold after India scored a cool $6.7 billion that quickly turned into a stash that is now worth $7.0 billion.

Surely, even the most dimwitted economists in Asian central banks are now tuned in to the rapidly changing landscape of global gold supply and demand.

While economists in the West may cling to their "money is just a unit of account and gold is nothing special" way of thinking, central bank staff half way around the world are now starting to look at things very differently after the events of this week.

If inflation begins to heat up in the months ahead, then we might just see central banks scramble to buy gold along with the rest of the world.

In a pure fiat money system, there is nothing to back a national currency other than faith in the government that issues it and confidence in the central bank that prints it.

Oh yes, and the central bank's gold.

Even the IMF noted in a recent statement that its (still) massive gold reserves give its balance sheet a "fundamental strength".

Clearly, other central banks around the world, along with millions of investors, feel the need for this "fundamental strength" too.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.