The Hated U.S. Dollar Might Rally

Currencies / US Dollar Nov 06, 2009 - 07:01 AM GMTBy: Graham_Summers

Few essays I’ve ever written have drawn as much ire as the ones in which I propose that the US Dollar might rally. The US Dollar is indeed hated, so hated that people will hate you just for considering that it might rally.

Few essays I’ve ever written have drawn as much ire as the ones in which I propose that the US Dollar might rally. The US Dollar is indeed hated, so hated that people will hate you just for considering that it might rally.

Virtually every day I receive emails from people asking me about the coming massive US Dollar devaluation or when the Zimbabwe-esque hyperinflation will hit. What’s striking about this is that I receive more of these sorts of emails today (when the Dollar’s at 76 or so) than I did last summer when the Dollar hit a 30-year low of 72.

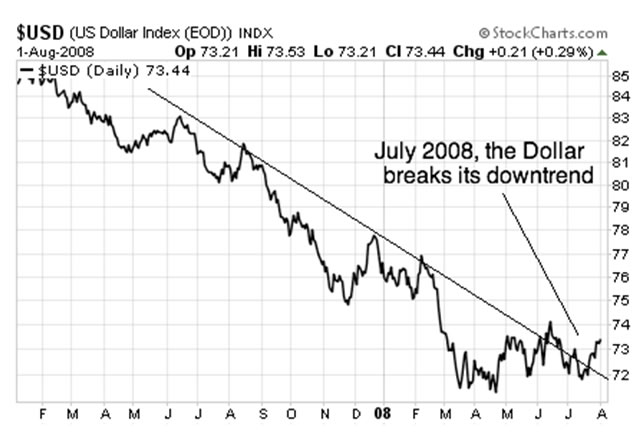

In fact, the Dollar is so hated that it recently broke a nine-month downtrend and virtually NO ONE noticed. I know you probably think I’m a jerk just for mentioning this. But you can see it for yourself:

Of course, this could simply be a “head fake” as the Dollar continues downward to test its 2008 lows. But I can’t help wondering if this recent move might be the start of something bigger: a potential Dollar rally that would catch 98% of the world off-guard (98% of investors are bearish on the greenback).

If you’ve been reading my essays from this week closely, you know that MOST of the stock market gains generated by the US markets have come from the Dollar losing value. Indeed, the US Dollar and the stock market have been trading at a near perfect inverse correlation for months now. Every day that stocks rise, the Dollar falls and vice-versa... Which is why I’ve noticed that the US Dollar broke its downtrend the EXACT same time that US stocks broke their uptrend.

The market gods are not without their sense of irony. And how ironic would it be for the US Dollar (the most hated investment in the world) to be the one asset that might be about to rally, crushing stocks and commodities (both of which have rallied hard largely due to Dollar debasement)?

The issue now is if the Dollar remains above its former downtrend line. If it does, then we may in fact be seeing the above scenario play out. I realize that it’s somewhat absurd for me to even suggest the Dollar might rally after all the bailouts and stimulus. But isn’t it odd that the Dollar today is actually HIGHER than it was in 2008 BEFORE the stimulus and bailout madness began? Shouldn’t the Dollar ALREADY have broken below its 2008 lows based on all the fiscal insanity going on?

Or is it possible, no matter how unexpected, that another financial Crisis is currently beginning to unfold… and the Dollar’s moves are a sign that the investors are already beginning to shift towards safe havens like they did in 2008?

I am not claiming this is the case. But the above charts indicate something very odd is going on with the Dollar in relation to stocks. I’ll be watching this development VERY closely going forward.

I highly suggest you do too. If the Dollar DOES rally, it’s going to catch EVERYONE by surprise. Stocks in particular will collapse staging a virtual repeat of 2008.

I’m already preparing investors for this eventuality with a FREE Special Report detailing THREE investments that should explode when stocks start finally collapse. While most investors are complacently drifting towards the next Crisis like lambs to the slaughter, my readers are already getting ready with my Financial Crisis “Round Two” Survival Kit.

The investments detailed within this report will not only protect your portfolio from the coming carnage, they’ll also show you enormous profits: they returned 12%, 42%, and 153% last time stocks collapsed.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.