The New World Of Investing SPDR KBW Regional Banking KRE ETF

Companies / Exchange Traded Funds Nov 19, 2009 - 02:54 AM GMTBy: Guy_Lerner

In this new era where fundamentals seem to matter less and less, here is an ETF that seems to fit right in with that theme. It is the SPDR KBW Regional Banking (symbol: KRE) ETF.

In this new era where fundamentals seem to matter less and less, here is an ETF that seems to fit right in with that theme. It is the SPDR KBW Regional Banking (symbol: KRE) ETF.

It isn't lost on me that the local or Main Street economy is in the toilet. All I need to do is drive down the nearby 4 lane road with all the malls and strip centers to know that "things" aren't that good, and they are unlikely to improve any time soon. After all, how many tortilla restaurants and nail shops can one locale support? Who is going to fill all those empty stores?

Like all of you, I read about the increasing number of bank failures, the impending commercial real estate crisis, the high unemployment rate, and the increasing number of home foreclosures just to mention a few of our economic pleasantries. It would seem that none of this is good for the regional banks, who have been treated as pariahs as the Wall Street Money Center banks garner all the monetary stimulus from Washington. But when looking at the charts, the SPDR KBW Regional Banking ETF or KRE is the kind of equity that stands out.

Welcome to the new world of investing. The fundamentals are stinky, but the chart looks great. Maybe all those fundamentals are baked in to the cake?

Before looking at the charts, here is a CNBC video of banking analyst Meredith Whitney; the video is interesting in and of itself, but what caught my attention occurred just before the 5 minute mark when she spoke about last year's trade and this year's trade in the banking sector. (Thanks to Trader Mark at FundMyMutualFund for bringing the video to my attention.)

Last year's trade was to go long the Money Center Banks and short the Regional Banks, and in essence, that is how things shaped up as the big banks gained over 100% from the March lows and the Regional Banks only notched a 50% gain. Whitney now believes that the two sectors will converge although she does stop short in that she does not give an endorsement for the regional banks.

Another factor to consider is insider buying. According to InsiderScore, there has been "buying at battered Regional Banks and in other less glamorous pockets of the Financial sector," and this buying has been to an extreme. One caveat, however, is that financial company insiders timed their buys poorly in the recent bear market.

With this in mind, let's look at two charts!

Figure 1 is a weekly chart of KRE. Price is basing along the 40 week moving average, which is now turning up. A weekly close above the pivot low (at 21.08 and marked with blue up arrows) would be a positive, and this would also represent a close over 3 pivot low points, which I would also view positively. A weekly close over the trend line formed by two prior pivot highs (at 22.43) would likely catapult prices to the $30 level.

Figure 1. KRE/ weekly

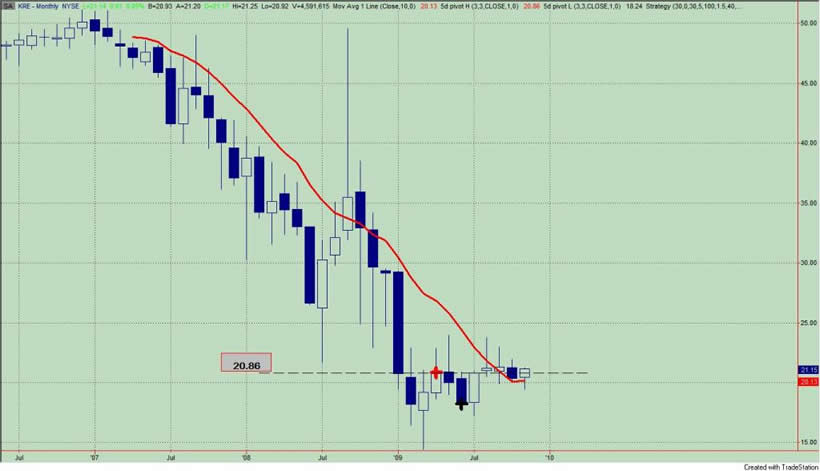

As far as a stop loss goes, I would look at a monthly chart. See figure 2. I would use one of two things: 1) either a monthly close below the pivot high point at 20.86; or 2) a monthly close below the simple 10 month moving average.

Figure 2. KRE/ monthly

In sum, I like the Regional Banks and the KRE. It has been a relative under performer, and maybe some of that "hot" may rotate to this sector. Insider buying is a plus as well.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.