U.S. Economy is a Geriatric on Viagra

Economics / US Economy Nov 20, 2009 - 02:35 AM GMTBy: Brian_Bloom

A retired friend, an academic in a field unrelated to the subject of economics or finance, recently asked me to tell him what I thought was happening in these (to him) surreal worlds. Why are some people so bearish that they were effectively anticipating the end of the world whilst others are insisting that a bull market is upon us?

A retired friend, an academic in a field unrelated to the subject of economics or finance, recently asked me to tell him what I thought was happening in these (to him) surreal worlds. Why are some people so bearish that they were effectively anticipating the end of the world whilst others are insisting that a bull market is upon us?

To answer him I had to provide some context, as follows. The table below shows a list of the top 14 world economies by size of GDP in 2008. (Source: http://siteresources.worldbank.org/.. )

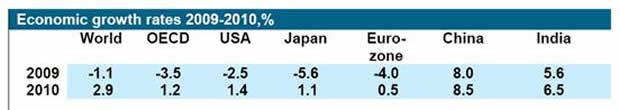

I explained to my friend that those people who are optimistic about the future are pointing to the fact that business in China and India is booming. By way of example, the forecast growth rates for 2009/10 are as follows, resulting in an overall anticipated growth rate of the World Economy of 2.9%: (source: http://www.opec.org/.. at page 14)

The four major emerging economies are Brazil, Russia, India and China. Those who are optimistic about the world economy are focusing on strong growth within the BRIC countries and those who are pessimistic are focusing on the weak growth being forecast for the USA and European economies.

Unfortunately, there is a problem with this logic. The tail cannot wag the dog. As can be seen from the first table above, the BRIC economies combined contribute only around 14.5% of the entire world (2.7% + 2.7% + 2.0% + 7.1%) as compared with the USA at around 23.4%.

From another perspective, the entire European Union bloc had a combined GDP of $18.4 trillion according to World Bank statistics (source: http://en.wikipedia.org/..) )

Together, the European Union and the USA contribute over 53% to total world GDP and are around three times the combined size of the BRIC countries.

Arguably, the focus of attention of both the optimists and the pessimists is really only a superficial view. If we dig deeper to understand the “drivers” of economic growth a very worrying picture emerges.

In recent years, the USA economy has morphed from an Industrial economy to a Service economy. Some argue that up to 70% of the US GDP is “driven” by consumer spending.

The following table shows personal savings rates (percentages of income) in the USA from January 2007: (Source: St Louis Federal Reserve.) http://research.stlouisfed.org/fred2/data/PSAVERT.txt

2007-01-01 1.9 2007-02-01 2.1 2007-03-01 2.2 2007-04-01 1.8 2007-05-01 1.7 2007-06-01 1.8 2007-07-01 1.7 2007-08-01 1.6 2007-09-01 1.7 2007-10-01 1.7 2007-11-01 1.3 2007-12-01 1.4 2008-01-01 1.3 2008-02-01 1.3 2008-03-01 1.0 2008-04-01 0.8 2008-05-01 5.8 2008-06-01 3.5 2008-07-01 2.6 2008-08-01 1.7 2008-09-01 2.2 2008-10-01 2.9 2008-11-01 3.8 2008-12-01 4.7 2009-01-01 4.4 2009-02-01 3.4 2009-03-01 3.5 2009-04-01 4.5 2009-05-01 5.9 2009-06-01 4.2 2009-07-01 4.0 2009-08-01 2.8 2009-09-01 3.3

The reader will note that savings rates were less than 2% in early 2007 but have since been in a rising trend. Of interest, the savings rate was as high as 10% - 11% in the 1980s and it follows that the US economy grew historically – in the service sector – by consumers becoming increasingly irresponsible in their attitudes towards savings. The “buy now, pay later” mentality gave rise to rising debt and falling savings and the now (subtly) rising trend of the 2008/2009 numbers in the savings column indicate that the US consumer may be moving towards a higher level of savings. Arguably, the Cash for Clunkers initiative of the US Government interfered temporarily with consumers’ growing propensity to save.

The following is a quote from a media article that appeared today, entitled : Geithner Saying Be Like Buffett Can’t Make Banks Lend

“The U.S. unemployment rate, which rose to a 26-year high of 10.2 percent in October, may increase to close to 11 percent by the middle of next year, according to Mark Zandi, chief economist at Moody’s Economy.com in West Chester, Pennsylvania. Bankruptcy filings by small businesses rose 44 percent in the third quarter from a year earlier, Atlanta-based Equifax Inc., a provider of consumer-credit information, reported Nov. 2. Bankers’ reluctance to increase lending has fanned frustration among lawmakers who question the financial institutions’ strategy after they received billions in capital from the government’s Troubled Asset Relief Program.” (source: http://www.bloomberg.com.au/apps/news?pid=20602085&sid=aZx_7zxrAkdk )

To this analyst, both Mr. Geithner and the other commentators quoted in this article have seriously missed the point. Yes, the banks may be tightening their lending criteria but that’s not the only reason that bank lending has been tanking. There are two sides to the lending/borrowing equation. It doesn’t matter even if the banks do want to lend if consumers don’t want to borrow. And if consumers don’t want to borrow and spend in a service based economy, what new businesses will be formed?

Put another way: Given that the USA is now a service based economy the probabilities favour that most “new” businesses formed in the USA will fall into the service industry category. Focusing on small business borrowers as opposed to consumers, why would a bank take a risk of lending to a small business that is being set up (or already exists) to provide a service if the purchasers of services are pulling in their horns? In this analyst’s view, Mr. Bernanke and Mr. Geithner are pushing on a string. Consumers are not going to leap back into the fire to suit the government’s agenda. The state of mind of the US consumer is not merely conservative at present, it is fearful.

The following is a quote from an article written by the arch conservative economist, Nouriel Roubini and published over the past weekend:

“Think the worst is over? Wrong. Conditions in the U.S. labor markets are awful and worsening. While the official unemployment rate is already 10.2% and another 200,000 jobs were lost in October, when you include discouraged workers and partially employed workers the figure is a whopping 17.5%…”(Source: http://www.creditwritedowns.com/.. )

From the perspective of an employed person working inside the USA, surely the unconscious question that is at the back of his/her mind is “Am I next?” Does Mr. Geithner really believe that, against a backdrop of 17.5% unemployed (and growing) the average consumer is going to go back to the borrow-and-spend behaviour that characterized the Greenspan era? If he seriously believes this, then the man should be fired. He clearly does not understand the problem which flows from the above facts. US consumers are by and large no longer worried about improving their situation. With one eye on tent cities, they want to hang on to what they have.

In another article that appeared in the media today, Mr. Obama was quoted as follows: “BEIJING – President Barack Obama says he's worried that spending too much money to help revive the economy could undermine a fragile U.S. recovery and throw the economy into a double-dip recession.” (source: http://news.yahoo.com/..)

Right on, Mr. Obama. It’s a pity that you didn’t focus on the fact that rising borrowings is not necessarily the answer when the US public debt was around $9 trillion. (Public debt hit $12 trillion this week)

Of course, there are those investors who would argue that the time to buy is when there is blood running in the streets; when things couldn’t look any blacker. Those people will be pointing to the chart below and arguing that “The Markets” are saying that the worst is behind us. (Chart courtesy Decisionpoint.com)

Black? What are you talking about? Where’s the black? Look at that market go. The Standard & Poor Industrial Index has risen from just above 650 to 1,109.80 since March 2009. Even the most conservative of advisers are turning bullish – even if this fact is being largely driven by their fear of looking stupid.

This analyst suffers no such fear and is fortunately am not troubled by ego needs. I don’t particularly care whether the reader agrees or disagrees with my view. On a worst case scenario, if you the reader think I am stupid then you will not buy a copy of my novel, Beyond Neanderthal. That is the extent of the risk I am taking. On the other hand, there is strong upside potential for my calling things as I see them. On a best case scenario you will come to think that I may be onto something and, as a consequence, sales of Beyond Neanderthal will rise. It can be ordered via www.beyondneanderthal.com or via Amazon.

In particular, the reader is cautioned to pay close attention to the declining red trend line on the monthly chart below (courtesy DecisionPoint.com). Note how the $SPX is encountering the resistance of that line?

There is an old truism: A trend will remain a trend until it is broken. Could the S&P break up above that trend line? After all the PMO oscillator looks like it has just given a buy signal.

Of course, with the massive “weight of money” out there, a break-up is quite within the bounds of technical possibility. But what will be the fundamental justification for such a break-up?

Of course, there are those who will argue that fundamentals are irrelevant in today’s world. In recent years, making money on the markets has been all about trading. I have no arguments with that concept. It happens to be true. Trading will work just fine – unfortunately, right up to the point that it doesn’t work anymore. And, when technical analysis no longer works, Sod’s Law says that technically driven investors will be fully invested on the markets. In my view, the timing of the next market top cannot be called until after the event – and the next pullback will very likely be a savage one during which traditional stop-loss techniques will probably not work. So I will personally pass on the trading opportunity.

In this context, the reader is cautioned to recall the expression “he pulled himself up by his own bootstraps”. The Baron Munchausen may have been able to save himself from drowning by performing this impossible feat, but the real world requires some laws of physics to be obeyed.

The fact is that the world economy is being driven by a geriatric engine that was designed to be powered by fossil fuel technologies and hydrocarbon derived products. But, as I cautioned my friend to consider: “Pumping the US economy with money is like pumping a geriatric full of Viagra. We should not lose sight of the fact that, at the end of the day, a geriatric on Viagra is still a geriatric.”

Yes, the equity markets can continue to rise from here. But the manufacturers of Viagra caution against the use of their product by heart patients. The US economy has a weak heart. Too much monetary Viagra can cause it to drop down dead from heart failure. A double dip recession may very well take “true” unemployment above the 20% level if one includes the disillusioned and those who would like to work full time but can only find part time work. What is needed is a new economic driver and that new economic driver will be based on a new energy paradigm/s that is unrelated to fossil fuels.

Which brings us to the BRIC countries. Clearly, we have to look at the “quality” of the economic growth to form a sensible view as to whether this growth will continue. What, in fact, has been driving the Chinese economy, for example? Is it that Chinese consumers in general are becoming consumption oriented? Or is it something else?

Here is a quote from one article, dated September 15th 2009. Source: http://tutor2u.net/blog/..

“The Chinese government has moved heaven and earth to keep their economy growing during the global economic crisis. The focus has been on boosting domestic demand such as consumer spending and capital investment. The government is behind the world’s largest stimulus programme - investing around $566bn - and the government has pledged to go ahead with large-scale projects. Quentin Sommerville reports on a huge infrastructural project - a good video to use to illustrate the multiplier effects of capital spending.”

Here is another quote from another article dated September 9th 2009:

“The major driving forces of China's economy would be property development, corporate investment and exports next year, instead of government-led spending for this year, a top economist said Monday at a forum in Xiamen in eastern Fujian province.

The Chinese government has arranged an economic stimulus package valued at 4 trillion yuan ($586 billion) to push the national economy forward.

Fan Gang, head of the research foundation for China's economic restructuring, said financial support to the Chinese economy would slacken next year, while other factors would play a bigger role in economic growth.

For example, investment in the real estate sector would likely grow at an average annual rate of 20 percent to 30 percent.

The exports sector, previously a major driving force for the Chinese economy, had been hit hard by the world's financial downturn, but would recover and regain double-digit growth next year, Fan said.” (Source: http://www.chinadaily.com.cn.. )

So, as this analyst understands it, the growth in China next year is going to come from exports rising by double digits which in turn is going to justify a 20% - 30% increase in real estate investment.

So here’s a question: “to whom is China going to export?”

Conclusion

Following the Global Economic Crisis the various government sponsored economic stimuli around the planet was misdirected. Instead of being channeled to (long term) projects associated with development of new energy paradigms which could be used as engines of economic growth to drive the world economy both forwards and upwards over time, the “quantitative easing” was directed to fund consumer giveaways and spending on (as opposed to investing in) random “shovel ready” infrastructure projects. At the point when the effects of quantitative easing begin to wane within the USA, that country’s economy is likely to enter a double dip recession. President Obama has already admitted this possibility in “politic speak” language and he has foreshadowed that there will not be further stimulus packages because the US cannot support more debt. A double dip recession, in turn, will probably impact on the economic drivers of the BRIC countries whose economies are not yet self sufficient. The optimistic growth rates being forecast will probably not materialize except in the short term.

When all is said and done, our political leaders have not been in problem solving mode. They have been in re-election mode. The missing element in their actions has been “integrity”. The markets will continue to be lifted by their own bootstraps until it becomes blindingly obvious that there is no genuine fundamental logic which underpins the rise. The fact is that when the chips were down our political leaders shot from the hip, with the primary objective of retaining the loyalty of their political constituencies. They behaved in a manner which was not “strategically” focused and had no longer term goal in mind.

Overall Conclusion

If you are the type of investor who runs with the herd, then you will probably be comfortable investing in the markets now; given the strong technicals being driven by the weight of money and based on arguments related to inflation. If, on the other hand you are the type of person who looks beyond the horizon, you will see the storm clouds gathering and you will take appropriate defensive action. The next hurdle that needs to be overcome is that the monthly $SPX chart needs to break up strongly through the downward pointing trend line and it needs to confirm the break up with further bullish signals. If the market fails to do this, then we might find it pulling back strongly within the next few weeks/months. Of course, if it succeeds in doing this then this analyst has got it wrong and there will be no purpose to be served I my writing these missives. Time will tell.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.