What Happens When a Carry Trade Blows Up?

Currencies / US Dollar Nov 23, 2009 - 03:43 PM GMTBy: Graham_Summers

As I’ve been pounding the table for the last several months, the markets have been operating based on an “inflation” trade mentality. By this, I mean that we’re in a “Dollar down/ everything else up” environment.

As I’ve been pounding the table for the last several months, the markets have been operating based on an “inflation” trade mentality. By this, I mean that we’re in a “Dollar down/ everything else up” environment.

This is to be expected. Fed Chairman Ben Bernanke has been doing everything he can to re-inflate the markets, hoping he can counteract the deflationary impact of the Housing Crash/ Credit Bubble bursting.

To do this, he’s made the Dollar unattractive on a yield basis, cutting interest rates to between 0% and 0.25% (effectively making the Dollar have NO yield). He’s also made the Dollar unattractive on a momentum basis by printing $900+ billion, expanding the Fed’s balance sheet from $800 billion to $2.2 trillion, and other anti-Dollar measures.

Consequently, the Dollar has become a MASSIVE carry trade, with virtually every bank/ financial institution in the world borrowing in Dollars and then funneling this “hot” money into the financial markets (stocks, commodities, gold, etc). Thus, we’ve seen a massive rise in stocks (blue), oil (black), and gold (gold), complimented by a disturbing drop in the US Dollar (green).

With so much of the financial markets’ action dictated by one trend (the Dollar’s collapse), the markets have begun operating on a beta rather than alpha basis. This means that picking out individual investments (individual stocks or companies) is FAR less significant than simply allocating your money into the right “sector” or “asset.” Indeed, there have been very few times in history in which stock-picking has been LESS relevant to successful investing. After all, if the rate of return for simply investing in the NASDAQ is 70%+ since the March lows, why bother picking out an individual Tech companies to buy?

Thus, today we are in an environment in which the US Dollar is THE carry trade of the world. More than 90% of investors are bullish on stocks, more than 80% are bullish on Gold, and LESS than 3% a bullish on the Dollar.

Now, markets are a bit like boats: when everyone crowds over on one side, the likelihood of disaster increases dramatically. This is WHY you need to be paying EXTRA close attention to the US Dollar if you have any interest in preserving your gains and portfolio going forward.

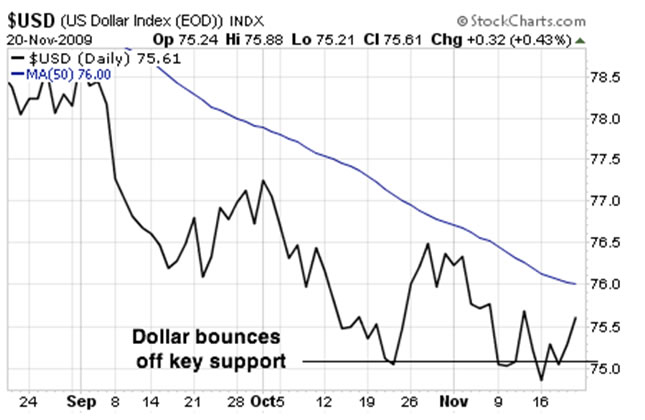

Quietly, and with little fanfare, the US Dollar appears to be carving out a bottom, having bounced off a level of key support three times in the last month. With virtually the entire world betting on the Dollar dropping further, there is the potential for a MAJOR blow-up here.

Remember, it was only a little over one year ago that the Dollar began rallying kicking off a solvency crisis. The entire world had to cover their Dollar shorts, pushing the US currency higher and destroying stocks and commodities in a panic of deleveraging.

Could this happen again? ABSOLUTELY. I’ve been warning investors about the potential for this (and other black swan events) since July. In fact, the warning signs of this MAY already be showing up…

On Friday, the Intercontinental Exchange (IE) was hit with a MASSIVE short-covering on Dollar contracts. At one point there was a brief price spike of 9% (NOT A TYPO) in the Dollar’s DXY index. The IE actually SHUT TRADES DOWN and REFUSED to honor the outstanding contracts to deal with this.

Setting aside the facts that the IE clearly violated any principle of free markets (and screwed any contrarians who were smart enough to note the Dollar is due for a reversal), this episode stands as a HUGE warning signal to the world of what can happen if the Dollar carry trade blows up: a currency spike of 9% is the kind of thing that can trigger full blown systemic collapses.

Folks, we are in a very, VERY dangerous position right now. If the Dollar continues to strengthen we could have a full repeat of 2008 (last week’s plunge in the markets could be just the beginning). The Fed has done everything it can to devalue our currency (including the insanity of buying our OWN debt), but the Dollar has refused to completely tank.

If you think I’m insane for saying this, (the Dollar has lost 16% this year), remember that in 2008 the Dollar hit a 30-year low of 72. At that time, the Feds had only committed to a few bailouts (Bear Stearns, discussions of Fannie/ Freddie, etc).

In contrast, today the Feds have backstopped virtually the ENTIRE financial system AND engaged in massive Stimulus (ALL of this EXTREMELY Dollar negative) and YET the Dollar remains at 75 and change, a full 4% HIGHER than it was during the 2008 lows before the bailout insanity began.

In plain terms, it’s truly incredible that the Dollar hasn’t fallen further already. The fact that it hasn’t, combined with the numerous bounces we’ve seen in the US currency in the last month, is a SERIOUS sign of US Dollar strength. If the Dollar begins a REAL rally moving above its 50-day moving average (see the chart above) the entire inflation trade would blow up with stocks and commodities (potentially even gold) entering a free-fall.

I think the chances of this are actually pretty high. Which is why I’m already positioning readers for the coming storm with FREE Special Report detailing THREE investments that are set to explode when the next Crisis hits. I call it Financial Crisis “Round Two” Survival Kit. Not only can these investments help protect your portfolio from the coming carnage.. they can ALSO show you enormous profits: they returned 12%, 42%, and 153% last time stocks collapsed.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.