Gold Perspective on a World Gone Economically Mad

Commodities / Gold & Silver 2009 Nov 24, 2009 - 03:21 AM GMTBy: Adam_Brochert

Since up is down and left is right in an anchorless fiat currency world, one must keep a perspective on things. As a Gold investor, I am not exactly bullish on the U.S. Dollar. However, I also am not bullish on other international paper currencies, either. I wouldn't place faith in the Euro, the British Pound, the Swiss Franc, the Japanese Yen or the Chinese Yuan over the next few years. When the chips are down and the global economy falters, every country now seems to have an endless ability to create more debt and start the party up again - it's like watching synchronized swimming for the damned.

Since up is down and left is right in an anchorless fiat currency world, one must keep a perspective on things. As a Gold investor, I am not exactly bullish on the U.S. Dollar. However, I also am not bullish on other international paper currencies, either. I wouldn't place faith in the Euro, the British Pound, the Swiss Franc, the Japanese Yen or the Chinese Yuan over the next few years. When the chips are down and the global economy falters, every country now seems to have an endless ability to create more debt and start the party up again - it's like watching synchronized swimming for the damned.

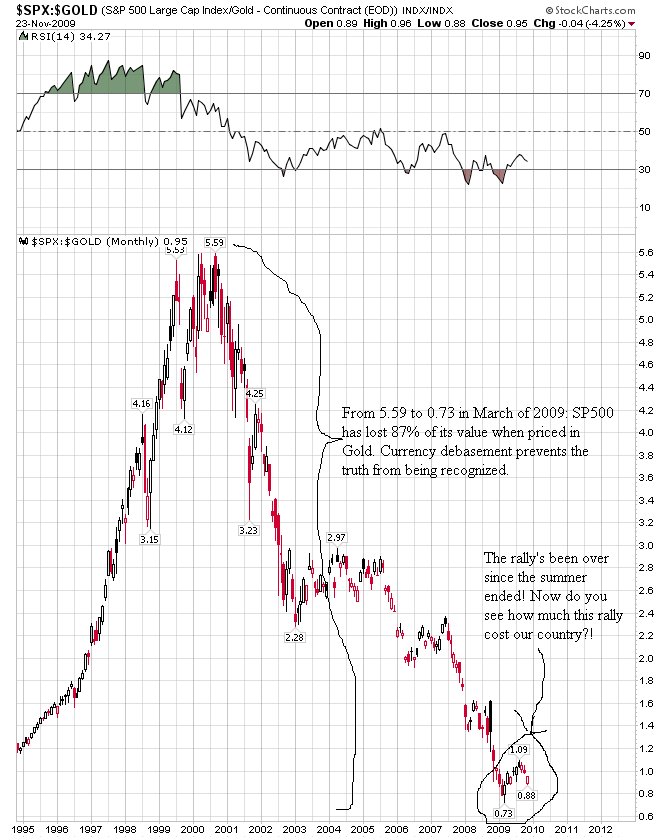

Assets are deflating relative to Gold. This is the missing link of the deflation/inflation game. Prechter is focused on the wrong currency. His theory has already been proven when Gold is used as the measuring currency. I know, I know, only freaky, crazy, tin foil hat-wearing, irrational, hunker down in the bunker Gold bugs could possibly think of Gold as money. I get it, paperbugs, I get it.

The promises of powerful men much smarter than I are obviously more reliable than a timeless piece of metal. Give men the power to create money out of thin air and they of course will be wise enough not to abuse it! Our society is so advanced that I couldn't possibly understand the ramifications of going back to a barbarous relic as the backing for our currency - only people of Paul Krugman's caliber really understand economics and they say it's a bad idea.

I guess this is because the most prosperous years this country has ever seen were on the Gold standard. I guess this is because the so-called "great depression" was on the federal reserve's watch, as was the irrational boom fueled by excessive money creation beforehand that was part of the cause of the "great depression." Yes, it is true that I have been reading the non-revisionist, non-party history texts and I know this is not encouraged, comrade. I am sure one of our new czars would be upset if they were to hear such talk. As our paper currency degrades further, we will need more and more czars and more and more government control to right the ship.

I also know that every currency in history has failed, whether Gold backed or not. When Gold backed, currencies are destroyed because the government breaks its promise and drops the Gold backing whenever a war needs to be fought or times get too hard. When not Gold backed, currencies generally hyperinflate into oblivion and are then replaced. History keeps repeating over and over again, but this time, gosh darn it, it is different. Bernanke and widdle Timmy Geithner are the most powerful brain trust ever seen in the history of financial markets and will take care of everything for everyone.

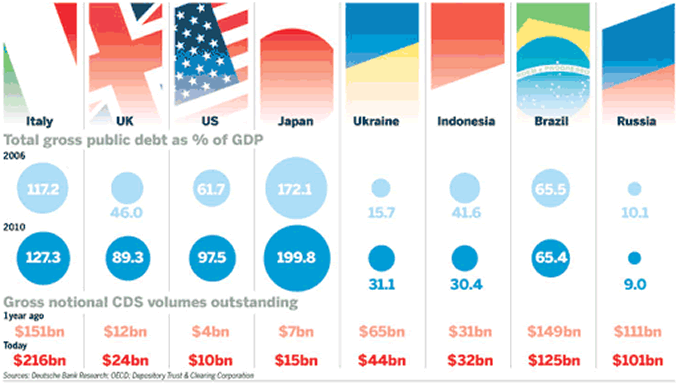

Keeping these admittedly Gold buggy-type background thoughts in your mind so that you realize this piece is written by an irrational lunatic, those who are calling for the imminent destruction and collapse of the U.S. Dollar need to remember that we are not the only country on the paper-money-road-to-hell path. We are not doing well, but the following graphic estimating the government debt-to-GDP ratios in 2006 and 2010 help one understand a bit where we are (chart "care of" Deutsche Bank and borrowed from The Automatic Earth blog - typical internet reporting...):

I do not fear only for American citizens or the American dollar, as a global crack up boom in assets priced with paper money seems a likely path if things continue on the current track. In Gold terms, we have already been in deflation for years depending on the asset in question. For what asset class left is not deflating in Gold terms? This is the missing link in Prechter's work that he needs to reconsider in my opinion. Perhaps T-Bills have outperformed the stock market over the past decade, but they have lost money when currency depreciation is taken into account. Gold has trounced T-Bills, T-Bonds and the U.S. Dollar as well as the stock market, corporate bonds, real estate market and general commodities.

If China, Japan, the Eurozone, Australia, India, the Middle East and Brazil all agree to crank up the printing presses and create an astronomical amount of new debt to replace that lost by the private sector, and then they all agree to buy each others' debt with this newly created debt, this will be deflationary when Gold is used as the currency of measurement. But will it really feel like deflation to the average gal or guy on the street holding paper currency units? For it is really only Gold that has a done a reasonable job of preserving purchasing power over this past cycle. Gold has reverted to its role as the international currency of last resort.

This is why the "mainstream" inflation-deflation debate has become less meaningful for me - I think we are in a wicked deflation, but it's in terms of Gold. And yet, in the parlance of paper, a rising Gold price is almost by definition called inflation. Six of one, half a dozen of the other. One thing I do know for sure even without a PhD in Ponzi economics: Gold's in a bull market and you don't want to bet against it.

Here's a picture of a nasty deflation - The S&P 500 index priced in Gold over the past 12 years (i.e. the S&P 500 divided by the price of Gold [$SPX:$GOLD ratio chart]):

While the individual sovereign paper currencies rise or fall relative to one another, they are all sinking. Which index accurately reflects this basic fact during the current cycle? The answer is simpler than you think. Gold. That's right, Gold, the senior international currency of this world, awakened from its slumber by the massive abuses of the prior secular stock bull market that have come home to roost. As the pendulum swings back the other way, a further loss of confidence in the teflon Wall Street dons, our apparatchiks and central bankstaz will occur. This will manifest itself via a further decline in the Dow to Gold ratio, which will continue to fall until it gets to 2 or less, much to the paperbugs' disbelief.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.