Dow Jones Surges! But Brazil and China ETFs Rise Far More!

Stock-Markets / Emerging Markets Jul 15, 2007 - 12:42 PM GMT Martin here with a quick update on the Dow and international markets.

Martin here with a quick update on the Dow and international markets.

On Thursday, even as the Dow surged 284, its biggest one-day gain since October 2003 …

My favorite international ETF — representing Brazil's bluechips — was up the equivalent of 573 points on the Dow!

And it wasn't the first time ETFs like these have left the Dow in the dust.

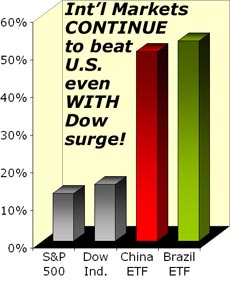

Since March 5, for example, when markets touched a temporary bottom, the S&P 500 Index is up 12.7% and the Dow Industrials are up 15%.

Not bad.

But at the same time, the ETF representing 25 of China's largest companies is up 50.4%. And the ETF that tracks Brazil's bluechips is up 53.3%!

This is one of the reasons I felt it was so important to reach out to you with my urgent video briefing last week.

But I Made a Big Mistake

Yesterday, we took my video offline, as scheduled. And, in retrospect, that was a big mistake and I apologize.

I didn't realize so many readers had not yet had a chance to see it. And I also wasn't aware that so many more had shared the link with friends or associates.

As a result we got many times the viewership than anticipated.

I'm sure glad our online video service company had unlimited Web capacity. And I'm also grateful they've promptly put it back online to accommodate you for a few more days.

Step 1. Turn on your computer speakers.

Step 2. Click here.

Step 3. You will come to a screen like the one to the right.

Step 4. Then, just use the handy toolbar to pause or review the presentation as you wish.

That's it! No registration needed!

Good luck and God bless!

By Martin Weiss

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.