UK Inflation CPI Falls But Interest Rates Set to Rise to 6% By October 2007

Interest-Rates / UK Interest Rates Jul 18, 2007 - 12:56 AM GMTBy: Nadeem_Walayat

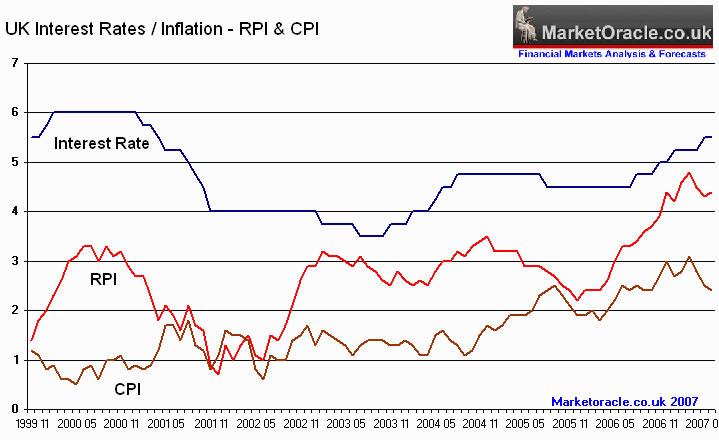

Yesterday the 'official' measure of UK inflation the Consumer Price Index (CPI) fell from 2.5% to 2.4%, and thus trending in the right direction towards the 2% target after a scare earlier in the year when the CPI breached the upper limit of 3%, prompting the Governor of the Bank of England to write a letter to the former Chancellor Gordon Brown explaining why the Bank had failed to control inflation.

Yesterday the 'official' measure of UK inflation the Consumer Price Index (CPI) fell from 2.5% to 2.4%, and thus trending in the right direction towards the 2% target after a scare earlier in the year when the CPI breached the upper limit of 3%, prompting the Governor of the Bank of England to write a letter to the former Chancellor Gordon Brown explaining why the Bank had failed to control inflation.

So if inflation has continued to fall from 3.1% to 2.4% , then why is this articles title suggesting further rises in UK interest rates ?

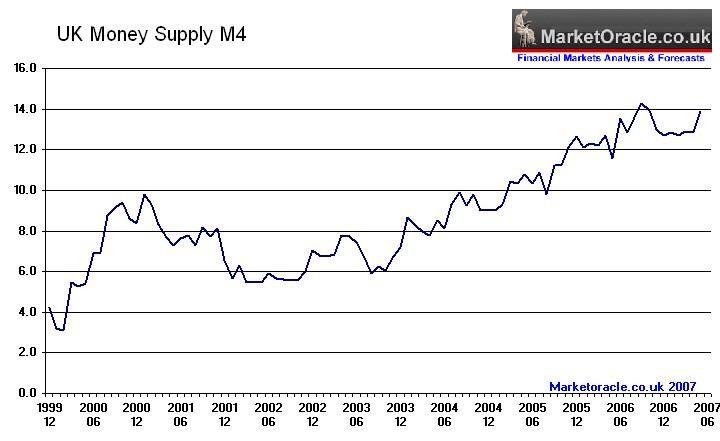

Simply put, the CPI measure is not as an important indicator of inflation in the economy despite being the preferred measure for inflation. Taking UK inflation trends as a tight three part story, where the CPI Index plays second fiddle to the Retail Prices Index which actually rose from 4.3% to 4.4% against expectations of a fall to 4.2% and the key indicator of future inflationary pressures, the money supply expansion (M4) which on the last figures rose to an annualised rate of 13.9% (below).

The strong upward trend in the money supply indicates that a further interest rate rise is likely to 6%, with the most probable date for the next rise in UK interest rates to be at the October MPC Meeting. Given the continuing upward trend, it is a little early to call 6% as the probable peak, especially since the rate rises to date have so far failed to have any significant impact on the UK housing market.

Related

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

The Market Oracle is a FREE Daily Financial Markets Forecasting & Analysis online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

This article maybe reproduced if reprinted in its entirety with links to http://www.marketoracle.co.uk

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.