U.S. Housing Market Equity Cushions and Impact of Negative Equity

Housing-Market / US Housing Dec 10, 2009 - 11:55 AM GMTBy: Tim_Iacono

A report last month indicating that almost 25 percent of all borrowers now owe more on their mortgage than their homes are worth punctuated one of the more dramatic turn of events in the ongoing credit crisis and housing bubble aftermath. Twenty five percent!

A report last month indicating that almost 25 percent of all borrowers now owe more on their mortgage than their homes are worth punctuated one of the more dramatic turn of events in the ongoing credit crisis and housing bubble aftermath. Twenty five percent!

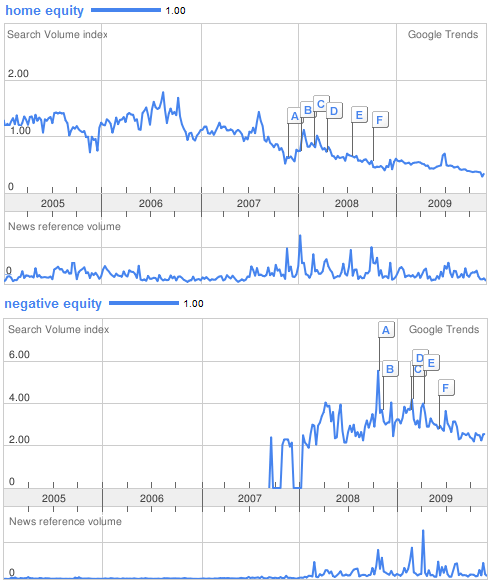

It seems those home equity "cushions" that Federal Reserve economists used to talk proudly about just a few years ago have all but vanished, giving rise to the new, far less pleasant reality of "negative equity" as captured at Google Trends and shown below.

[Note: The term "equity cushion" does not have a high enough volume to register on Google Trends, but the more general "home equity" serves as a good proxy here.]

The idea of owing more than your house is worth was virtually unknown prior to late-2007 as seen in the lower half of the graphic but, once the phrase "negative equity started rolling off of peoples tongues, it went on to produce search volume of two or three times its positive predecessor and, surely, it is no coincidence that curiosity about "negative equity" peaked during the height of the credit market crisis last fall.

Negative equity - as in, not only the complete deflation of an equity "cushion", but actually falling through the chair upon which the equity cushion used to sit - was a major factor in last year's financial market melt-down.

But, it was only a few years ago that home equity was something to be embraced - and spent!

At the time, few saw it as anything more than confirmation that, in this great country (and in some other parts of the world) there really are free lunches. How else to explain how ordinary Joes could so quickly become so extraordinarily wealthy with such little effort?

There were doubters though - those labeled "bubble-heads" back in the middle of the decade and who, for years, were on the wrong side of the housing bubble argument, a side that ultimately proved to be the right side.

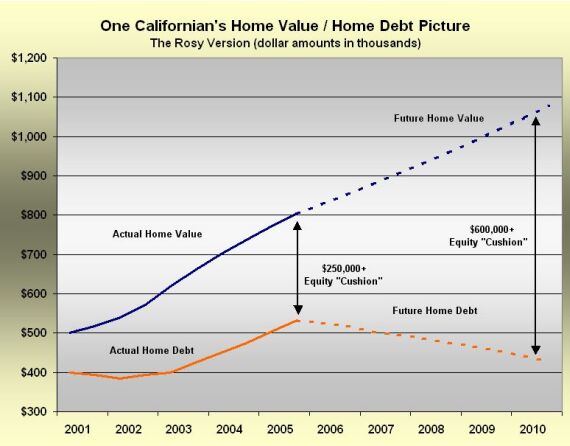

As best I can tell, the first time that the term "equity cushion" appeared here was in October of 2005 when the LA Times reported on the household finances of the Rodriguez family and their situation was assessed in Equity Cushion Possibilities, a piece that included the odd looking chart with a yellow background as shown below.

To be sure, this is blurry and hideous. That is, both the chart above and the predicament that the Rodriguezes most likely find themselves in today, however, back then, they were just doing what everyone else was doing - spending their free money.

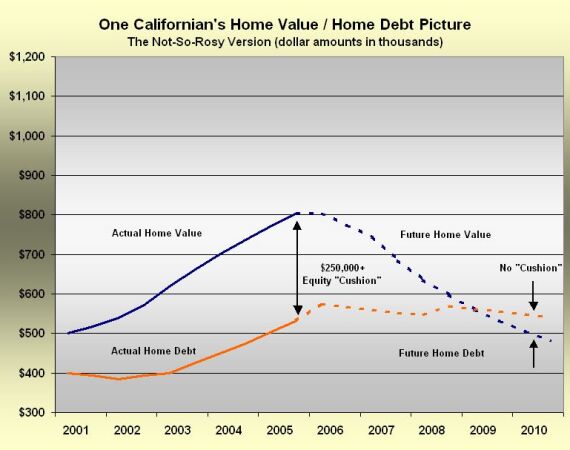

Note that, in this 2005 piece, this "Rosy Version" of the family's future finances was followed by a not-so-rosy view as shown below.

As it turns out, their home value probably followed a path very close to what was forecast here four years ago. Based on a comparison with the Case-Shiller Home Price Index for the Los Angeles area, the curve below seems to peak about six months prior to the real world price peak and reach a bottom about nine months after the index, however, the important 40 percent decline was nearly spot-on.

How the finances of the Rodriguez family have held up since 2005 is anyone's guess, but, my guess would be, "not good".

The subject of "equity cushions" has been discussed here on any number of occasions since the middle of the decade, the term apparently originating with former Federal Reserve member Susan Schmidt Bies in this early-2005 speech that was chronicled here.

From the point of view of bank supervisors, affordability products do not necessarily pose solvency concerns. Despite the apparent decline in underwriting standards, less than 5 percent of outstanding mortgages have a loan-to-value ratio greater than 90 percent, which means that the vast majority of homeowners have a significant equity cushion; in the event prices fall, only a very small percentage of owners are likely to see their debts exceed the value of their homes.

From the point of view of bank supervisors, affordability products do not necessarily pose solvency concerns. Despite the apparent decline in underwriting standards, less than 5 percent of outstanding mortgages have a loan-to-value ratio greater than 90 percent, which means that the vast majority of homeowners have a significant equity cushion; in the event prices fall, only a very small percentage of owners are likely to see their debts exceed the value of their homes.

Of course, Ms. Bies no longer works at the nation's central bank, having resigned in early-2007, according to this Wikipedia entry, doing so to spend more time with her family. But, a few months ago, the government called, and now she sits on the board of Bank of America, someone with her foresight obviously an invaluable addition to this organization.

Former Fed chief Alan Greenspan was quick to adopt this new rationalization of the bubble they were in the midst of, this speech in late-2005 being his first known usage.

In summary, it is encouraging to find that, despite the rapid growth of mortgage debt, only a small fraction of households across the country have loan-to-value ratios greater than 90 percent. Thus, the vast majority of homeowners have a sizable equity cushion with which to absorb a potential decline in house prices.Obviously, that turned out to be an overly optimistic assessment of the situation, one of many made during the latter years of his 18 year term.

In summary, it is encouraging to find that, despite the rapid growth of mortgage debt, only a small fraction of households across the country have loan-to-value ratios greater than 90 percent. Thus, the vast majority of homeowners have a sizable equity cushion with which to absorb a potential decline in house prices.Obviously, that turned out to be an overly optimistic assessment of the situation, one of many made during the latter years of his 18 year term.

All of this brings us back to the current day and the ongoing discussion of "equity cushions" by big banks and how they might be bolstered. Homeowners' equity cushions are now long gone but, apparently, there is still a need for some padding in the banking system to avoid a repeat of last year's tumult.

What is most bothersome in this regard is that some of the same "equity cushion" arguments are being made here in 2009 about banks as were being made in 2005 about homeowners. The fact that a lot of the same people are still involved, (e.g., Ms. Bies' new position at BofA) makes it all the more scary.

Naturally, the distinction between the big banks and homeowners is that the U.S. government stands ready to bail out the former at any whiff of trouble, whereas, that latter are mostly left to their own devices.

If only homeowners back in 2005 could have somehow changed the way they were accounting for their assets and debt the way the banks can today - by marking their balance sheet items to whatever dollar amount they deemed best - maybe the housing market wouldn't still be in such a funk right now.

With equity markets now appearing to teeter a bit more each day and with banks now dependent upon November stock prices rather than those seen in March, the more you think about it, today's banking "equity cushions" are starting to look as potentially unreliable as those possessed by homeowners during the middle of the decade.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.