All That’s Gold Does Not Shine

Commodities / Gold & Silver 2009 Dec 10, 2009 - 07:58 PM GMTBy: Richard_Shaw

The well worn phrase, “All that shines is not gold” can be turned about when talking of investing in gold to say, “All that’s gold does not shine.”

The well worn phrase, “All that shines is not gold” can be turned about when talking of investing in gold to say, “All that’s gold does not shine.”

Gold has been a fine investment as of late, but how has it done over a long period? How about over a lifetime of investing in comparison to other major assets, such as 3-month Treasuries, US aggregate bonds, and all country world stocks?

We have data to answer that question from 1976 (34 years ago, and around about the time this author began saving for investment in an organized way).

If you began with $100 in each class in January 1976, and taxes were deferred as they could have been in a Keogh plan, or if the account were tax-free as in a non-profit organization, the values of each position at the end of November 2009 would have been:

- 3-month Treasuries (proxy: SHV) - $648.92

- US aggregate bonds (proxies: AGG and BND) - $1,576.19

- All country world stocks (proxy: VT) - $3,185.52

- Gold (proxies: GLD and IAU) - $814.49.

So, over the long-haul of the past, gold was better than short-term Treasuries, but not as good as diversified bonds, and nowhere near as good as global stocks.

That is not to say that gold will not be better than the others going forward, but we have been through tough times before, and in the end stocks won.

We have serious doubts about US stocks (proxies: SPY, IWV and VTI) doing as well going forward as emerging market stocks (proxies: EEM and VWO), or possibly even European stocks (proxy: VGK).

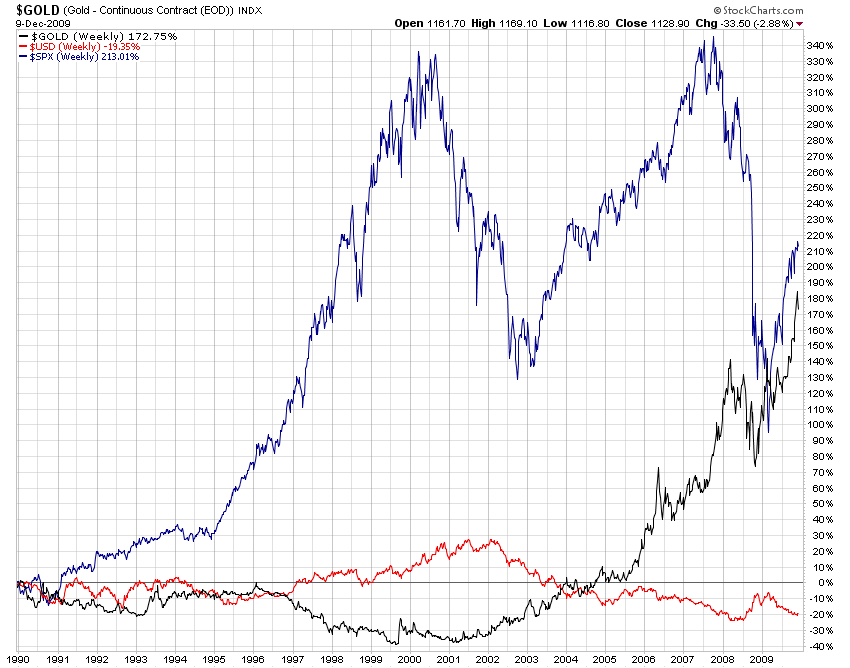

The key is the value of the Dollar (proxy: UUP) for the future of gold.

The profligate public spending, mountainous national debt, negative import-export balance, anti-capital policies and wealth distribution goals of the government in the US today, and the multi-national call for a new reserve currency do not bode well for the Dollar. That gives gold a better long-term performance expectation relative to US stocks and bonds than it had in the go-go days of US stocks.

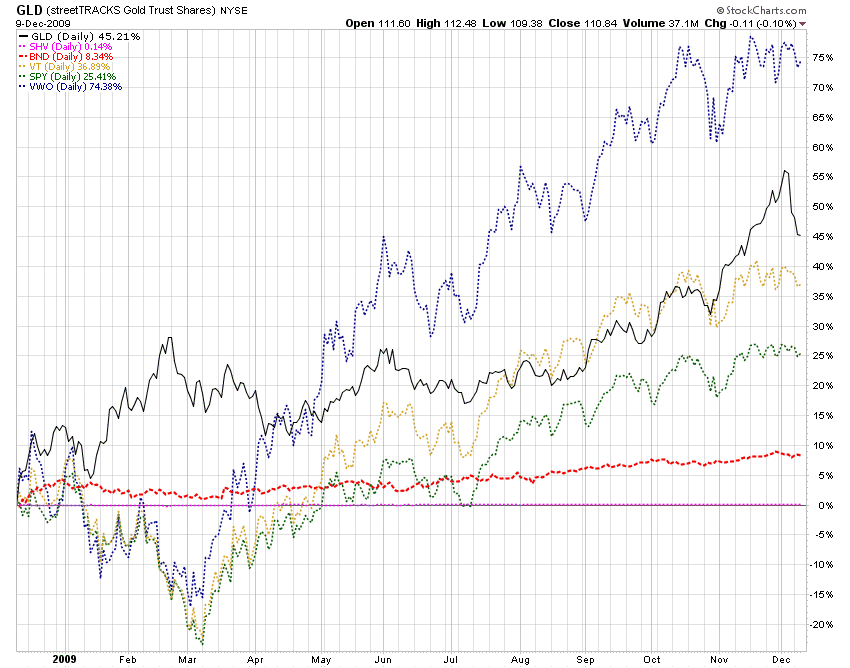

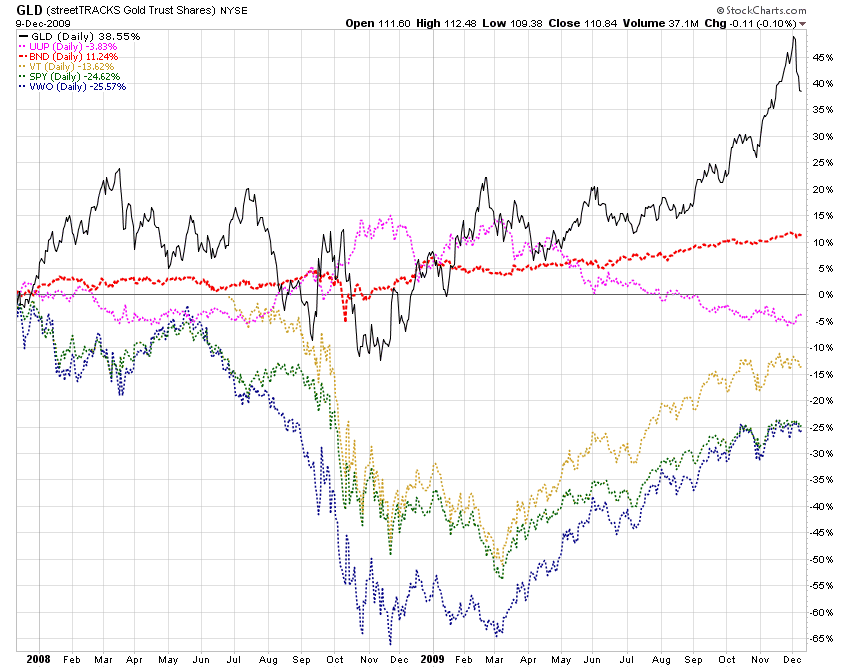

Gold versus Other Classes

Non-US and global stocks, however, may not be as negatively impacted by a declining Dollar as US stocks in general.

The long-term decline of the Dollar against a trade weighted basket of currencies, does not fully explain the recent strong rise in gold, which seems to be anticipating something more like a global monetary collapse, which we tend to doubt (but if we are wrong, our stop loss orders on all our exchange listed positions will pull our fat out of the fire as they did in 2008 to save us from that devastation).

Gold versus US Dollar Index versus S&P 500

Compliance Disclosure:

We own GLD, AGG, BND, SPY, VTI, EEM, VWO, and VGK in some managed accounts. We do not own other mentioned securities. We are a fee-only investment advisor, and are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.