Currencies Do Not Float, They Sink at Different Rates - The Crack-up Boom Series Part VII

Currencies / Financial Crash Jul 24, 2007 - 04:47 PM GMTBy: Ty_Andros

In This Issue

The Crack-up Boom Series, Part VII

Currencies Do Not Float, They Sink at Different Rates.

Foreword - For greater insight into our publication, have a look at the Overview of Tedbits . It helps current and potential subscribers understand our mission in serving you. It also gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

The Crack Up Boom series is exploring the unfolding “Indirect Exchange” (as detailed by Ludvig Von Mises), that dollar holders will be using to exit their holdings now and eventually is will be followed by all holders of fiat currency holdings no matter which country is perpetrating the “fraud” of confiscation of wealth through the printing and credit creation process that all such monetary schemes evolve into. The “Crack Up Boom” will drive an inflationary global expansion to inconceivable heights over the coming years.

Asset prices will skyrocket as people do what they always do when threatened they will modify their behavior and do the things necessary for “SELF PRESERVATION” of their families, countries, economies and their wealth. Let's take a look at Von Mises' description of the CRACK UP BOOM once again:

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It was this that happened with the Continental currency in America in 1781, with the French Mandats Territoriaux in 1796, and with the German mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last. Thank you Ludwig.

Unfortunately, for us all this is now NOT an isolated currency policy as detailed in the last paragraph, as globally virtually “ALL” governments are pursuing this policy at this point. So first we will see the biggest offenders suffer from their hubris AKA the “UNITED STATES” then it will rotate to all countries who follow such monetary policies. Public Servants always and every time have become Public Serpents robbing their constituents to further their personal ambitions and collection of power and wealth.

Currencies Do Not Float, They Sink at Di fferent Rates.

Ever since today's currencies were torn from their gold and silver underpinnings you knew one thing at the beginning of each year. “You have to make 3% a year just to break even on inflation”. That number has now changed as the Developed and Emerging world alike now churn out funny “faith based” money in any amount that fits their ambitious goals. In the era of WORLDWIDE Fiat Money and credit creation the number is probably double that rate. Financial authorities and central banks have become adept at “Painting the tape”, adjusting and statistically manipulating the stated inflation numbers to reflect what they wish the publics perception of inflation to be. This is now a worldwide epidemic of misinformation used to manipulate the publics “expectations” about inflation, to mask the deliberate government policy of inflation.

For instance we know that globally the increase in currencies in circulation worldwide increased over 14% FOR THE WHOLE WORLD COMBINED in 2006 and is extending this into 2007. Thank you www.financialsense.com for this chart!

GLOBAL MONEY SUPPLY |

|

| as of 07/09/07 Country | YOY % |

| Russian Fed. M2 | 50.94 |

| India M3 | 19.70 |

| China M2 | 16.74 |

| Australia M3 | 14.05 |

| United Kingdom M4 | 13.84 |

| Mexico M4 | 12.21 |

| Brazil M2 | 11.92 |

| Denmark M3 | 10.62 |

| Korea M3 | 10.07 |

| Canada M3 | 8.08 |

| OECD Total M3 / Eurozone | 7.86/10.9 |

| United States M3 reconstructed | 13.9 |

| Germany M3 | 6.16 |

Gold has broken out against every major currency in the world and it is appreciating at double digit rates against every piece of sovereign paper in the world, which is the true inflation rate. (See Tedbits archives at www.traderview.com ). This next chart is courtesy of John Mauldin, he can be reached at john@frontlinethoughts.com it is through January 2007. Thank you John!

This is fiat currency and credit creation illustrated in the price of GOLD, now let's look at another chart illustrating the erosion of PAPER against real money, ie gold. Once again this is courtesy of John Mauldin, and John can be reached at John@frontlinethoughts.com

This is another illustration of paper versus REAL money. Both charts are through January 2007. But what we can also see from these charts is how different currencies fair against REAL money. Notice how the charts above show the strongest currencies are the ones whose economies have the most REAL growth potential going forward?

The exchange rate difference in between any two currencies is also a reflection of the many other factors such as; investment potentials in local currency terms, interest rates between countries, relative inflation statistics, comparative government policies, current and future growth rates, central bank policies, tax policies, etc..

Managed exchange rates through currency market intervention also plays a role, which is a purely political attempt to manipulate competitiveness against ones trading partners and tilt the playing field to overcome the reflections of government's bad policy choices. To the detriment or benefit of the local Mandarins in whichever Capital they may reside. This has now morphed into self preservation as the sheer size of US money printing dwarfs the float of all the worlds' currencies. So they MUST print money or see their domestic ones skyrocket.

The United States had 20 years of prosperity in no small measure because the dollar was rising and the government was able to print its way to prosperity for much of that time. And because taxes were low for foreign investors (what an incentive for foreign dollar holders, this too is now ending as well) in the US . The US and credit and currency in circulation grew exponentially during the great bull market in dollars. As near as I can tell it (the numbers are fuzzy) dollars in circulation grew almost 600% in Greenspan's tenure as the dollar became the reserve currency of the world. Ce ntral Banks and Savers relied on the full faith, fiduciarily responsible, and reliability of the US government to meet its obligations and to keep the straight and narrow.

So we gave them what they asked for Trillions and Trillions of dollars to store their wealth in and shield them from their irresponsible local governments. Those dollars then took the place of the gold and silver they used to hold in their reserve vaults to underpin their currencies. They sold the metals and other reserve assets and spent the money. Exchanging assets which have no credit claims against them (gold and silver are no one else's liability) and exchanging them for ones that do (the dollar is a claim against the US government and ultimately citizens). Is there any major central bank whose US dollar reserve holdings are not more than 50% of the total reserves? I don't think so. Now those dollars are quickly doing the reverse of what ancient Alchemists tried to do (they tried to change lead into gold). They are turning from gold into Lead. And they are the elephant in the room, impossible to ignore and impossible to hide.

The United States has built such a gargantuan pile of obligations, current and future that it guarantees the destruction of any of the any intrinsic value that may still be embedded in dollars. The current US budget spends $9,666 on every man woman and child in the United States , and this number has grown 60% in the last six years. And that doesn't include the Social Security and Medicare trust funds they” BORROWED”, which is 100s of billions more in unchecked spending and theft from past generations represented by anyone who has paid into social security, and future ones who will have to pay the money which has been pilfered. They say Social Security and Medicare are not bankrupt and there are trust funds, but they are gone, stolen from the “lock box”, LOL. A funding crisis that was not to be a problem for twenty years is now on the close horizon.

According to the GAO (government accounting office) on balance sheet obligations of the US government have grown during the Bush administration from 20 trillion to over 47 trillion in less than 6 years. Non recognized future obligations are at least another 20 trillion. State, municipal, corporate and individual debts are not included in this number, and they are enormous, but that is another story. Regulations and the size of government have increased almost 60% over this period as a further impediment to future growth prospects. The new Democratic majority is set to ratchet all of this up, in all of the mentioned areas. These are calls on the future earnings of an economy whose GDP is approximately 13 trillion dollars. Obligations on the same children they say they want to protect from global warming. There is no way we can grow our way into paying these unpayable obligations. These promises to pay by the government will only be met through the printing presses.

The guaranteed monetization of these obligations mean the reserves in central banks around the world (they are up to 70% of the backing in central banks for Euros, Yen, British Pounds, Yuan, British pounds, Russian Rubles, etc. depending on the reserve holding of the respective central banks) are about to begin a accelerated decline in value A “Crack Up Boom” is unfolding as Ludvig Von Mises has outlined, as the “INDIRECT EXCHANGE” looms dead ahead. So we now we know and can understand that a falling dollar will bring down the purchasing value of every currency in the world, as the dollar is the reserve holding in their central banks, reducing the currency values of the currency they back in an equivalent manner. Does anyone understand what this means for gold in terms of every currency in the world? It is time to buy every pullback…

Responsible government is now impossible in the United States , its all politics all the time. Policies that reward and create wealth are now a distant memory in the US , the “SOMETHING FOR NOTHING” constituent demanding the expansion of government BENEFITS to offset the declines they relentlessly experience at the grocery store checkout counters and in everything else they consume. Republicans are Borrow and spenders and democrats are Tax and spenders, the one thing they agree upon is the spending, creating more future new obligations.

Now we are seeing the entry of a newly enlarged and insidious element to the spending plans of these politicians which know nothing else. It is PRINT and Spend. And it is accelerating, almost a trillion dollars was created out of thin air between July 2006 to July 2007, hidden as M3 is no longer reported. I promise you it went into propping up the stock markets, runaway government spending, supporting the dollar (as it was very close to a new 30 year LOW) and smoothing out losses in the sub prime arena, just to name a few. Removing balance sheet bombshells and propping up asset values. It is the Fed in action as the buyer/lender of last resort, and it is set to continue “ad infinitum” forever. There is no purpose which they will not support a quick printing to solve. It is now second nature to them, it is the answer to every problem for them, “throw money at it”.

Now the Laws of unintended consequences (but they can be anticipated and these are big investment opportunities) are kicking in for our foreign dollar holders and lenders, and they are faced with a conundrum of epic proportions. They are holding the proverbial ICE cube in their hands and bank accounts. It is slated to melt, slowly now but it will gather steam as each holder forces the other to speed up their diversification plans or lose out. And there is nowhere to run as the dollars in circulation dwarfs the local currencies in size. A conversion into another script will quickly turn ugly for the receiving currency as it skyrockets in price and the holder of the dollar as it plummets. It must primarily flow into assets, not currencies.

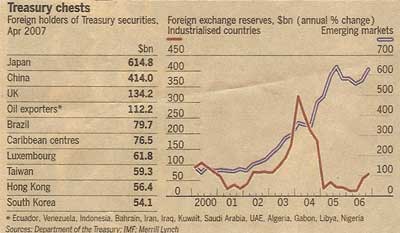

Governments around the world are setting up global investment corporations to dump them, and emerging market central banks are signaling they won't be accumulating many more. China alone is set to accumulate OVER 500 billion of them in 2007, US dollar reserves in other developed and emerging nations are SKYROCKETING as well. They will buy enough American goods to protect the value of their dollar holdings and not a penny more. Many foreign exchange professionals doubted the magnitude of their intentions in the statement. This may or may not have been an overstatement or a Freudian slip about their future plans. Take a look at this chart from a recent financial times ( www.ft.com ) at the massive amounts currency recycling and treasuries purchases required to stem the dollars demise and preserve currency competitiveness:

These purchases are for SELF PRESERVATION purposes only as to fail to support the budget and trade deficits of the US would be currency and export SUICIDE. The “twin” US deficits have increased over 400% since 2000.

These purchases are for SELF PRESERVATION purposes only as to fail to support the budget and trade deficits of the US would be currency and export SUICIDE. The “twin” US deficits have increased over 400% since 2000.

The governments of Iran and Malaysia no longer accept dollars, and Russia has outlawed the speaking of assets in dollar terms. Iran , Venezuela , Kuwait are heading for the exits of accepting dollars as well. Slowly but surely destroying the US Politicians/public servant's ability to print infinite amounts of them and exchange them for real wealth including OIL.

This is only the beginning as there is really nowhere to run, the positions they hold are too big to swap into other currencies without destroying the value of their dollar holdings on the offer and distorting the value of the receiving currency by putting too much of them on the bidding side. And then there is the US congress which does not quite understand the cows are already out of the barn, it's too late, and their parties are over. But the “SHELL” game will continued to be played as every day it is, the receivers of it get MORE AND MORE outside the control of the US Hegemon.

The one redeeming aspect to the problems for the politicians in Washington is that foreign holders of dollars don't vote in elections. Foreign holders can run on the edges but not leave en masse, so it will be a long bleeding process “death by a thousand cuts” as other repositories of wealth are developed and moved into slowly. It's a game of hot potato as foreign holders search the world over for another greater fool to take these dollars off their hands in exchange for things that can't be printed!! Do you think the Chinese are buying energy assets with dollars or Yuan?

How did we get to this point? Bretton Woods established the US dollar as the world reserve currency. The US became creditor to the world. Over time, the US government borrowing abused this power and Bretton Woods collapsed in the early 1970's, when Nixon took the US off the gold standard. But other central banks around the world continued to take in dollars believing they were an asset and sold off gold reserves. Over time this asset is becoming a liability. Four to five trillion dollars are now in foreign hands . From the largest creditor in the world to now its largest debtor! This is why the dollars days as the world's reserve currency are NUMBERED.

The currency market is the only one I am aware of that hopes the value of the dollar will remain unchanged, those that are long the dollar: foreign banks and dollar holders and those that are short the dollar US Federal Reserve banks and the US government. It will not remain the same. The supply has overwhelmed the demand. Those holding them will suffer at an ever increasing rate, as the “something for nothing” constituent will never relinquish his mistaken assumption that he can have “something for nothing”, only the ultimate crisis will change his path.

This was OK when dollars were mostly a domestic affair, but now it is international in scope and over 5 Trillion of them are in the hands of international interests. 2.5 trillion of them sit in domestic money market funds. Dollars are NO LONGER a unit of money backed by an asset (GOLD and SILVER) they are now like a bond; they are a call on “FUTURE INCOME”. They are IOU's written against the production and property of the United States of America . Written and printed by “PUBLIC SERVANTS” who use this money to buy votes and support from campaign supporters, the “SOMETHING FOR NOTHING” constituents and their corporatist business partners. Every time they print one and spend it you can expect a little less income in your future and that of your children. Because you either owe it to the Federal Reserve or to foreign suppliers of real stuff such as oil, and imported products.

The FED's invisible hand of intervention is trying to keep interest rates as low as the world will allow. But the world is becoming a bit nervous. The US has SPENT and borrowed over $4.5 trillion from overseas. Some day it will be repatriated. The exchange of paper for wealth will go into reverse. We will get our paper back and have to return real wealth. Recently, the dollar has been rapidly declining against the Euro and gold but at a much slower rate against the Asian Tigers. Our biggest export under Greenspan's term was paper – the US Dollar.

This has worked to the advantage of the emerging world as they have now been CUT lose from their former financial masters, as they no longer have to look no farther than themselves for lenders of last resort during financial crisis. Formerly they were VICTIMS of the IMF (International monetary fund) and the World Bank, who would impose crippling economic policy decisions as terms of rescue. Severing their futures from their “WOULD BE” socialist masters in the G7.

Since the maestro, Allan Greenspan took over; the dollar has lost 37% of its value. Now we have Bernanke as the new head of the FED. When he left office M3 money supply was growing at about 8% compounded annually. Bernanke has studied the depression and deflation at great length so now money supply is growing at 13.8% (reconstructed M3) compounded annually, a 50% increase in less than a year and a half. He has stated the FED has many options to avoid deflation including dropping dollars from helicopters if necessary, earning him the nick name “Helicopter Ben.”, you had BETTER believe him! This is not a man who is prone to Hyperbole. LOL. The dollar bears the legend on it, “In God We Trust.” This was placed on US currency BEFORE the Federal Reserve was created. And before the US government tried to substitute itself for “GOD”. Placing your faith in the Fed and Washington DC could be a dangerous plan. Someday, the dollar could fall to its intrinsic value. De”nial” is not just a river in Egypt .

There are TWO ways currencies are created by central banks, one is very insidious and one very virtuous to the future prospects of the economies they reside in.

In the G7 money is created by DEBT, a call on future income. The treasury of whatever country in which you reside, calls up the central bank and says we need money. The central bank say's how much? If tax receipts are 20 billion dollars and spending requirements are 50 billion dollars they then say: 30 billion dollars. The central bank then says send us a bond that is for 30 billion dollars, so the government creates a bond for 30 billion dollars and hands the repayment obligation to the public, current and future generations of them. The Central bank sends them the 30 billion dollars and it is spent not on investment in future wealth creation but on CONSUMPTION by the “something for nothing” constituents and special interests which are their ticket to reelection. Saddling YOU with the bill!

This cuts the citizens twice. Plus, since the currency is now backed by nothing, the true holders of the obligations are the US citizens; their future earnings and their property back those IOU's, since they are no longer backed by silver, gold and REAL assets. The GDP of the United States grew less then 4% in 2006 on a 13 trillion dollar economy that is 520 billion dollars of GDP, so the CURRENT obligations on 47 trillion dollars will take 90 years to pay off even if you pay NO INTEREST, with the compounding of the debt the obligation DOUBLES every 18 years at an interest rate of 5% (no way this is the average rate on these obligations this low). Many believe that when you include state, municipal and private obligations the amount of debt outstanding is over 80 Trillion dollars in which case an economy growing at 4% takes 145 years to pay off, once again BEFORE INTEREST AND COMPOUNDING. The only conclusion you can come to is Bankruptcy or raping the purchasing power of the currency. You can bet on the latter option. The US is headed the way of Rome .

The second way currencies and money is created is through STERILIZATION, and although this is very STIMULATIVE, it does not borrow from the future. In fact, it pays for the future with the borrowings from the G7 central banks. How does this work? Since Alan Greenspan began the great experiment with fiat money and credit creation, the US has exported more and more dollars represented by the budget and trade deficits. This number has now grown to over $800 billion dollars a year. When the US ships the money overseas to pay for their purchases the central banks of the receiving country are FORCED to take the dollars and print an equivalent amount of them in the local currency to pay the exporter of the products to the United States .

Otherwise their currencies would SKYROCKET against the US dollar and the dollar would collapse against the local currency. So they MUST do this or destroy their export competitiveness in a world where commerce is now GLOBAL in nature. It is self preservation. The receiving country central bank then accumulate reserves which are insurance against financial crisis, and their exporters still get paid for their goods. This is a double blessing as the central bank is now much better backed in respect to the reserves and the exporter is thriving and getting paid allowing him to expand his business while maintaining his export competitiveness. The citizens in this economy are rewarded in many ways, jobs are plentiful and always expanding and their central banks are always more reliable in preserving the purchasing power of their currencies are they are continually being backed by more and more reserves.

IN conclusion: As you can now see this is a CRACK UP BOOM written across the globe, as currencies are now backed by NOTHING! Think about it, emerging central banks reserves are backed by currencies of countries which are BANKRUPT, both morally (currency creation through debt on the public) and fiscally (they have sent so many IOUs overseas ie “dollars” and borrowed so much money “bond issuance”, and promised entitlements “Social security, Medicare, Medicaid, etc which cannot be paid). Public servants as socio and psycho paths, with no regard to history. Blindly printing however much money that is required to manipulate their “something for nothing” constituents.

Politicians/public servants are absolutely in control of every central bank in the world regardless of the words and methods they use to FOOL you into thinking they are independent. If you think they are independent just think of Ronald Reagan telling Paul Volker to plunge the economy into recession as quickly as possible to get the pain of purging inflation from the economy as over as quickly as possible, or check the visitors log at the White house over the last 20 years and look at how often Greenspan and now Bernanke visited their masters (once or twice a week) over the last 20 years.

Do you think the Chinese central bank is independent of the Mandarins in Beijing ? Or how about Putin in Russia ? The answer is NO. Do you think emerging world central banks would print Yuan, rubles, real, rupees, Di rhams, etc. to buy US dollars and protect the purchasing power of their existing holdings of dollars from going into freefall? Do you think that might explain how their dollar reserve holdings are RISING faster than their trade surpluses would indicate? The answer to both questions is YES. The emerging world MUST devalue their currencies FASTER then the US or risk having their currencies GO THROUGH the ROOF, and destroy their export competitiveness. They actually must devalue their own currencies even faster as the economic growth prospects of their economies are far in excess of the INCREASINGLY socialist G7. Capital is naturally flowing to the areas with the most GROWTH POTENTIAL!

The G7 is no different, central bankers serving at the whim of their political masters. The world has learned Greenspans formula well, but they like he have forgotten history or failed to learn it. This madness has many years to run as the broad public is paddling so hard as to not to have much time to really understand what is going on. Politicians, public servants and central bankers are MASTERS of creating inflation and confiscating wealth through FIAT currency and credit creation, and slaves to deflation as it is something they cannot control.

So the policy forever is INFLATION, and because they have been so irresponsible for the last 10 years the inflation is now outside their grasp as to really tighten, normalize interest rates (interest payments in EXCESS of inflation) or reign in liquidity GARANTEES the collapse of the worlds “ASSET BACKED” financial and monetary systems. So its “EASY MONEY FOREVER”, realize it and thrive! Or believe inflation will subside and be severely harmed in preserving your wealth! It is an unfolding “CRACK UP BOOM” and the only safe harbor for FIAT cash is the indirect exchange provided by stuff such as commodities and business enterprises. An inflationary boom of EPIC proportions is about to go into HIGH GEAR! If you would like help in capturing some of the opportunities in the CRACK UP BOOM as the unfold contact me through the website www.TraderView.com

The final edition of the “CRACK UP BOOM” series will be released next week don't miss it. If you enjoyed this commentary, send it to a friend or subscribe its free at www.Traderview.com . Thank you for reading Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication that comes out on Thursdays or Fridays.

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.