Goldman Sachs The Giant Vampire Squid’s Journey To The East

Companies / Banking Stocks Jan 14, 2010 - 01:04 AM GMTBy: Darryl_R_Schoon

Usury, once a venal sin, was now commonplace and bankers who live by the charging of interest were considered respectable. The hand of evil was everywhere as the end-times, the end of days, were upon them.

Usury, once a venal sin, was now commonplace and bankers who live by the charging of interest were considered respectable. The hand of evil was everywhere as the end-times, the end of days, were upon them.

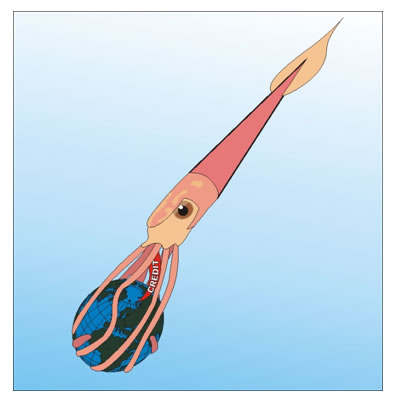

Rolling Stone writer Matt Taibbi’s description of Goldman Sachs as a Giant Vampire Squid which wraps itself around its victims draining them of their productivity and profits is chillingly accurate.

In truth, Matt Taibbi’s Giant Vampire Squid was created in the recesses of 17th century London, for Goldman Sachs is but one of many; but, unlike Frankenstein’s monster, the Giant Vampire Squid is not a fable. It is as real as are its appetites and victims; and, although now badly wounded, the Giant Vampire Squid is still alive—and it’s headed east.

Taibbi’s metaphor is an apt description for modern banks, especially investment banks such as Goldman Sachs, JP Morgan Chase, Deutsche Bank, Credit Swiss, RBS, etc. Allowed by governments to create capital from virtually thin-air, these banks have an in-house advantage in a world dependent on credit, an advantage they use to leverage the world’s need for money into profits and obscene bonuses for themselves.

Banking is simple. We profit by the indebting of others by taking advantage of their need for money. We do this by creating money from nothing using the savings of others to do so.

The Dark Arts: The Secrets of Banking, 14th ed.

the FEEDING mechanism OF THE Giant Vampire Squid

The feeding mechanism of the Giant Vampire Squid is simple. First, it expands the size of its victim by injecting it with credit through its beak. Over time, this will enlarge the victim to its maximum possible size.

This mimics the nurturing process in nature. But the Giant Vampire Squid’s intent is singularly self-serving. At first, the victim enjoys the squid’s credit, absorbing as much as possible. The victim experiences the increased growth as pleasant and positive; and so it is—but ultimately only to the benefit of the squid.

The victim, enlarged to its maximum size and thoroughly entwined by tentacles, the Giant Vampire Squid then begins its deadly cycle of extraction, a protracted process that accelerates over time.

The Giant Vampire Squid possesses a rudimentary but highly sensitive extraction system alerting the squid to start the extraction process at the most advantageous time, indicating also the maximum amount that can be extracted and the most efficient way to do so, i.e. sovereign debt, mortgages, initial public offerings, leveraged buy-outs, consumer credit, bankruptcy, etc.

Inevitably, the victim begins to shrink as the extraction process has a debilitating effect over time. In some instances, speculative bubbles appear, nex ebullio, a sure sign of the victim’s approaching demise. The process can take years, even decades—or it can happen overnight.

Eventually, the victim, now shrunken and depleted and almost unrecognizable, its productivity and profits completely leached, its future if it ever existed encumbered beyond redemption, expires.

The life cycle of the giant vampire squid

The Giant Vampire Squid is a member of the family Architeuthidae, but unlike its biological brethren, the Giant Vampire Squid is also a parasite that, unlike others, dies when its host dies. To survive, it must always find another host before its present host expires.

The Giant Vampire Squid’s first such crisis occurred when England could no longer expand fast enough to support the Giant Squid’s rapid growth. As its victims expand, the Giant Vampire Squid expands also and, at the time, the Giant Vampire Squid needed another victim as its then host, England, was no longer expanding.

The United States of America was to be the perfect replacement for England. At the end of the 19th century, England’s empire was shrinking while America was on the verge of great industrial growth.

With little debt and much potential, the US fit the exact profile of the Giant Vampire Squid’s perfect victim/host—and it was. In less than 50 years, due to the squid’s continuous injections of credit, the US would expand to become the richest most productive country in the world, only to be bled completely dry by the Giant Vampire Squid in a few short decades—just as America’s founding fathers had warned.

Through its beak, the US Federal Reserve Bank, the Giant Vampire Squid increased US debt by an extraordinary 4,000 %, from less than $3 billion to over $12 trillion, by leveraging then draining the wealth of the world’s once strongest economy.

When the American economy collapsed in 2007, it almost destroyed the Giant Vampire Squid in the process. Only a massive emergency infusion of capital in 2008 would save it. TARP didn’t save America. TARP saved the Giant Vampire Squid.

Despite causing the collapse of the US economy, bankers inside the US government insured the squid would survive. Trillions of dollars in US aid were directly given to Wall Street banks resuscitating the giant squid from certain extinction.

TARP had enabled the Giant Vampire Squid to survive its greatest crisis since the 1930s; and, now, although badly wounded, its short-term survival is assured—but only as long as its host survives too.

The collapse of America’s economy reawakened the conundrum of parasites such as the Giant Vampire Squid, i.e. when its present victim has been completely drained of its wealth, another host must be found or it will die.

Today, its current host, the US, is fighting for survival as it succumbs to insurmountable levels of squid-induced-debt, SID. Its manufacturing base now transferred to China, its savings now replaced by IOUs, its future so encumbered it can never be paid, the US is now living on borrowed time and borrowed money—and the squid knows it.

The search for a new host is on.

THE EAST BECKONS—or does it?

The West, now indebted and drained of its wealth by the Giant Vampire Squid, is no longer its optimal venue. The emerging markets in the East with their high savings rates and largely untapped markets look to be its next victim—or at least appear to be so.

The West’s view of itself is Western-centric. This is natural. It is also natural that the East’s view of the West is Eastern-centric. It is a view, however, that is far less kind than the West’s own view of itself.

To the East, the West is the Giant Vampire Squid incarnate. Originating in London in 1694, spawned by banks and government, the Giant Vampire Squid immediately headed East in the 1700s to take the East’s riches for itself.

India especially beckoned the Giant Vampire Squid. For 15 centuries prior to the Giant Squid’s arrival, India is estimated to have had the largest economy of the ancient and medieval world controlling between one third and one fourth of the world's wealth up to the 18th century.

http://en.wikipedia.org/wiki/History_of_India

But after the Giant Vampire Squid’s arrival, everything changed. It would do well for those enamored of the West’s “free trade” to acquaint themselves with the actual origins and use of the concept.

“Free trade” was used by the West to forcibly extract trade concession from the East in order to profit; and, while those in the West don’t remember it as being so, those in the East do.

In Opium Wars I (1849-1842) and II (1856-1860), the British East India Company used the cover of “free trade” to force China to allow the importation of opium; just as previously the East India Company had forced upon India “free trade permits” in Bengal province.

Bengal was the first major area conquered by the [East India] Company. Its army defeated the native ruler in 1757, and proclaimed itself the official ruler of Bengal in 1765. It imposed incredibly harsh taxes. The province deteriorated rapidly. In 1770, the failure of monsoon rains, led to a famine in which an estimated one-third of the population perished…Bengal then became the center of the East India Company's opium monopoly…The East India Company's domination of the Indian economy was based on its private army. However… the ultimate muscle behind the company was the British military, as Lord Palmerston demonstrated by deploying it in the Opium Wars, to back up the British demand for ``free trade…the ``free-trade'' East India Company was, effectively, a semi-official branch of the British government

Robert Trout, The Chinese Opium Wars, American Almanac July 1997

http://american_almanac.tripod.com/opium.htm

Free trade in actuality was but a cover for the Giant Vampire Squid as it moved East in its quest for world dominion. Communism was the East’s flawed, dysfunctional and self-destructive attempt to resist it.

The merits of free trade depended on whether you were advantaged or disadvantaged, strong or weak, the victim or the victimizer.

PROPHYLAXIS AND the Giant Vampire Squid

The power of the Giant Vampire Squid is found deep in its genesis where it was formed by the hand of man to grow into the monster it is today. Its power came when England allowed the Bank of England’s banknotes to be considered as good as gold and silver.

Of course they weren’t. They never were. But with the sanction of the government, the paper banknotes were accepted as money, guaranteed that they were convertible to gold and/or silver upon demand. A fine promise but, in the end, only a promise, a promise today that is no longer made as it can no longer be kept. The paper, however, keeps passing.

The global monetary system is now completely infected with the Giant Vampire Squid’s debt-based banknotes; and, consequently, a global financial crisis is now in the making. In fact, it has already begun.

It is ironic that Martha and I are in engaged in parallel businesses designed to protect those at risk in today’s world—from AIDs and paper money. Our condom company, Mr. Happy’s Hat, www.mrhappyshat.com exists in part because of the threat posed by the spread of the HIV virus, a threat very much equal to that posed by the Giant Vampire Squid and the spread of its paper money.

Whereas the use of a condom will suffice in the case of HIV to protect those potentially at risk, the prophylaxis in the case of the Giant Vampire Squid is gold and silver, throughout history the only known antidotes to a potentially fatal overdose of fiat money.

The price of gold, in fact, is a direct measure of the Giant Vampire Squid’s current distress. The price of gold is now over $1100, a very high number especially considering the squid is a cold-blooded creature, e.g. Goldman Sachs. Today, the Giant Vampire Squid is in serious trouble—and so are its victims.

Professor Antal Fekete has just announced his spring seminar will be held March 25-29 in Hungary. Is the Global Financial Crisis Really Over? will be the topic. Those attending will have the opportunity to hear and meet the esteemed professor, a monetary apostate in a time of paper money, albeit one who has delivered papers to audiences that included Nobel Prize winner Robert Mundell and former Fed chairman Paul Volker in the past year. For event details go to http://www.professorfekete.com/gsul.asp

I also will be attending and giving a talk. My topic will be The Giant Vampire Squid and its Reception in the East.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.