PIMCO's Bill Gross Says Invest in 'Less Levered' Countries

Economics / Investing 2010 Jan 27, 2010 - 08:43 AM GMTBy: Trader_Mark

This morning we had Jeremy Grantham's much read quarterly letter, and now we have Bill Gross' widely followed monthly letter. In this month's missive, he essentially summarizes where we plan to be invested long for the next few decades - countries who act (relatively) fiscally responsible, with solid demographics, and either are modern commodity rich "Western" nations or developing countries who are akin to investing in the US in the 1950s, 1960s. Old habits die hard and people still believe the fiscally irresponsible, borrow / spend developed economies are still the place to be... they are "safe". bah.

This morning we had Jeremy Grantham's much read quarterly letter, and now we have Bill Gross' widely followed monthly letter. In this month's missive, he essentially summarizes where we plan to be invested long for the next few decades - countries who act (relatively) fiscally responsible, with solid demographics, and either are modern commodity rich "Western" nations or developing countries who are akin to investing in the US in the 1950s, 1960s. Old habits die hard and people still believe the fiscally irresponsible, borrow / spend developed economies are still the place to be... they are "safe". bah.

- Bill Gross, who runs the world’s biggest mutual fund at Pacific Investment Management Co., said investors should seek “less levered” countries like China, India and Brazil that are “less easily prone to bubbling.”

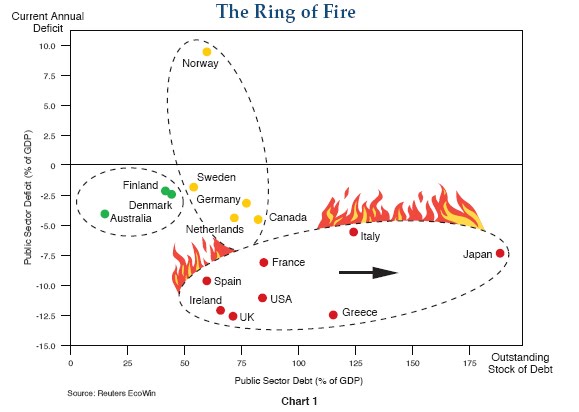

- “Go where the growth is, where the consumer sector is still in its infancy, where national debt levels are low, where reserves are high, and where trade surpluses promise to generate additional reserves for years to come,” Gross wrote in a monthly investment outlook published on Newport Beach, California-based Pimco’s Web site. “The old established G-7 and their look-alikes as they de-lever have lost their position as drivers of the global economy.” (welcome to our world Bill! You're still relatively early to the thesis - no worries)

- Gross recommended that investors should look for “a savings-oriented economy, which would gradually evolve into a consumer-focused economy,” adding that miniature examples of China, India and Brazil would be excellent examples.

- The U.K. is “a must to avoid,” Gross wrote in the commentary published today. “Its gilts are resting on a bed of nitroglycerine. High debt with the potential to devalue its currency present high risks for bond investors.” (the UK is the mini US - the only difference is the Brits seem to have *some* political will at fighting deficits whereas all we have is vague talk of "deficit fighting" that has been full of empty promises - while acting in complete opposite.) [Dec 1, 2009: Morgan Stanley Lists UK Sovereign Debt / Currency as Potential "Fat Tail" Risks for 2010]

- Among developed countries, Gross recommended Canada and Germany. “Given enough liquidity and current yields, I would prefer to invest money in Canada,” Gross wrote. “Its conservative banks never did participate in the housing crisis and it moved toward and stayed closer to fiscal balance than any other country.” (both considered "socialist" by Americans - irony. I would put in Australia as well - ahead of Germany. Germany is going to be dealing with irresponsible brethern in the European Union over the next decade - a lot of very tough decisions) “Germany is the safest, most liquid sovereign alternative,” Gross wrote. However, “its leadership and the EU’s potential stance toward the bailouts of Greece and Ireland must be watched. Think AIG and GMAC and you have a similar comparative predicament.”

- In the firm’s investment outlook for 2010 released on Jan. 4, Pimco said it was cutting holdings of U.S. and U.K. debt as the two nations increase borrowing to record levels.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2010 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

M. Isaac

27 Jan 10, 20:10 |

Norway

One can easily invest in Norway by buying the Norwegian kroner which pays higher interest than most nations. |