EURO March to Reserve Currency Status

Currencies / Euro Feb 07, 2010 - 04:10 AM GMTBy: G_Abraham

Continuation of my colleagues analysis, Vishal Damor (Editor InvestingContrarian.com) dated 6 Feb 2010:

Continuation of my colleagues analysis, Vishal Damor (Editor InvestingContrarian.com) dated 6 Feb 2010:

EU bonds are the safest bet. STILL!

The EURO has had its stuffing taken out of it over the last 2 months and it needs a lot of analysis and courage to back the EURO at this point of time. We do believe fundamentally that EURO is the future base currency and EU bonds are to be toast of the world central banks. Trichet has vehemently denied that EURO has no role as a reserve currency unless otherwise needed. It only means he will let the world sink the dollar and come begging for an alternative which will not be found anywhere else other than the EURO.

Not withstanding the current crisis in Portugal, Spain, Ireland and Greece, EURO is gaining strength as central banks around the world are buying it and diversifying out of the dollar. While the blogs awash with stories of India and China buying tonnes of Gold, I think the real value is not in Gold but rather an alternative currency to the dollar. The Euro and IMF SDR are the only two true alternatives. Gold has very little role to play today or in future monetary formation for the simple reason that currencies based on Gold standard will decline the world living standards and will be an unacceptable solution to most nations. Gold bugs need to question their thesis on why will Gold go to $4000 and $5000. Who will buy it ? Not me. Not the Central banks around the world. China balked at the idea of buying Gold at $1225 and in fact it turned around and said that “Gold is a bubble” at a price of $1225. Gold bugs dismissed it as China strategy to buy more Gold. Well Latest Dec statement from people Bank of China does not show any increase in Gold holdings. Gold has no future in monetary standards today or in years to come. It is a precious metal and that will be its status for decades. It rises and falls based on movement of HOT MONEY which is speculative money.

So what is the future in currency reserves?

The dollar decline has been analysed to death and I concur with that view. The structural damage in the US economy is permanent and its decline to the toilets is only a matter of timing. One would have expected the decline to have accelerated in 2001 post the 9/11 attacks but US some how found another golden goose in financial engineering through securitisation and cheap money credit which spawned risk taking around the world and US banks became the underwriters of such risk taking, pocketing massive fees which helped the government revenues and that system kept it going for another 7 years.

That bubble has burst in 2008. The best hope for US was to reflate the bubble by stitching the balloon and that is exactly what Ben Bernanke has been doing for the last 14 months and to some extent has succeeded. But a burst balloon is a burst balloon and it will burst again. So the game is up!!

Now central banks around the world know this and have started the slow and subtel diversification out of the dollars as analysed below.

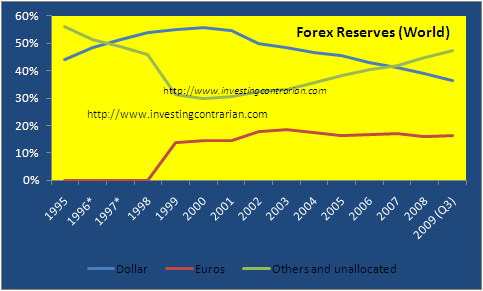

World Forex Reserves

Policy makers boosted foreign currency holdings by $413 billion in Q2 2009 (latest data awaited), the most since at least 2003, to $7.3 trillion, according to data compiled by Bloomberg. Nations reporting currency breakdowns put 63 percent of the new cash into euros and yen, Barclays Capital data show. That’s the highest percentage in any quarter with more than an $80 billion increase. The dollar’s 37 percent share of new reserves fell from about a 63 percent average since 1999.

As of Q3 2009, the world holds 7.5 trllion dollars of forex reserves. This includes 3.1 trillion unallocated reserves whose data is not available but we know that China accounts for roguhly 2.7 trillion of the 3.1 unallocated. China has stopped formally disclosing its US dollars holding status but common understanding is that China holds roughly 800 billion in dollars of its total foreign reserves. The 800 bllion has stayed constant for the last 2 years while its reserves has grown by about 8% which defintely means China is diversifying strongly out of USD.

In our analysis we have kept the Chinese reserves as neutral to the whole analysis as we do not know where exactly are they deploying their reserves. The follwing charts clearly show the diversification out of USD as USD accounts for less than 40% of world reserves from its peak in 2000 when it hit 58%. The unallocated reserves of China is out growing the world reserves as shown by the green curve. Even assuming 800 billion to be in USD, USD will still be only 50% of world reserves, a far cry from its peak of 65% in 2000.

My understanding is that China while keeping its 800 billion in USD, holds roughly 1 trillion in EURO and rest in yen, CAD and Gold. If so be the case, EURO percentage of world holding will be closer to 31% compared to USD holding of 39% which is remarkable feat for a currency launched in 2000.

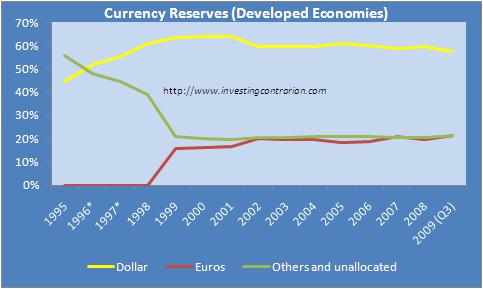

Forex Reserves in Advanced Economies

Advanced economies provide a more accurate picture due to the reserves being more transparent and made available to IMF by member countries. Dollar holds a steady grip of forex reserves in developed world mainly cause of UK and Japanese holding. Japan alone holds close 1.3 trillion in USD which hardly varies. EURO too holds steady courtesy its member countries. I personally do not see USD reserves varying too much in advanced economies unless Japan decides to dump USD which looks difficult given tat US maintains a strong millitary base in Tokyo. Lest no one tell you that milliatry base is not to defend Japan from outsiders but to make sure that Japan does not destabilise world forex by diversifying, might it wake up one day and start acting like China.

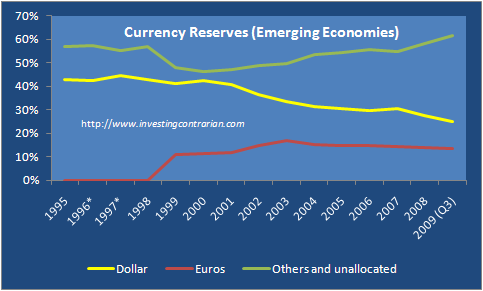

Forex Reserves in Emerging Economies (China and India included)

Jim Rogers believes China is the future of the world. It is difficult to argue with that accept China still does not have the military to stand against any US aggression. Make no mistake, US will attack China if China decides to completely dump USD reserves. US will not stand by if its country is sold short in world markets. It is a question of national security. Refer latest news items as US deploys its missiles in Taiwan. Read Here. Interpret the article in light of recent hostility by US towards Chinese central banks statement questioning US dollar status.

Analyzing the world forex reserves and its holding, the graph shows the yellow curve clearly trending downwards for the last 7 years as China is diversifying at a frantic pace. Given that China does not believe in the Gold standard, where else does China store its wealth. Not in stones right? It has to be the next best alternative which is the EURO. The graph does not show upward trending euro as we have treated China reserves as neither USD nor EURO due to lack of proper allocaiton data. But Bloomberg data and Chinese analysts believe that China US holding totals roughly $ 800 bn while EURO holding has been going up to $900-1000 bn. China in all holds $2.7 forex reserves.

The world forex as it stands last updated is shown below:

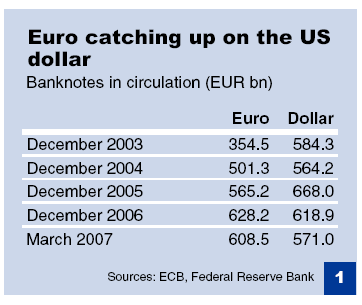

EURO money circulation

As the tables clearly shows that EURO has been catching up with the dollar at a very fast clip and now has outrun the dollar in terms of money in circulation. We do not have further data post deleveraging in 2008 but we assume the deleveraging has been more in the US than in the EU judged by the actions of FED reserves to pump in additional money into the system while ECB has stayed on the sideline.

Here we use the Krugman matrix1 that differentiates between the medium of exchange, unit of account and

store of value functions in the private and public use of money.

Private international use comprises

- The role as a medium of exchange in payment and foreign exchange transactions. On the basis of the volume of banknotes in circulation worldwide, the euro narrowly overtook the dollar for the first time at the end of 2006 (at around EUR 630 bn). However, it is estimated that only 10-20% of euro notes are used extraterritorially, compared with 50-70% of dollar banknotes. By choosing not to issue EUR 1 notes the ECB missed an opportunity to achieve a better international positioning of the euro against the US currency, which offers a USD 1 note for which there is strong demand in the international travel arena. As a transaction vehicle in the global foreign exchange markets, the EUR/USD segment was the most frequently traded currency pair, according to the BIS survey of April 20042. It accounted for 28% of global foreign exchange turnover, compared with 17% for the USD/JPY and 14% for the USD/GBP;

- The role as a unit of account in the invoicing of international trade. The data situation is, however, unsatisfactory on this count. According to earlier analyses nearly 50% of world trade is invoiced in dollars. Oil and other commodities are billed in dollars (the exception is Iran, which invoices oil exports in euros). External trade of the euro area has in recent years been increasingly invoiced in euros (average share of around 60%). This trend also applies to EU member states outside EMU;

- The store of value function, which is closely linked with the creation of dynamic euro financial markets. The financial markets for euros and dollars are now comparable in terms of liquidity and variety of instruments. For initial offerings of international bonds in 2006, 46% were issued in euros and just 39% in dollars, whereas in the preceding years the euro had to settle for second place (with shares of between 34% and 44%) behind the dollar (39%-49%). Lagging a long way behind are the pound sterling (latest reading: 8.5%) and the yen. In the circulation of international bonds the euro achieved a share of 32% in 2006 compared with some 19% in early 1999, while the dollar share fell from 50% to around 43% and that of the yen halved to 6%.

Public international use comprises

- The role as an intervention currency for central banks in foreign exchange markets. Central banks have made only very limited use of euros for this purpose over the last few years. This applies both to the EUR/USD market, where only in 2000 were there a few interventions to bolster the then weak euro, and also within the European exchange rate mechanism II (ERM II) as well as against the currencies of those countries whose exchange rate policy is geared towards the euro. By contrast, in the past few years central banks in Asia have made massive interventions to support the dollar and accumulate huge foreign exchange holdings;

- The anchor role for other currencies, where the euro performs the unit of account function. According to the IMF’s classification there are some 40 countries in Europe, Africa and the Mediterranean that align their exchange rate policy with the euro, with the range of regimes extending from a currency board (e.g. Bulgaria) and the membership of ERM II to managed floating with a loose orientation to the euro (e.g. the Czech Rebublic). Worldwide there are some 60 countries whose exchange rate policy is geared towards the dollar. Several countries administer their exchange rate policy via a basket of currencies whose main constituents are the dollar and the euro (e.g. China, Russia). There are also countries that have unilaterally adopted the dollar as legal tender (e.g. Ecuador, Panama) and regions where the euro is legal tender (Montenegro, Kosovo);

- The holding of foreign exchange reserves, primarily for exchange rate management via intervention.

Given the overwhelming force and conviction in our analysis on EURO reserve status, there are risks which could delay the reserve status of EURO:

- Ability of US government to reign in its deficits and act as a responsible world wealth holder: This is easier than done. The latest budget puts forward a1.4 tirllion budget gap which needs to be financed by new bond auctions. If by a miracle the US economy discovers its hey days in 1990’s Dollar will be the preferred currency. We will carefully watch the US economy data over the next 1 year to test out hypothesis that US economy is dipping into a double dip rather than the recovery that the media is talking about. Meanwhile there seems to credible evidence that EURO area will stabilise at growth rates of 0.5-1.0%.

- New competition from Sterling and YEN could delay the EURO march. While this is an outside risk, nonetheless we recognize it here.

- Political Risk: Eurozone peripheral countries could wilt under a strong a EURO and thus giving rise to bickering within the zone. This may happen but as long as they are provided for by the stronger nations within the zone, I do not see this risk playing out. There will be occasional jitters but none that cannot be solved. It is quite similar to any countries problems of managing their weaker states.

Latest EUROZONE analysis:

The German economy has recorded its fastest post-war contraction, at 5 percent in 2009, with exports falling by 14.7 percent, alongside investment.

At 12.7 percent of GDP, Greece’s deficit is far above the eurozone ceiling of 3 percent. Greece is also burdened with debt amounting to 113 percent of GDP – more than double the eurozone limit of 60 percent.

The European Commission has already voiced its unwillingness to bail out the country, leaving the International Monetary Fund as the last resort for a potential lifeline. However, the country’s Prime Minister said Wednesday that Greece will not quit the euro zone, nor will it resort to the IMF. Next week, the new Greek budget is to be presented to the Greek Parliament, a statement which will be closely watched by the markets.

CNBC Jan 14 2010:

“The Germans are saying to everyone else: where is your exit strategy? You’re going to have to have one, because we’re going back to fiscal orthodoxy,” said Roche.

We believe the four countries at the center of the current eurozone crisis (Spain, Portugal Ireland, Greece) are being held out to dry as the ECB beats some discipline into their buedgetary allocation before the EC soaks in the pressure and saves these countries. Mind you, the only weakness in EURO are these 4 countries and if they can be fixed either by disciplining them or ousting them EURO will be a fortress of a currency. It is also blessing that EU puts its house in order before the world turns its attention one last time to US deficit.

Summary:

We have gone to great lengths to voice our analysis about the coming change in the world currency systems as EURO will adopted as the leading currency. The change will be dramatic and unexpected but one that will stabilise the world financial system.

Data Source: IMF, ECB, EUStas, FED Reserve, Reuters, Bloomberg, Haver Analytics, People Bank of China, DB Research

Source : http://investingcontrarian.com/global/euro-march-to-reserve-status/

Godly Abraham

http://investingcontrarian.com/

Formerly a hedge fund analyst for India's largest fund house and currently a Private Equity fund analyst with a swiss firm, Godly Abraham is an active writer at INVESTING CONTRARIAN which is a daily online publishing house, covering investing ideas and economic analysis on wide ranging topics but mainly specialized to covering US,UK, EU and BRIC countries and their political ramifications.

© 2010 Copyright Godly Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.