UK Interest Rates Expected to Stay on Hold at 5.75% Today

Interest-Rates / UK Interest Rates Aug 02, 2007 - 02:13 AM GMTBy: Nadeem_Walayat

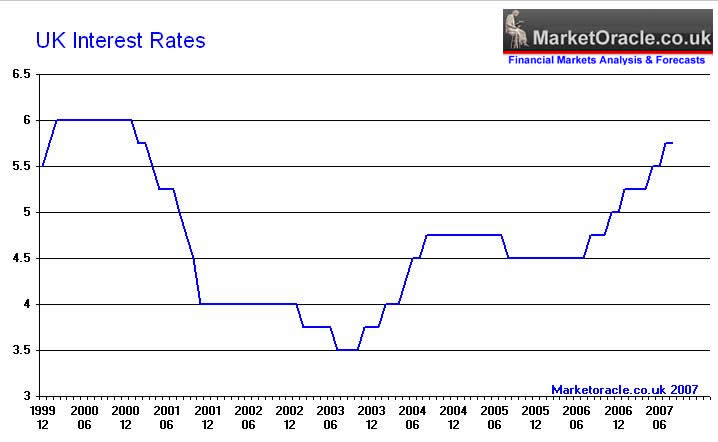

The Market Oracle expectations are for the Bank of England to keep interest rates on hold at 5.75% at today's MPC meeting.

Our last analysis (18th July 07) targeted the next rise to 6% to occur at the October 2007 MPC Meeting. More importantly there is increasing probability that 6% will mark a peak for UK interest rates. This is becoming clearer with each passing months economic data on the economy which show a slowing housing market and moderating inflation. Additionally, the series of financial knocks such as the ongoing liquidity squeeze sparked by the failure of Bear Stearns Hedge funds due to excessive positions in the faltering US Subprime mortgage market, are also expected to be taken into account at today's interest rate decision meeting.

Recent weakness in sterling also implies that the financial markets are adjusting to expectations for UK interest rates to stay on hold, against previous expectations of a rise at today's meeting which had seen sterling rally towards $2.07. Further weakness is expected in the coming weeks following today's decision.

The European Central Bank is also expected to keep rates on hold at 4%.

Related

| Hedge Fund Subprime Credit Crunch to Impact Interest Rates - 31st July 07 | |

| UK Inflation CPI Falls But Interest Rates Set to Rise to 6% By October 2007 - 18th July 07 | |

| Bank of England Expected to Raise Interest Rates to 5.75pcent Thursday - 4th July 07 | |

| UK CPI Inflation rate falls but RPI will ensure further rise in UK Interest Rates - 12th June 07 | |

| Inflation report confirms further rise in UK Interest rates to 5.75% - 17th May 07 | |

| UK strong house price growth signals further rises in interest rates - 26th March 07 | |

| UK Interest Rate forecast for 2007 - Bank of England to do battle with inflation - 26th Dec 06 | |

| UK Interest Rates could rise to 5.75% in 2007 - 9th Nov 06 | |

| Interest Rates Correction is Over - 7th March 2006 | |

| UK Long-term Interest Rates Trend is still UP ! - 13th Nov 2005 |

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

The Market Oracle is a FREE Daily Financial Markets Forecasting & Analysis online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.