Global Investment Guru Sees Gold as "Great Buying Opportunity"

Commodities / Gold and Silver 2010 Feb 11, 2010 - 06:55 AM GMTBy: GoldCore

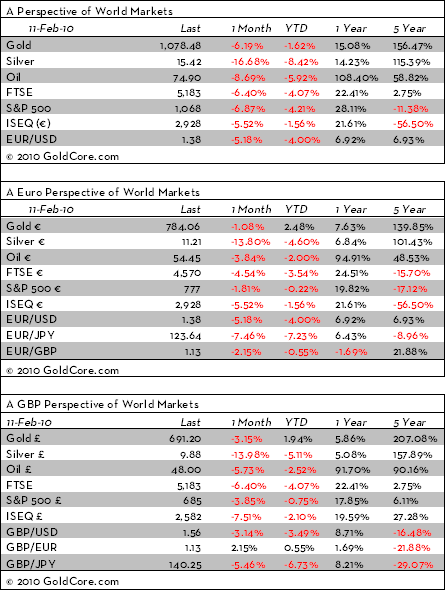

Gold rallied as high as $1,083/oz early yesterday in US trading before dropping by $19 but it soon recovered to finish the day down marginally at $1,075.30/oz. It moved upwards to as high as $1,080/oz in Asian trading this morning and has held those gains in morning traded in Europe. Gold is currently trading at $1,078.00/oz and in euro and GBP terms, at €785/oz and £693/oz respectively. The fiscal challenges facing the UK and eurozone economies are seeing gold challenge resistances at £700/oz and €800/oz.

Gold rallied as high as $1,083/oz early yesterday in US trading before dropping by $19 but it soon recovered to finish the day down marginally at $1,075.30/oz. It moved upwards to as high as $1,080/oz in Asian trading this morning and has held those gains in morning traded in Europe. Gold is currently trading at $1,078.00/oz and in euro and GBP terms, at €785/oz and £693/oz respectively. The fiscal challenges facing the UK and eurozone economies are seeing gold challenge resistances at £700/oz and €800/oz.

Hopes that the EU summit may alleviate the growing crisis in the eurozone have seen risk appetite return as seen in buoyant equity markets this morning. But there are concerns that the swelling public deficits seen in some European economies, more specifically Spain, Portugal and Greece may thwart recovery and future growth in the region. This will likely lead to increasing risk aversion which could see the euro, equities and government bonds come under further pressure.

A slightly weaker dollar and oil back near $75 a barrel is supporting gold. As is the continuing crisis in the eurozone with lingering concerns that the 'Greek tragedy' might lead to contagion in financial markets. And the problems confronting Greece are by no means exclusive to Greece as many other western nations' public finances face similar challenges.

Competitive currency devaluations continue as seen in Vietnam where the central bank announced its second currency devaluation since November. It devalued the dong by more than 3 percent to help balance the foreign exchange market and control the trade deficit. The dong's continuing devaluation explains the significant demand seen for gold in Vietnam in recent weeks as seen in the continuing high premiums being paid for gold - local Vietnam gold stood at a $17.08/oz premium to world gold of $1,077/oz yesterday. Reuters reports that demand remains strong: "Saigon Jewelry Holding Co. increased its gold trading volume to 40,000 taels, or 1.5 tonnes, on Tuesday as residents in Ho Chi Minh City rushed to gold shops to purchase the metal."

The lackluster response to John Paulson's new gold fund may indicate that talk of a 'gold mania' and a 'gold rush' is exaggerated. The legendary fund manager put an incredible $250 million of his own money into the fund but has only managed to raise $90 million from investors internationally. Sentiment towards gold remains tepid and cautious among market participants which suggests that gold has yet to become a bubble.

Silver

Silver has between $15.40/oz and $15.48/oz so far in Asia. Silver is currently trading at $15.43/oz, €11.22/oz and £9.92/oz.

Platinum Group Metals

Platinum is trading at $1,523/oz and palladium is currently trading at $418/oz. Rhodium is at $2,475/oz.

News:

Asian and European shares have risen so far today, with solid economic data from China and Australia lifting sentiment as investors awaited a possible bailout for Greece. European markets were higher.

Crude-oil futures rose in Asia Thursday to nearly $75 a barrel due to a weaker U.S. dollar and speculation by traders as heavy snow blanketed much of the eastern U.S., delaying oil inventory data from the U.S. Energy Information Administration.

The pound fell after the Bank of England cut its forecast for economic growth and said inflation would undershoot its 2 per cent target significantly if interest rates rose as fast as markets were predicting. Sterling was not helped by the Bank of England's quarterly inflation report painted a gloomy picture of the UK economy.

Geopolitical risk continues to simmer with the volatile political situation in Iran continuing and simmering tensions between China and the EU and US (the US and the EU issued a strong criticism of China's restrictions on political expression today after a court upheld the 11-year prison sentence for high-profile dissident Liu Xiaobo). Iranian security forces clashed with opposition supporters today as crowds flocked to central Tehran to mark the 31st anniversary of the Islamic revolution.

Global investment guru, Marc Faber, who predicted the current crisis and was more accurate in his forecasting than even the respected Nouriel Roubini, has said that the US and Europe will eventually default on their debt. He continues to advocate having a long term diversification in gold and sees the recent correction as a "great buying opportunity".

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.