Are US Treasury Bonds About to Rally or Implode? Part2

Interest-Rates / US Bonds Feb 17, 2010 - 09:14 PM GMTBy: Graham_Summers

Back in October I wrote a piece, Are US Treasuries About to Rally or Implode? At that time, I noted that the chart for long-term US debt was forming what could have either been a challenge to long-term support, or a potential head and shoulders pattern.

Back in October I wrote a piece, Are US Treasuries About to Rally or Implode? At that time, I noted that the chart for long-term US debt was forming what could have either been a challenge to long-term support, or a potential head and shoulders pattern.

The main idea was that the market was about to tell us whether or not investors considered US Treasuries a safe-haven anymore. If they did, long-term debt would rally. If they didn’t the potential head and shoulders pattern would be confirmed by a break below the “neckline” which would trigger a major sell-off.

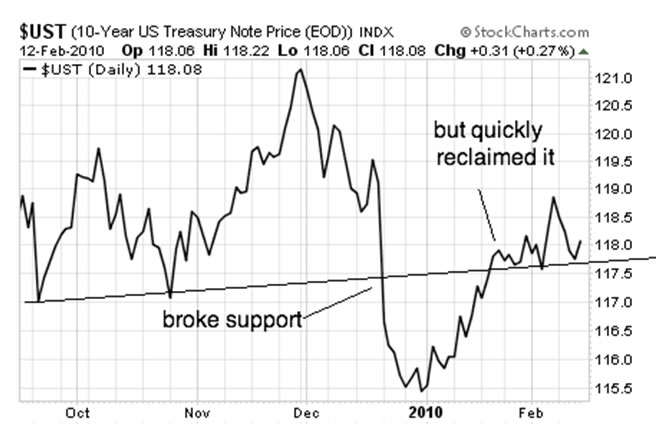

Well, we DID break support. Indeed, in late December it even looked like “neckline” for Treasuries had been violated. But then stocks took a nose-dive and investors plunged back into US debt as a safe haven.

Put another way, Treasuries did a head-fake. They lured the bears into believing that the neckline was violated and that US debt was about to collapse… but then quickly regained their support line, shredding the bears and re-asserting that despite our reckless monetary policy, investors still consider US debt to be a safe haven (if for no other reason than we have a money press and can simply print cash to insure the return “of” capital rather than a return “on capital; yes, this matters during a Crisis as 2008 proved).

So here we are in February and the exact same set-up has occurred. Once again Treasuries are bumping up against long-term support:

But they could be just as easily primed to break below their neckline:

Which will it be?

I can’t tell you (no one can). But given that demand for long-term US debt has fallen off a cliff (not to mention that China has actually open discussed potentially selling Treasuries) the potential for a “neckline” violation followed by a serious sell off (to 110 or lower) is higher than it was back in October.

However, we could just as easily see stocks take a nosedive which could precipitate a flight to safety that could push Treasuries back up to 122 again. Really the only thing to do here is wait and let the market dictate to us.

As I stated last month, Bonds, not Stocks will be the BIG Story of 2010. We’ve already seen the beginnings of a Crisis in the Euro. A Crisis in the Dollar is not out of the question. For those of you who take an abstract approach to your investment philosophies, the trend-line for long-term US bonds can be seen as representing the line of “confidence” in the US. If bonds fall below it, confidence has been lost and we may be witnessing a full-fledged flight from US debt (what the recent long-term bond auction seems to be warning).

Conversely, if bonds stay above this level, then we know investors are still willing to put their money with Uncle Sam if for no other reason than he has a printing press handy.

Forget Greece, forget the Euro, forget stocks. Keep your eyes on long-term US debt. It’s a proverbial “canary in a coal mine” for virtually every other investment class in the US. If long-term debt collapses, the Dollar is in trouble and stocks might temporarily rally (the ensuing spike in interest rates would quickly crush this though). However, if long-term debt rallies, the Dollar should jump and stocks/ commodities should take a serious hit.

In tomorrow’s essay I’ll detail where Gold fits into all of this. Gold of course is a commodity, but ultimately it’s a currency. The question is whether investors are really beginning to see this (a flight from paper money is underway) or if they still see Gold as some kind of anti-Dollar hedge and nothing else.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.