Money Flow Implications of 2011 U.S. Investor Tax Rates

Stock-Markets / Investing 2010 Feb 21, 2010 - 08:32 AM GMTBy: Richard_Shaw

To the extent that federal tax rates drive investor behaviors and money flows, and to the extent that 2011 federal tax rates simply revert to prior rates under “sunset” provisions; 2011 would be a year in which municipal bonds rise in relative appeal versus other debt instruments, and equity income declines in relative appeal versus stock capital gains.

To the extent that federal tax rates drive investor behaviors and money flows, and to the extent that 2011 federal tax rates simply revert to prior rates under “sunset” provisions; 2011 would be a year in which municipal bonds rise in relative appeal versus other debt instruments, and equity income declines in relative appeal versus stock capital gains.

It is entirely possible that Congress will do more that simply allow the current tax rates to expire under sunset rules, and instead create a new structure, which could be more burdensome or that could change the relative rates. Certainly the long-term history of federal taxes on investment income since they were made permanent in 1913, shows that Congress has frequently and sometimes massively changed taxation and relative incentives in both the upward and downward direction.

It is also possible that Congress may pass a securities transaction tax that is currently under some level of consideration. That would further change behaviors and money flows — basically toward longer-term holdings, and funds with lower turnover.

What we have to work with right now, though, is the assumption of the current rates expiring with prior rates returning.

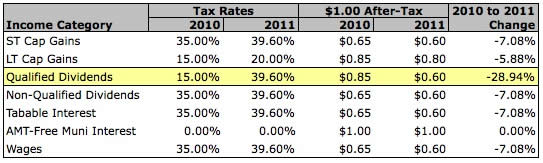

This table shows the 2010 and 2011 expected rates side-by-side, and the after-tax amount (before state and local taxes) retained by investor for $1.00 of income from various investment sources, and the percentage change in the after-tax amount under the expected new law.

Muni bonds and muni bond funds (such as MUB) will become approximately 7% more attractive than taxable bonds or bond funds (such as BND) — of course, excluding credit risk issues.

The change in after-tax retention for short-term capital gains and for non-qualified dividends (see note) will a bit more unfavorable than for long-term gains. However, the change in relative after-tax retention for qualified dividends will be significantly greater and unfavorable than for all other types of investment vehicles.

Other factors may overwhelm the tax issues, but in isolation the new tax laws are bound to change money flows and thereby returns by type of investment.

In 2010, the after-tax remainder (before state and local taxes) on $1.00 of qualified dividend income is $0.85, but that becomes $0.60 in 2011 (approximately a 29% reduction in after-tax amount); whereas long-term capital gains go from an $0.85 after-tax amount to an $0.80 after-tax amount (an approximate 6% reduction).

Will that shift investor money flow from equity income toward capital gains positioning of portfolios? Would a fund such as SDY (S&P 500 Dividend Aristocrats) suffer relative to a lower yielding aggregate index such as SPY (the S&P 500 index). Or will lower yielding growth funds (such as IVW, for the S&P 500 Growth index) become relatively more attractive than higher yielding value funds (such as IVE, for the S&P 500 Value index)? Will dividend oriented investments that are best placed in taxable accounts in 2010, be shifted to tax-free or tax-deferred retirement accounts in 2011?

Note: Non-qualified dividends come from companies in some countries (essentially those without reciprocal tax agreement with the US) and certain other kinds of domestic companies, such as REITs, limited partnerships and royalty trusts.

Lastly, will Congress decide that the change in relative appeal of dividends versus capital gains would create the wrong incentive or burden the wrong people? If that were to happen, Congress might increase capital gains rates to maintain more of the level playing field between equity income investing and capital gain pursuits that we have today. Alternatively, Congress could scale back the tax rate on dividends to keep the playing field more level.

For most of tax history in the US, capital gains have been highly favored, whereas dividends have been fully taxable at ordinary rates at times, and fully tax exempt at other times. Dividends have been on a tax seesaw.

From 1971 -1981 dividends were actually taxed at a higher rate than wages; and for 36 of the first 40 years of income tax since 1913, dividends were totally exempt from federal taxes. Today, New Hampshire and Tennessee, for example, tax investment income, but not wage income. Punishing capital, or punishing equity income relative to capital gains has historical and current precedent.

In our opinion, the relative rates should be closer than 20% and 39.6% as a matter of fairness to the older investors who tend to favor dividends more than younger investors, and to avoid the tendency of the expected rates to favor companies retaining earnings and potentially dissipating them on executive compensation, monumental campuses or ill-conceived developments or acquisitions. We favor companies sharing the cash profits with the people who own the company, and then raising capital in the debt or equity markets for projects that exceed their internal funding capabilities.

In the same way that we favor more investor representation and investor perspective on corporate boards, we favor more investor participation in the cash profits of the companies they own. Whether or not arguments can be made for overall tax efficiency of earnings retention by companies, we think corporate management needs to be under greater investor control. Putting more of the cash profits in the hands of company owners whose trust and confidence must be continuously earned and renewed for reinvestment, is one way to create more investor control.

Questions about how changes in tax rates will likely change investor behavior and money flows to various types of investments are important for investors to evaluate as we approach the next tax regime.

Holdings Disclosure:

As of February 19, 2010, we own SDY, MUB, and BND in some, but not all managed accounts. We do not have current positions in any other securities discussed in this document in any managed account.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.