Gold Bugs, Curing the Addiction and Acquiring some Patience

Commodities / Gold and Silver 2010 Feb 22, 2010 - 11:10 AM GMTBy: J_Derek_Blain

Gold Bugs have a die-hard sense of expectation that is akin to waiting for the Toronto Maple Leafs to win the Stanley Cup (NHL championship). It just bloody never seems to happen, and though you start the season with some sense of hope, you realize partway through that there’s no friggin’ way it’s going to happen this time.

Gold Bugs have a die-hard sense of expectation that is akin to waiting for the Toronto Maple Leafs to win the Stanley Cup (NHL championship). It just bloody never seems to happen, and though you start the season with some sense of hope, you realize partway through that there’s no friggin’ way it’s going to happen this time.

And yet you cling to that hope, year after year, and before you know it, it’s been 43 years since sweet victory - and the last time there was one, peace and love, long hair and a widespread disdain for the invention commonly known as the razor were a widespread societal phenomena.

Now, gold did not win the Stanley Cup in 1967, nor can I recall it ever picking up a hockey stick in its multi-thousand-year use in human history. However, it did win a championship, back in 1980 when it made an inflation-adjusted high (based on dec-2009 dollars) of $2,398.14. Silver fared even better, with an inflation-adjusted-high of $250.00 per ounce.

Gold now sits down roughly 50% from that high, in real terms - its championship run. And what a run! That put gold a moon-shot and a half above its previous average purchasing power all the way back to the early 1700’s. That massive spike in sentiment in which so many people ran to the metals is what many are counting on to propel the price to new nominal highs in the coming months. I think we’ve covered what that psychology does to the eventual price of assets.

When you ask a gold bug how much gold should be today, you get as many different answers as there are gold bugs, with only one thing in common – “higher than it is today”.

One major mental note to make on this chart is that the price of gold was in a very long-term downtrend for well over 200 years.

This chart is measured in dollars and thus is also representative of a fixed (or relatively fixed) dollar supply, minus certain wartime eras of fiat money accounting for some of those smaller, near-vertical, post-fiat returns to gold. So what you are actually looking at is essentially a long-term growth in productive capacity of the United States where industrial output and the volume of goods and services was increasing steadily per person. Thus, money over time could buy more stuff, which is what happens when real money is used.

That wonderful blue box where prices seem to start going zany is about when the good ol’ Federal Reserve stepped into the batting cage to manage the most intrinsic part of any economy – its unit of exchange.

Two things have essentially happened since the Federal Reserve’s Frankenstein-creation in 1913 – the first is that the entire world has been absolutely flooded by US Dollars. Trillions upon trillions of dollars are out there, all created via some form of debt and given “intrinsic” value by the fact that they are universally accepted and that they are legal tender (claimable in court).

The second is that the massive and continual flooding and increase in money has done what all long-term fractional reserve banking ventures do – they start lending to the good, capital-producing folks first. Then, when those folks are borrowed up to the hilt, the FRB system turns its sites on individual consumers using mortgages and other forms of credit. Finally, when the best of those are all lent up to the hilt, the quality of lender decreases again and again, until finally everyone with a first and last name, and being fully clothed, who appears in a bank is given a massive amount of credit-created fiat currency with which to do whatever their hearts desire.

But this process can only go on for so long. Eventually, the smartest of these folks wise up to the debt burden and, against the wishes of all their “betters” (you know, the demigods in charge of managing the economy), begin to do something that very few of the living have even seen.

They begin to pay off their debt faster than they take out new debt. The positive psychology towards debt turns negative very quickly. It usually takes a loss of some kind, say in real estate and stocks, as in the Post-Roaring-20’s era. People realize that using credit to speculate is dangerous, that paying interest and principal on something worth less than their credit bought for is like contractual slavery. The first and most savvy of these folks start erasing their debt in earnest.

Meanwhile, the dead, who have lived through deflation before, shake their heads in pity for what is about to unfold.

Just as, on the way up, the rush is to take on as much credit and get into the stock game, or house game, or commercial property game, as soon as possible, the rush is to get the hell out as soon as you can before you’re holding the bag.

That rush has not yet truly begun. It has been temporarily shimmied into a structure of seeming stability by those economic managers who think they have a chance in hell of stopping the rush. They don’t. When the collective market turns on them they will be swept away in the tsunami along with the crowd they are trying to trick into falling asleep.

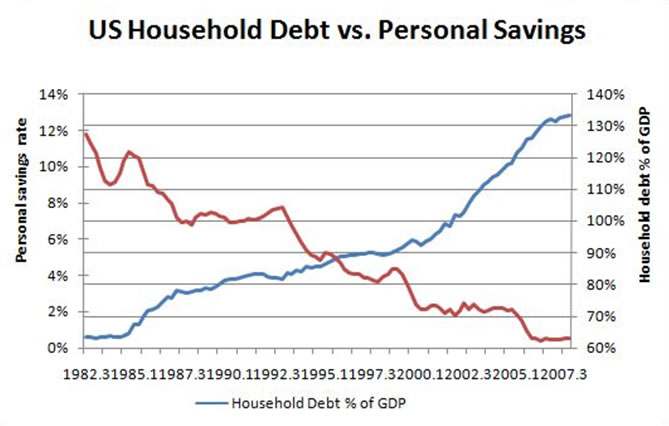

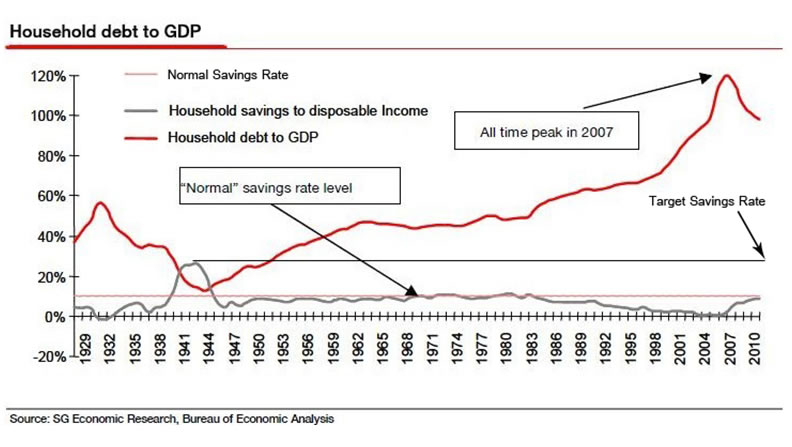

Savings rates will be in the double digits again before this deflationary period is over, a most likely a lot higher than the 12% it was sitting at in 1982. Household debt’s share of GDP will first skyrocket as economic output decreases (if you discount government spending, which just makes matters worse anyway, it has already skyrocketed), before falling rapidly to a level less than half of where it stands today.

Another reason the Gold Bugs will have to hold out just a little longer to break-even on their 1980 splurge in the PM’s, and that generation long wait for redemption.

People aren’t going to “flee” to gold and silver just yet – you can’t pay off debt in gold and silver, the banks won’t take it. Try asking your employer to pay you in gold and silver coins instead of dollars – not happening. And with today’s unemployment numbers the way they are, most people are willing to not only get paid in FRN’s, but far less than they were a few years ago.

No, Gold Bugs, there are still some major hurdles to be overcome before a real return to gold and silver can happen. The catalyst, to this writer’s eyes, is going to be that point when about as much of that private debt has been paid off and written down, and those malinvestments reallocated, so the only ones left holding the bag are… guess who?

You know it – your friendly, neighborhood “I’m from the government, and I’m here to help!” collective body commonly known as the State. When the majority is out there and free of the debt shackles, and the State is left with the bulk of the liability, that’s when the people should finally wake up and tell those folks to eat it.

In the meantime, psychology is still extremely elevated toward the metals as a capital gains asset - Psychology that should be unwound along with everything else, so the market can pick its money when the time is right.

And if history tells us anything, there is a good bet that at least one of the PM’s will be waiting nearby to take up that role.

By J. Derek Blain

© 2010 Copyright J. Derek Blain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.