Still Living in a U.S. Dollar Centric World

Currencies / US Dollar Feb 24, 2010 - 12:59 AM GMTBy: Justice_Litle

Abstract: For all its fatal flaws, the $USD is still king of the hill – and for now at least, the focus of investor optimism has shifted to the United States.

Abstract: For all its fatal flaws, the $USD is still king of the hill – and for now at least, the focus of investor optimism has shifted to the United States.

With apologies to Mark Twain, the dollar’s death has been greatly exaggerated. We can see this with a simple glance at the $USD chart below.

This is not to say the dollar is healthy, of course. Its demise will come in due time.

“That which cannot go on forever must stop,” as someone both wise and dry-witted once said, and the current arrangements certainly qualify. The United States cannot go on forever rampantly abusing its privileges as printer of the world’s reserve currency. Similarly, China cannot go on amassing further mountains of dollars in its Smaug-like vaults.

But for now, we still live in a dollar-centric world.

For all its recent drama, the euro has been dubbed “the anti-dollar” for the manner in which it trades as a mere foil to the king. To add insult to injury, the brewing Greek meltdown has put paid to any real notion of the euro as a viable world reserve currency.

The other main pretender to the throne, the Japanese yen, looks dodgy too – a currency better suited to renting than truly owning. (Who could sit comfortably with such awe-inspiring levels of debt on their shoulders, not to mention the latent threat of hyperinflation?)

The Fed Giveth, and the Fed Taketh Away

On Thursday after market close, the Federal Reserve gave futures markets a jolt with its announcement of a rise in the discount rate – the rate charged on short-term loans made directly to banks.

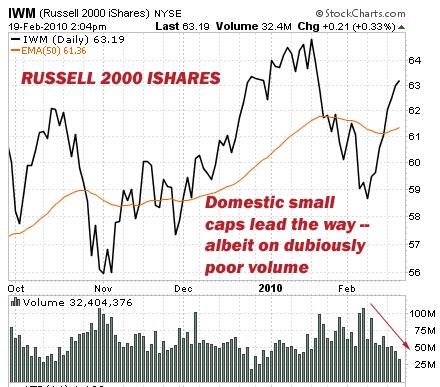

Fed Chairman Bernanke went out of his way to stress that policy would remain accommodative – that this was just a “baby step” – and after some initial fear and confusion, investors seemed to take him at his word. (Financials and small caps are up, albeit on vanishingly low volume, on Friday afternoon as your editor writes these words.)

Whether the Fed’s move is a “big deal” or not, though, a clear psychological shift is taking place. Like a frog in a pan of heated water, investors are slowly getting used to the idea that interest rates will have to rise.

It was China that gave the markets a jolt in January with its aggressive tap on the fiscal brakes. Now, with a little more finesse, the Fed is telegraphing the same intent. This dawning reality is further bolstering the dollar.

Made in the U.S.A.?

Another interesting twist: As of this writing, the world seems to be embracing a narrative of relative economic recovery in the United States. Befitting the dollar’s rise, money has been flowing out of emerging market equities... and presumably back into American coffers.

We can see this sentiment shift both anecdotally and in the charts.

Technically speaking, the Russell 2000 small cap index has seen the most impressive thrust among the major indices (albeit on weak volume). The countertrend rallies in emerging market stalwarts like the Brazil iShares (EWZ:NYSE) and the Xinhua China 25 (FXI:NYSE) have been truly weak beer in comparison.

The chart observations are further confirmed by data from EFPR Global, a fund flow research firm, who reports that emerging market fund outflows hit a 60-week high (!) in the first week of February.

In plain English, that means investors got shed of emerging market assets in more aggressive fashion this month than any prior period since fall 2008, when the global financial crisis was in full swing. (Your editor imagines Greece had something to do with it.)

Pinball Rules Still Apply

For those of you wondering how the $USD and small caps can be rallying against a truly horrifying “real economy” backdrop that resembles Mad Max Beyond Thunderdome... remember, again, that on the one hand there is “top down” and on the other there is “bottom up.”

A feature of the times seems to be cause for U.S.-based optimism on the “bottom up” side, coupled with a range of blithe excuses to ignore the looming dangers of the “top down” side. Rather than being administered evenly, jolts of reality are administered in sharp “forced awareness” bursts, which lets them be put aside by the forever hopeful for varying intervals of time.

Source: http://www.taipanpublishinggroup.com/taipan-daily-022210.html

By Justice Litle

http://www.taipanpublishinggroup.com/

Justice Litle is the Editorial Director of Taipan Publishing Group, Editor of Justice Litle’s Macro Trader and Managing Editor to the free investing and trading e-letter Taipan Daily. Justice began his career by pursuing a Ph.D. in literature and philosophy at Oxford University in England, and continued his education at Pulacki University in Olomouc, Czech Republic, and Macquarie University in Sydney, Australia.

Aside from his career in the financial industry, Justice enjoys playing chess and poker; he enjoys scuba diving, snowboarding, hiking and traveling. The Cliffs of Moher in Ireland and Fox Glacier in New Zealand are two of his favorite places in the world, especially for hiking. What he loves most about traveling is the scenery and the friendly locals.

Copyright © 2010, Taipan Publishing Group

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.