Major War Coming Between Union Parasite "Haves" and Non-union "Have-Nots

Politics / Demographics Mar 01, 2010 - 12:34 PM GMTBy: Mike_Shedlock

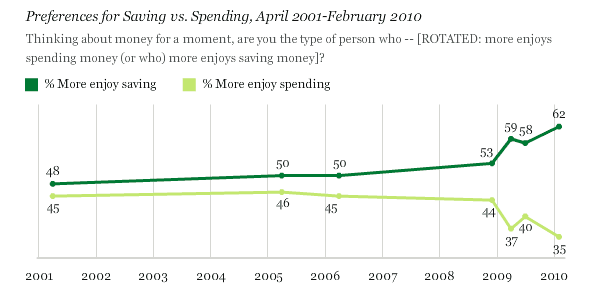

Perhaps by necessity, perhaps by desire, but most likely by both, An increasing percentage of Americans say they more enjoy saving than spending.

Perhaps by necessity, perhaps by desire, but most likely by both, An increasing percentage of Americans say they more enjoy saving than spending.

The recession and financial crisis have resulted in a significant change in the way many Americans feel about spending and saving. Six in 10 Americans (62%) now say they more enjoy saving than spending -- while 35% say the reverse. This reflects a shift that began in December 2008 and a marked change from the first half of the decade, when Americans were about evenly split regarding whether they more enjoyed spending or saving.

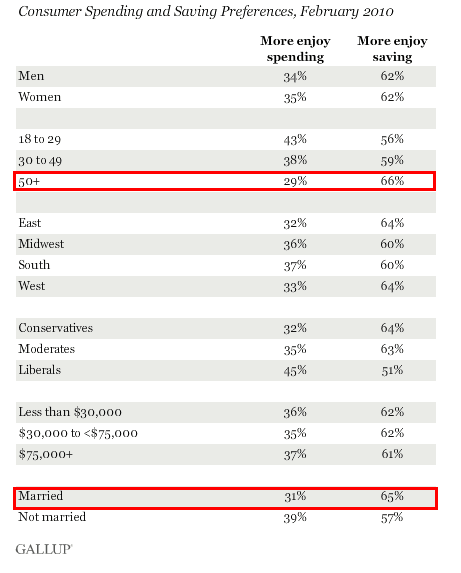

Demographics

Changing Consumer Psychology

Essential to the "go forward" economic outlook is whether consumer spending will return to pre-recession levels or reflect a "new normal" spending pattern. The significant shift to saving in American preferences, as opposed to spending, suggests an important change in consumer psychology. Most likely, this change in consumer preferences results from the severity of the recession, the financial crisis, many Americans' severe loss of wealth in their homes and investments, and the significant change in the availability of credit throughout the economy.

At the same time, many consumers also say their spending behavior has changed. More than half of the nation's consumers across socioeconomic groups say they are continuing to spend less, despite the claims of many economic observers that things are getting better and recovery is underway. Two-thirds of consumers who are spending less -- and 38% of all Americans -- say their current reduced level of spending is their new, normal spending pattern. And significant percentages of Americans across all major demographic groups say this is their new normal.

Further, Gallup's continuous tracking of consumer spending behavior in early 2010 shows that consumers are actually doing as they say by spending at a new-normal level -- consistent with their 2009 spending, and much lower than their spending at the beginning of the recession in 2008.

Peak Boomer Spending Is In Rear View Mirror

The key takeaway is that consumers are saying they will spend less and actually do so. 38 percent say that spending less is the new pattern. I expect that percentage to jump.

Look at those areas I circled in red. Boomers have tossed in the towel on spending. Peak income, and purchasing ability is highest for those 45-60. Salaries are peaking and the kids have moved out of the house (perhaps in this economy starting to move back home).

No doubt boomers are headed into retirement scared half to death about not having saved enough. In general, that demographic is downsizing, not buying new boats. Peak boomer spending has come and gone. It is only visible in the rear view mirror.

Birds Return To The Nest

At the other end of the working age ladder, students are coming out of college, hundreds of thousands of dollars in debt, with no way to pay those loans back.

Think they are about to go on huge spending sprees? Many will delay family formation and buying of houses. Some, fresh out of college with no job are moving back home.

I'm Sure Glad The Recession Ended

All of this is a much needed deleveraging, and yet another reason why cash strapped states are going to remain cash strapped for a long time. Sales tax revenue coming out of this recession is not going to jump as it has out of previous recession.

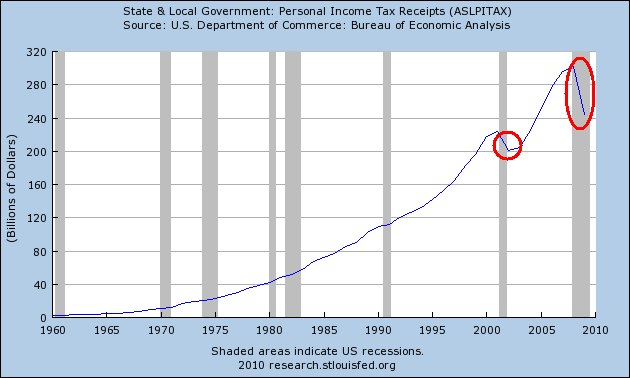

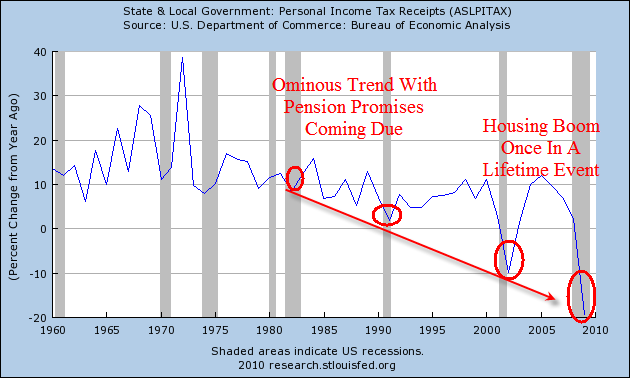

Here are two of the seven charts from I'm Sure Glad The Recession Ended.

State Income Tax Receipts

State Income Tax Receipts Percent Change From Year Ago

If you believe retail sales are going up because of government reports on Advance Sales, then please think again.

You owe it to yourself to read Retail Sales Rise: Where? Let's Take a Look; Expect Nothing Less Than Panic.

After you click on and read the above link, take a good hard look at that last chart and ponder the implications in regards to union salaries, school budgets, pension promises, medical benefits, etc.

Next think about what the massive wave of boomer retirements might do to boomer spending habits and future tax revenue.

Next think about the implications on consumer spending habits were tax hikes attempted to cover any shortfalls.

....

At some point retail sales and tax levels will stabilize, but it will not be at a level that will support rising wages for public unions, or even current benefits promised to public workers via defined benefit pension plans.

A major war is coming between the union parasite "haves", and the non-union "have-nots", the latter already forced to live in the real economy.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.