China's Main Currency Reserve "Not Likely" to Be Gold

Commodities / Gold and Silver 2010 Mar 09, 2010 - 06:29 AM GMTBy: GoldCore

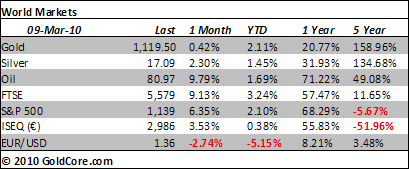

Gold dipped sharply in US trading yesterday from $1,136/oz to $1,118.50/oz before closing down 1% to $1,120/oz. Gold also fell in pounds, euro and Swiss francs but remains near record nominal highs in these currencies. Gold rose to $1,123/oz so far in Asian trading and is currently trading at $1,119.50/oz and in euro and GBP terms, it is trading at €825/oz and £749/oz respectively.

Gold dipped sharply in US trading yesterday from $1,136/oz to $1,118.50/oz before closing down 1% to $1,120/oz. Gold also fell in pounds, euro and Swiss francs but remains near record nominal highs in these currencies. Gold rose to $1,123/oz so far in Asian trading and is currently trading at $1,119.50/oz and in euro and GBP terms, it is trading at €825/oz and £749/oz respectively.

Receding eurozone debt fears saw US equities maintain last week's gains but equity markets in Asia were mixed and have fallen in this morning's European trade.

China's growing financial and economic power was seen yesterday when the head of China's foreign exchange administration, which manages the country's $2,400bn in foreign exchange reserves, said that gold is "not likely" to be the country's main reserve investment. The Director of the State Administration of Foreign Exchange, Yi Gang, said that China's main tool in its diversification agenda would not be gold - "it is, in fact, impossible for gold to become a major investment channel for China's foreign exchange reserves." Gold had already fallen some 1% prior to the announcement and the gold was flat after his comments.

Gang highlighted what is already known by markets - that the gold market is tiny in terms of total currency value when compared to the massive value of all currency and bond markets internationally. While the gold mining supply is increasing at a small 1.5% per annum, money supply internationally is growing extremely rapidly as debt monetization, quantitative easing and near zero interest policies continue. China's gold reserves are miniscule when compared to their huge foreign exchange holdings. The Chinese currently hold 1,054 tonnes which are just 1.5% of official reserves.

Chinese officials are on record on numerous occasions stating their intent to increase China's gold reserves and Chinese citizens have been encouraged on Chinese state television to invest in gold and silver. Selectively, Mr Gang said that gold was not a good investment over a 30 year period. He thus, ignored how gold has outperformed most investments over a 5, 10 and even a 40 year investment horizon. Mr Gang's comments may be an effort to talk gold down and ensure China secures gold at competitive prices in the coming months.

Given the recent diplomatic tension between the US and China there is an important geopolitical dimension to this story that bears watching. It could also be interpreted as a diplomatic warning to the US financial authorities that they expect US monetary economic policies to be responsible and that the vast Chinese holdings not be devalued. Gang said that China does "not want to politicise [these investments] ... We are a responsible investor and in the process of these investments we can definitely achieve a mutually beneficial result."

Chinese diversification into gold will continue but the Chinese will continue to do so under the radar and will not broadcast their intentions for fear of driving up gold prices and then having to chase the market. However, were geopolitical tensions to continue escalating between the US and China, then the Chinese could use the gold market as a form of economic leverage with the US.

Silver

Silver reached as high as $17.22/oz this morning in Asia. Silver is currently trading at $17.09/oz, €12.55/oz and £11.41/oz.

Platinum Group Metals

Platinum is trading at $1,596/oz and palladium is currently trading at $472/oz. Rhodium is at $2,550/oz.

News

Oil fell in Asian trade today amid fading exuberance over better than expected US jobs data. New York's main contract, light sweet crude for April delivery, was off 45 cents to $81.42 a barrel. Brent North Sea crude for April delivery eased 42 cents to $80.05.

German Chancellor Angela Merkel has warned of the hurdles facing the new EMF. Radical plans for a European version of the International Monetary Fund to bail out crisis-hit countries would need a new treaty and the agreement of all European Union member states, she warned.

The lessons from the current crisis and previous crises suggest that failure to address long overdue reform challenges promptly might result in a "lost decade" for the global economy, Jürgen Stark, the chief economist of the European Central Bank (ECB) said on Monday.

The US Congressional Budget Office has warned of the surging US national debt. If President Obama's 2011 budget were put into effect as proposed, the U.S. federal government would add an estimated $9.8 trillion to the country's accrued debt over the next decade, according to a preliminary analysis from the Congressional Budget Office. Of that amount, an estimated $5.6 trillion will be in interest alone. By 2020, the agency estimates debt held by the public would reach $20.3 trillion, or 90% of GDP. That's up from 53% of GDP in 2009. These numbers are a stark illustration of the long term challenges facing the dollar and serve to underline why the Chinese are likely to continue gradually diversifying into gold.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.