Gold Under Pressure as Equities Fall and CFTC Investigates Market Manipulation

Commodities / Gold and Silver 2010 Mar 11, 2010 - 06:26 AM GMTBy: GoldCore

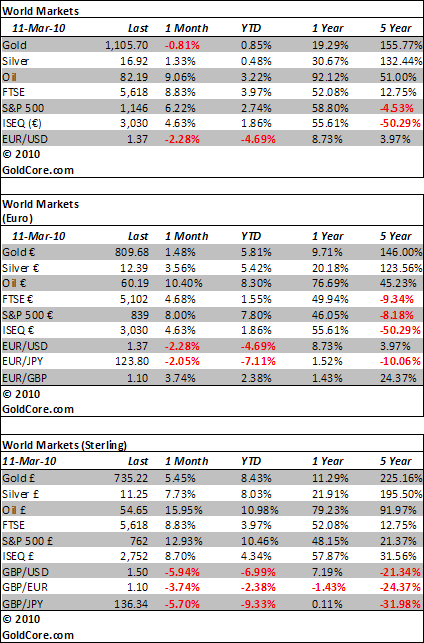

Gold fell sharply in a short period of time yesterday in US trading - falling from $1,127.35/oz to $1,103.45/oz to close with a loss of 1.26%. It has range traded from $1,105/oz to $1,109/oz so far in European trading this morning. Gold is currently trading at $1,105.70/oz and in euro and GBP terms, gold is trading at €811/oz and £739/oz respectively. Oil at over $82 a barrel would be expected to lead to inflation hedging buying but is not supporting gold today.

Gold fell sharply in a short period of time yesterday in US trading - falling from $1,127.35/oz to $1,103.45/oz to close with a loss of 1.26%. It has range traded from $1,105/oz to $1,109/oz so far in European trading this morning. Gold is currently trading at $1,105.70/oz and in euro and GBP terms, gold is trading at €811/oz and £739/oz respectively. Oil at over $82 a barrel would be expected to lead to inflation hedging buying but is not supporting gold today.

Yesterday's sell off confused traders as there was no ostensible reason for the sharp sell off as there was no corresponding move in the equity, oil, dollar and currency markets. There is speculation that a large fund may have liquidated a position. Allegations of manipulation, due to concentrated short positions on the COMEX, continue. The Commodity Futures Trading Commission (CFTC) continue to investigate these allegations and these investigations bear watching. The CFTC is holding a public meeting on March 25th to discuss speculation limits in US precious metal futures.

Gold has found support at the $1,105/oz level but should it fall below this level we could see it fall quickly to support at $1,090/oz. Bargain hunters and value buyers have emerged at this price level.

Europe's main stock markets have weakened after the unconvincing gains yesterday on Wall Street. Investors are evaluating the latest economic data and company news and many seem happy to sit on the fence for the moment.

Concerns about the euro and other currencies and the growing risk of the emergence of inflation should see gold remain buoyant. Also, there are growing concerns about the continuing declines being seen in commercial property internationally and worries that this could lead to a new chapter in the economic crisis.

The Financial Services Authority (FSA) in the UK has sounded an alarm about the prospect of a meltdown in commercial property. Announcing much tougher stress tests for banks, the Financial Services Authority raised concerns that they are not setting aside enough to cover losses on the sector. In its overview of the financial risks facing Britain this year, the FSA said about £160 billion of UK commercial property debt would mature over the next five years. German housing completions fell to the lowest level in at least 50 years in 2009. While declines in the US real estate market have slowed recently, given the slow pace of economic recovery it seems quite likely that there will be another period of falling prices.

Continuing concerns about property markets internationally should lead to continuing safe haven demand for gold.

Silver

Silver has slowly risen from $16.85/oz this morning in Asia. Silver is currently trading at $16.98/oz, €12.42/oz and £11.32/oz.

Platinum Group Metals

Platinum is trading at $1,588/oz and palladium is currently trading at $458/oz. Rhodium is at $2,550/oz.

News

New figures show that Japan's economy grew by less than initially estimated in the fourth quarter of 2009, adding to pressure on the Bank of Japan to ease monetary policy further next week. Reports say the BOJ is leaning towards doing exactly that at its policy meeting on March 16-17. Deputy finance minister Yoshihiko Noda said today that he wanted to attend the BOJ's meeting next week, and that he believed the BOJ has a sense of crisis.

There are increasing hopes that Dubai World's creditors will not have to incur any losses on the principal debt as a result of the conglomerate's $26bn restructuring. Representatives of Dubai World are meeting some of its banks this week to discuss the outlines of a restructuring plan and there are reports of progress being made.

Chinese economic data released overnight showed rising inflation and reignited tightening concerns. Chinese consumer price inflation jumped to a 16-month high in February, while a raft of economic data displayed broad strength. CPI increased by 2.7% vs last month's 1.5% increase, while PPI grew by 5.4% vs January's 4.3% gain.

Australia's employment change was worse than expected in February and rose to 5.3%.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.