Federal Reserve Rising Interest Rates Positive for Gold?

Commodities / Gold and Silver 2010 Mar 16, 2010 - 06:47 AM GMTBy: GoldCore

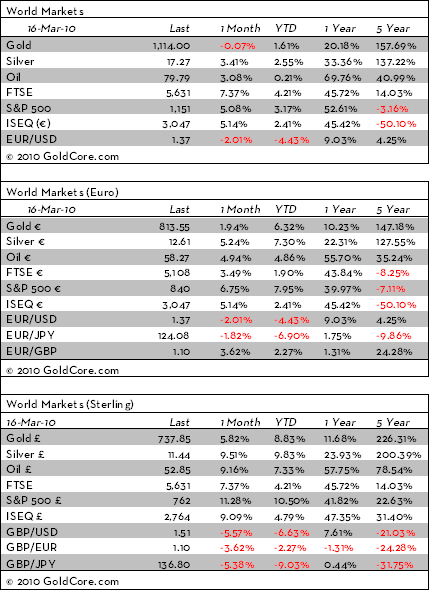

Gold dipped to $1,101.15/oz in early US trading before recovering to close with a gain of 0.37% despite continuing dollar strength. It rose in Asian trading and has range traded from $1,109/oz to $1,113.50/oz so far in European trading this morning. Gold is currently trading at $1,114.00/oz and in euro and GBP terms, gold is trading at €813/oz and £739/oz respectively.

Gold dipped to $1,101.15/oz in early US trading before recovering to close with a gain of 0.37% despite continuing dollar strength. It rose in Asian trading and has range traded from $1,109/oz to $1,113.50/oz so far in European trading this morning. Gold is currently trading at $1,114.00/oz and in euro and GBP terms, gold is trading at €813/oz and £739/oz respectively.

Gold may challenge resistance at $1,119/oz and above that is resistance at $1,128/oz. Technical support is at $1,100/oz and recent action is leading to increasing confidence that gold will remain above the psychological level of $1,000/oz for the foreseeable future.

Asian equity markets were mixed but Eu rope's have gotten off to a positive start. Markets await the Federal Reserve rates decision and FOMC statement later today and they should provide direction. Debate is heating up within the Federal Reserve over how and when to signal that the days of record-low interest rates are numbered. Federal Reserve Chairman Ben Bernanke and his colleagues may soon communicate subtly that higher rates are coming once the economic recovery is on a firmer footing. There is a growing realization that Fed policymakers will soon need to start increasing rates to head off inflation and protect the value of the dollar and the US' credit rating.

In the short term an increase in interest rates could be negative for gold. But, in the medium to long term rising interest rates are likely to be positive for gold as they were in the 1970s. When interest rates return to more normal levels (above 5%) then gold would be vulnerable to a correction as savers and bondholders become enticed by higher yields.

We are a long way from there yet and gold is likely to be correlated with rising interest rates and only fall towards the end of the interest rate hiking cycle. It is worth remembering that the 1970s gold bull market only ended with interest rates close to 20%. Also rising interest rates are not positive for equities and property and volatility and or further falls in these asset classes could lead to further safe haven demand for gold.

Silver

Silver has range traded from $17.14/oz to $17.28/oz this morning in Asia. Silver is currently trading at $17.27/oz, €12.61/oz and £11.46/oz.

Platinum Group Metals

Platinum is trading at $1,626/oz and palladium is currently trading at $465/oz. Rhodium is at $2,535/oz.

News

Prime minister Gordon Brown has been warned by the European Commission to take more action to reduce Britain's soaring debt burden, according to early drafts of Brussels' latest assessment of the UK's finances. The European Commission reports comes just a week before the pre-election Budget, which will be dominated by the size of the UK's debts and how they are going to be cut. The EC's main concern is official growth forecasts may be too optimistic and they also warn regarding the size of the UK government's support for the banks.

Crude oil is stable just below $80 after falling some 2% yesterday. OPEC may be able to leave output unchanged for 2010 if the global economic recovery continues and the oil market remains well balanced according to Saudi Arabia's oil minister.

Japan's central bank began a two-day monetary policy meeting today amid speculation it may announce fresh emergency measures to spur an economic recovery hobbled by deflation and weak demand. The Bank of Japan is widely expected to hold interest rates unchanged at 0.1% - a rock-bottom rate it has kept since December 2008, during the worst of the global financial crisis - to keep credit flowing in the economy.

Europe's finance ministers have agreed how to help Greece in its battle to control its finances. After a meeting in Brussels, they revealed few details, except that they had ruled out any loan guarantees.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.