Euro Gold Up 0.45% as Euro Falls on Concerns over Greece and Portugal

Commodities / Gold and Silver 2010 Mar 24, 2010 - 08:17 AM GMTBy: GoldCore

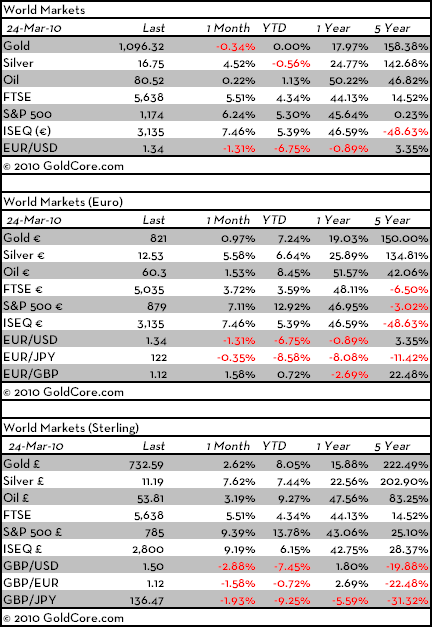

Gold closed at $1104.15/oz in New York, gaining 0.4% on the day; it also advanced in Asian trading this morning. Gold has fallen in USD terms and is currently trading at $1,094.62/oz and remains firm in EUR and GBP terms at €820.06/oz & £730.87/oz respectively.

Gold closed at $1104.15/oz in New York, gaining 0.4% on the day; it also advanced in Asian trading this morning. Gold has fallen in USD terms and is currently trading at $1,094.62/oz and remains firm in EUR and GBP terms at €820.06/oz & £730.87/oz respectively.

Risk aversion has increased in the course of the morning with European equities giving up earlier gains. The euro has again fallen against the dollar and gold due to doubts about rescuing debt laden Greece and now about another eurozone economy Portugal. US stock futures and European equities have fallen after Fitch slashed its view on Portugal creating renewed concerns about European debt problems.

Investors are worried that eurozone leaders may not come up with a rescue package for Greece at the eurozone summit. Germany signaled for the first time the previous day that it may accept European financial aid for Greece but only if the IMF was involved and eurozone partners accept tougher budget discipline rules.

There is a growing realisation that even if Greece is bailed out that there are other daunting challenges facing other eurozone economies such as Ireland, Spain, Italy and Portugal. Not to mention the similar problems facing most US states and many economies internationally. In the US, 48 out of 50 states face budget shortfalls in 2010 and even larger shortfalls are projected for 2011. California's shortfall alone, is almost $52 billion, a huge 56% of the state's general fund budget. Arizona, Nevada, Illinois, New York and New Jersey are not far behind in terms of significant fiscal challenges.

The panacea of massive bailouts and debt monetisation may only prove effective in the short term and investors with a more long term horizon are looking to the inflation protecting qualities of gold.

Market players will keep an eye on the Commodity Futures Trading Commission (CFTC) day-long hearing tomorrow. The hearing is to determine whether it needs to write a rule to create speculative position limits for gold, silver and copper markets to prevent price manipulation. Gold and silver investors who believe governments and banks artificially depress precious metals prices are expected to ask the commission to prevent concentrated positions by one or two banks and thus prevent price manipulation in metals markets. Commissioners will hear from banks and hedge funds who oppose position limits and are expected to argue that limits will drive trade to unregulated or overseas markets.

Silver

Silver closed at $16.98/oz, showing a gain of about 0.4% on the day. Silver is currently trading at $16.71/oz, €12.52/oz and £11.16/oz.

Platinum Group Metals

Platinum is trading at $1586/oz, palladium at $450/oz and rhodium at $2300/oz.

News

Gold imports into India are seen at 23-28 tonnes, vs 4.8 tonnes a year ago, according to the head of the Bombay Bullion Association. This is robust demand considering how sensitive India is to the gold price and shows India is becoming accustomed to gold above $1,000/oz.

The British Chancellor of the Exchequer Alastair Darling today presents his last budget before the general election, which is due in a few weeks' time. Mr Darling is expected to tell the House of Commons that the British economy is showing signs of recovery and that the Labour government will stick to its target for reducing the budget deficit. Recent data has showing receipts up, unemployment down, and borrowing scaled back, has led some to suggest that Darling's budget may be a larger fiscal opportunity than seemed. This would be a mistake as the UK is facing a very serious fiscal situation and an imprudent budget could lead to further sharp falls in the value of sterling and consequent further rise in gold in sterling terms.

Oil prices fell to just below $81.00 a barrel Wednesday in European trade after a report showed a larger-than-expected jump in U.S. crude inventories last week. Benchmark crude for May delivery was down to $80.80 a barrel by mid morning in Europe. The contract gained 31 cents to settle at $81.91 a barrel on Tuesday.

The European Economic and Monetary Affiairs Commissioner said this morning that the EU risked causing a ‘serious disruption’ if a decision on Greece was not made this week, keeping Euro gold close to recent record nominal highs.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.