Stock Market Buyers Beware

Stock-Markets / Stock Markets 2010 Mar 24, 2010 - 03:04 PM GMTBy: Toby_Connor

The rally off the February bottom is now going on 32 days. This is probably not the best time to chase stocks higher. I’ve been saying for a couple of weeks that the market needs to take a breather, preferably before earnings season as it would then be setup for a strong rally through April.

The rally off the February bottom is now going on 32 days. This is probably not the best time to chase stocks higher. I’ve been saying for a couple of weeks that the market needs to take a breather, preferably before earnings season as it would then be setup for a strong rally through April.

As the “normal” cycle in stocks lasts on average 35-45 days trough to trough we are now getting very deep in the cycle and in jeopardy of putting in a short term top at any time. We just need a catalyst to halt this incredible momentum move.

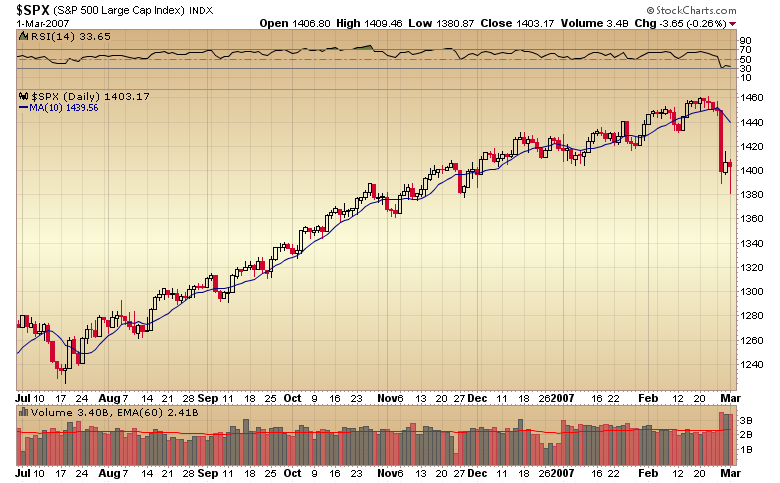

I’ve been expecting a runaway move to develop as this rally progressed but this is starting to turn into a parabolic move. Since the February bottom the market has ended higher 68% of the past 32 days and hasn’t closed below the 10 day moving average in over a month.

Compared to the runaway move in 06/07 which averaged 57% up days it’s apparent this rally is getting very overheated.

The leading tech sector is also becoming rather stretched. At $3.00 above the 50 day moving average it’s now in the range that has marked the tops of previous daily cycles.

Not to mention the Nasdaq 100 is only 12 points away from major resistance.

And the SPYDER’s are now bumping up against the declining 200 week moving average.

I doubt they will be able to penetrate and hold above this level on the first try.

I suspect the catalyst will come from the same area it came from in January, another leg up in the dollar.

The breakout above 81 today gives pretty good odds that the dollar will now be heading up to test the pivot at 83. That should be an ending move for the current intermediate stock cycle. The expectation would then be for stocks to rally hard for the next four or five weeks as the dollar works its way down into an intermediate low in early to mid May.

I expect the markets to hang in reasonably well during the impending correction, possibly filling the March 5th gap. Once the dollar begins the trip down we should see an explosive move in stocks and commodities, possibly the final surge higher in this third leg of the cyclical bull market.

I’m expecting the correction in stocks will also correspond to the final leg down in what now looks to be a D-wave decline in gold that will most likely test the $1000-$1025 level. The left translated character of the current daily cycle is also confirming this.

That should be followed by a powerful A-wave advance as the dollar moves down into its intermediate cycle low.

For now the best strategy is to sit patiently and wait for the dollar to rally up into resistance at the 83 level and the market to move down into the cycle low. Once that happens we should have a fairly low risk entry for long positions in almost any asset class as the dollar works its way down into the intermediate cycle low.

Toby Connor

Gold Scents

A financial blog with emphasis on the gold bull market.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.