Crude Oil Reaches Seasonal Peak While Natural Gas Begins Its Climb

Commodities / Crude Oil Aug 14, 2007 - 11:53 AM GMTBy: Donald_W_Dony

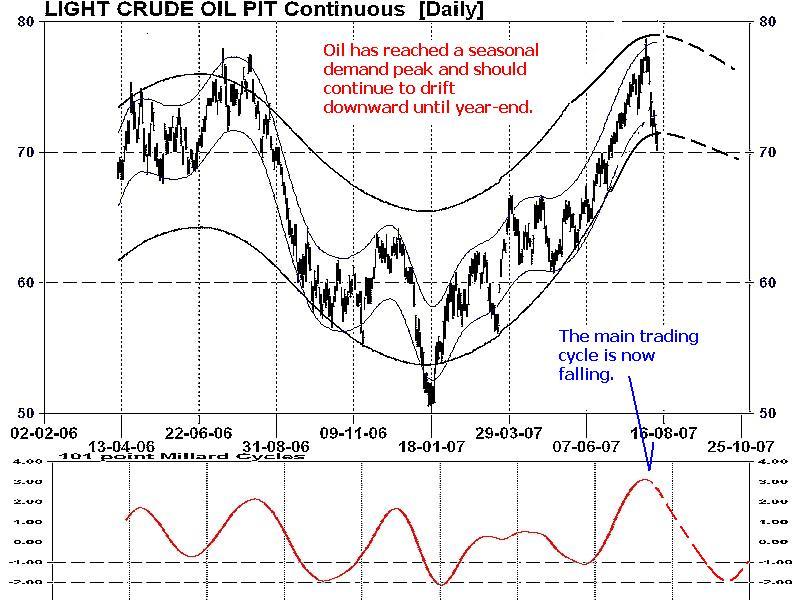

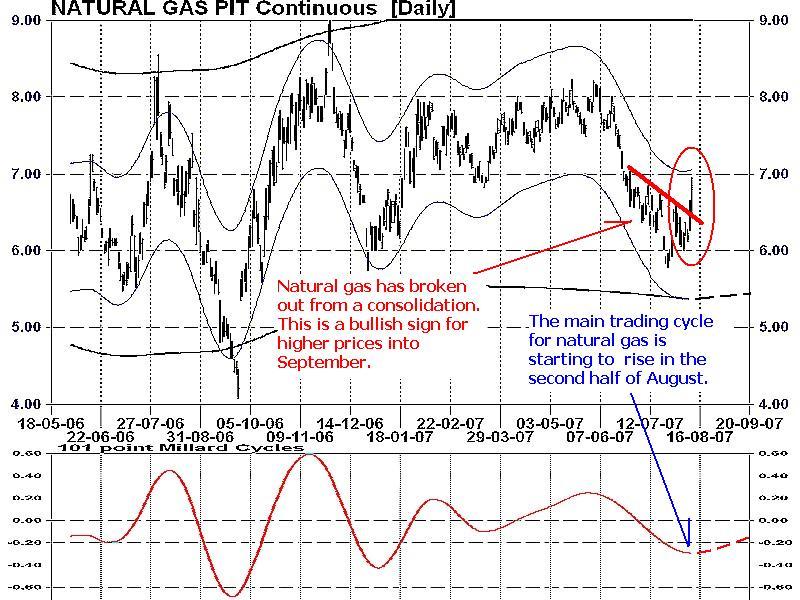

The normal annual demand forces for oil have reached a crest again. Mid-year driving pressures, which usually peaks in between early August to as late as mid-October, has forced this commodity once more to roar over $78 in early August in similar fashion to last year. Oil then follows a typical path of drifting downward to a low late in the 4th quarter. Natural gas, on the other hand, begins to escalate upwards during this time and tops in October to December depending on winter weather.

The normal annual demand forces for oil have reached a crest again. Mid-year driving pressures, which usually peaks in between early August to as late as mid-October, has forced this commodity once more to roar over $78 in early August in similar fashion to last year. Oil then follows a typical path of drifting downward to a low late in the 4th quarter. Natural gas, on the other hand, begins to escalate upwards during this time and tops in October to December depending on winter weather.

Oil (Chart 1) is expected to develop downward pressure over the next several months. The first key level of support is at $69 which should provide short-term propping in early September. $65 and $62 are also important price support lines as seasonal demand begins to ease.

Natural gas, which is mainly utilized as a home heating fuel, has recently found solid support at $5.80-$6.00 (Chart 2). As fall and winter approaches, greater demand lifts this commodity from a normal seasonal bottom in August-September to a peak in the 4th quarter. Greater buying pressure in late August and recent price movement point to the likelihood of higher gas prices over the next few weeks and the start of the seasonal advance. Two key overhead prices levels may offer resistance; they are $7.00 and $8.10. As the extent of the seasonal run in natural gas is heavily dependent on weather conditions, the percentage of growth is often difficult to predict. However current fundamental and technical data suggests $8.00-$8.50 should be the peak.

INTERMARKET REACTION: Weakening oil prices have historically been favourable to the stock market and consumer spending. This observation usually applies when the peak in the commodity is early in the business cycle as is the current case. Lower fuel costs normal spill over to equal additional consumer purchases. Inflationary pressures are also temporarily reduced which again bodes well for advancing investor confidence.

MY CONCLUSION: Natural gas securities can be expected to have higher performance over the next few months. It is important for investors to remember that the annual top in natural gas can arrive as early as late October or as late as early January. Weather conditions are the key that defines demand.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.