America and China, the Next Major War

Economics / Global Economy Mar 27, 2010 - 04:17 PM GMTBy: Clif_Droke

In the current phase of relative peace and stability we now enjoy, many are questioning when the next major war may occur and speculation is rampant as to major participants involved. Our concern here is strictly of a financial nature, however, and a discussion of the geopolitical and military variables involved in the escalation of war is beyond the scope of this commentary. But what we can divine from financial history is that “hot” wars in a military sense often emerge from trade wars. As we shall see, the elements for what could prove to be a trade war of epic proportions are already in place and the key figures are easily identifiable.

In the current phase of relative peace and stability we now enjoy, many are questioning when the next major war may occur and speculation is rampant as to major participants involved. Our concern here is strictly of a financial nature, however, and a discussion of the geopolitical and military variables involved in the escalation of war is beyond the scope of this commentary. But what we can divine from financial history is that “hot” wars in a military sense often emerge from trade wars. As we shall see, the elements for what could prove to be a trade war of epic proportions are already in place and the key figures are easily identifiable.

Last Wednesday the lead headline in the Wall Street Journal stated, “Business Sours on China.” It seems, according to WSJ, that Beijing is “reassessing China’s long-standing emphasis on opening its economy to foreign business….and tilting toward promoting dominant state companies.” Then there is Internet search giant Google’s threat to pull out of China over concerns of censorship of its Internet search results in that country.

The trouble started a few weeks ago Google announced that it no longer supports China’s censoring of searches that take place on the Google platform. China has defended its extensive censorship after Google threatened to withdraw from the country.

Additionally, the Obama Administration announced that it backs Google’s decision to protest China’s censorship efforts. In a Reuters report, Obama responded to a question as to whether the issue would cloud U.S.-China relations by saying that the human rights would not be “carved out” for certain countries. This marks at least the second time this year that the White House has taken a stand against China (the first conflict occurring over tire imports).

Adding yet further fuel to the controversy, the U.S. Treasury Department is expected to issue a report in April that may formally label China as a “currency manipulator,” according to the latest issue of Barron’s. This would do nothing to ease tensions between the two nations and would probably lead one step closer to a trade war between China and the U.S.

Then there was last week’s Wall Street Journal report concerning authorities in a wealthy province near Shanghai criticizing the quality of luxury clothing brands from the West, including Hermes, Tommy Hilfiger and Versace. This represents quite a change from years past when the long-standing complaint from the U.S. over the inferior quality of Chinese made merchandise.

On Monday the WSJ ran an article under the headline, “American Firms Feel Shut Out In China.” The paper observed that so far there’s little evidence that American companies are pulling out of China but adds a growing number of multinational firms are “starting to rethink their strategy.” According to a poll conducted by the American Chamber of Commerce in China, 38% of U.S. companies reported feeling unwelcome in China compared to 26% in 2009 and 23% in 2008.

As if to add insult to injury, the high profile trial of four Rio Tinto executives in China is another example of the tables being turned on the West. The executives are by Chinese authorities of stealing trade secrets and taking bribes. There’s a touch of irony to this charge considering that much of China’s technology was stolen from Western manufacturing firms which set up shop in that country.

It seems China is flexing its economic and political muscle against the West in a show of bravado. Yet one can’t help thinking that this is exactly the sort of arrogance that typically precedes a major downfall. As the Bible states, “Pride goeth before destruction, and an haughty spirit before a fall.”

In his book, “Jubilee on Wall Street,” author David Knox Barker devotes a chapter to how trade wars tend to be common occurrences in the long wave economic cycle of developed nations. Barker explains his belief that the industrial nations of Brazil, Russia, India and China will play a major role in pulling the world of the long wave deflationary decline as their domestic economies begin to develop and grow. “The are and will demand more foreign goods produced in the United States and other markets,” he writes. Barker believes this will help the U.S. rebalance from an over weighted consumption-oriented economy to a high-end producer economy.

Barker adds a caveat, however: if protectionist policies are allowed to gain force in Washington, trade wars will almost certainly erupt and. If this happens, says Barker, “all bets are off.” He adds, “The impact on global trade of increased protectionism and trade wars would be catastrophic, and what could prove to be a mild long wave [economic] winter season this time around could plunge into a global depression.”

Barker also observes that the storm clouds of trade wars are already forming on the horizon as we have moved further into the long wave economic “winter season.” Writes Barker, “If trade wars are allowed to get under way in these final years of a long wave winter, this decline will be far deeper and darker than necessary, just as the Great Depression was far deeper and lengthier than it should have been, due to growing international trade isolationism.

He further cautions that protectionism in Washington will certainly bring retaliation from the nations that bear the brunt of punitive U.S. trade policies. He observes that the reaction from one nation against the protectionist policies of another is typically far worse than the original action. He cites as an example the restriction by the U.S. of $55 million worth of cotton blouses from China in the 1980s. China retaliated by cancelling $500 million worth of orders for American rain. “As one nation blocks trade, the nation that is hurt will surely retaliate and the entire world will suffer,” writes Barker.

Barker comments that a major trade conflict between the United States and some of its trading partners may be inevitable due to the protectionist tendency of the current Congress. “When the world plunges deeper into the long wave decline and barriers are thrown up everywhere to protect ailing industries that have expanded beyond world demand for their goods with expensive debt,” writes Barker, “the situation could force major changes.”

Sounding an optimistic note he concludes, “Let us hope that leadership emerges that can take a trade crisis during this long wave winter to produce sweeping positive changes in the form of new free trade agreements for the global trading system. It is possible that we maintain free and open markets and go in the direction of greater free trade for the next long wave advance, since we are only a few years away.”

There seems to be an emerging consensus among investors that China is “decoupling” from the West and has developing its own domestic markets to the point where it needs no longer to rely on export growth to the U.S. for its economy strength. As debatable as this prospect is (and there are valid arguments on both sides), our main focus is on the financial outlook for China. Two things stand out. The first is that the iShares China 25 Index Fund (FXI), our proxy for the China stock market, has been notably lagging the recovery in the U.S. broad market S&P 500 index in the past few months. While the U.S. stock market has recently made an 18-month high, shares of Chinese companies as measured by FXI are still below their previous high from November 2009.

What’s interesting to note is that not only has there been a decoupling from the U.S. stock market, but the China stock market has been closely correlated to movements in the price of gold, especially in the last several months. Comparing the FXI to the SPDR Gold Trust ETF (GLD), a proxy for the gold price, the similar trajectories can be easily seen. China’s appetite for gold is well known and until its near term financial condition improves it’s likely that the gold price will move more or less in harmony with China’s stock market, as has been the case in recent months.

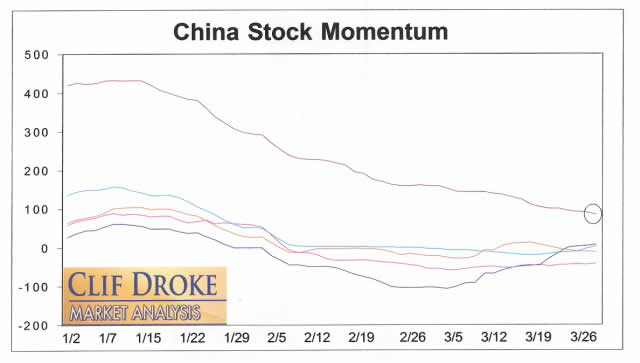

Another observation is that the China stock internal momentum indicator series (CHINAMO) is showing far less internal strength than the broad market NYSE index shown above. Moreover, the dominant longer-term indicator for the China stocks (circled) has been in a sustained decline for the past few months. This is reminiscent of what the long-term NYSE hi-lo momentum index looked like in 2007 heading into the credit crisis. Beyond a short-term rally, which is possible based on the near term internal rate of change for China shares, the longer-term momentum structure for Chinese stocks is troubling. Unless it shows substantial improvement in the weeks and months ahead, it could set the stage for further trade disputes. As we observed in last week’s commentary, prolonged trading ranges always elicit the worst sort of emotions among investors. Governments are no more immune to the negative psychological effects of financial market stagnation than individual investors.

It’s evident that as much as China’s internal markets are developing, that nation is still heavily reliant on the U.S., whether it wants to formally admit it or not. For this reason, a trade war between the two nations would prove catastrophic and one can see how a trade war between these two economic titans could easily escalate into something far more destructive. Touching on this issue in his latest book, “The Ascent of Money,” author Niall Ferguson asks, “Could anything trigger another breakdown of globalization like the one that happened in 1914 [leading to World War I]? The obvious answer is a deterioration of political relations between the United States and China, whether over trade, Taiwan, Tibet or some other as yet subliminal issue.”

He further comments, “Scholars of international relations would no doubt identify the systemic origins of the war in the breakdown of free trade, the competition for natural resources or the clash of civilizations….Some may even be tempted to say that the surge of commodity prices in the period from 2003 until 2008 reflected some unconscious market anticipation of the coming conflict.”

This brings us to the crux of the matter, namely, when can we expect to see the chimera of war rear its ugly head (or heads) once again? In my recent book on the Kress Cycles, “The Stock Market Cycles,” I identified the Kress 24-year cycle as the War Cycle since it’s bottoming has always coincided with a major outbreak of war. The latest 24-year cycle is scheduled to bottom in 2014 along with the Master Cycle of 120 years. The final “hard down” phase of any cycle is always the last 8-12% of the cycle’s length. This means that we can most likely expect to see an eruption of major war sometime in the latter part of 2011 to the year 2012, up until the cycle bottom in 2014. The last of the major yearly cycles, namely the 6-year cycle, will peak in later 2011. This should afford the global economy with more time to rest and recuperate from the effects of the late credit crisis and build up their war chests before the next “big one” begins. Now is the time to fear a sudden outbreak of war, which is unlikely just yet. Instead, it’s a time for the small investor to take advantage of the final “peace phase” by focusing on opportunities in the financial markets as they continue to emerge in this recovery.

Cycles

Over the years I’ve been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few books on cycles that are available, most don’t even merit mentioning. I’ve read only one book in the genre that I can recommend – The K Wave by David Knox Barker – but even that one doesn’t deal directly with stock market cycles but instead with the economic long wave. I’m pleased to announce, however, that after nearly 10 years of research and one year of writing, I’ve completed a book on the subject that I believe will meet the critical demands of most cycle students. It’s entitled, The Stock Market Cycles, and is available for sale at:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.