U.S. Stock Market Returns, What's in Store?

Stock-Markets / Stock Markets 2010 Mar 30, 2010 - 01:33 AM GMTBy: John_Mauldin

It has been some time since we have looked at stock market valuations and expected future returns. I made a large point in Bull's Eye Investing that long term returns are closely correlated with the valuation of the stock market upon entry. In fact, I argue that secular bull and bear markets should be viewed in terms of valuation and not prices. The market clearly goes from high valuations to low and back to high again over very long periods of time. The average length of a secular bull or bear cycle is 17 years.

It has been some time since we have looked at stock market valuations and expected future returns. I made a large point in Bull's Eye Investing that long term returns are closely correlated with the valuation of the stock market upon entry. In fact, I argue that secular bull and bear markets should be viewed in terms of valuation and not prices. The market clearly goes from high valuations to low and back to high again over very long periods of time. The average length of a secular bull or bear cycle is 17 years.

Based on valuations, we are still in a secular bear market. But clearly we are in a bull phase, which within long term secular bear cycles are quite normal. They make for good trading opportunities. But should you invest now with a view to holding for 10-20 years?

This week's Outside the Box from my friend Prieur du Plessis of Plexus Asset Managment looks at what long term return expectations might be from today's stock market valuations. He offers us a range of expectations which I think should help you in your investment decision making process.

I am on my way back to Dallas from a quick trip to Washington DC. The cherry blossoms are beautiful, even if the weather is gray.

John Mauldin, Editor

Outside the Box

--------------------------------------------------------------------------------

US stock market returns – what is in store?

By Dr. Prieur du Plessis

Surging stock markets since the lows of March 2009 have caught most investors by surprise, especially as new pieces of the economics puzzle are not always rosy and do not quite seem to support an overly bullish case. In short, investors are increasingly struggling to make sense of the most likely direction of stock prices.

Are we perhaps nearing the end of a cyclical bull phase in a structural bull market? Or will strong earnings growth ensure the longevity of the bull? Or is a "muddle-through" trading range in store? It seems to be a case of so many pundits, so many views.

It is one thing to trade the market's rallies and corrections, but this is easier said than done, with not many people actually getting it right with any degree of consistency. Others are of the opinion that the recipe for creating wealth is simply to follow the patient approach, saying that "it's time in the market, not timing the market" that counts. But "buy-and-hold" investors in the S&P 500 Index are still 25.5% down from the levels of 10 years ago, the Dow Jones Industrial Index a similar 23.5% lower and the Nasdaq Composite Index a massive 52.5% under water.

This gives rise to the all-important question: does one's entry level into the market, i.e. the valuation of the market at the time of investing, make a significant difference to subsequent investment returns?

In an attempt to cast light on this issue, my colleagues at Plexus Asset Management have updated a previous multi-year comparison of the price-earnings (PE) ratios of the S&P 500 Index (as a measure of stock valuations) and the forward real returns (considering total returns, i.e. capital movements plus dividends). The study covered the period from 1871 to March 2010 and used the S&P 500 (and its predecessors prior to 1957). In essence, PEs based on rolling average ten-year earnings were calculated and used together with ten-year forward real returns.

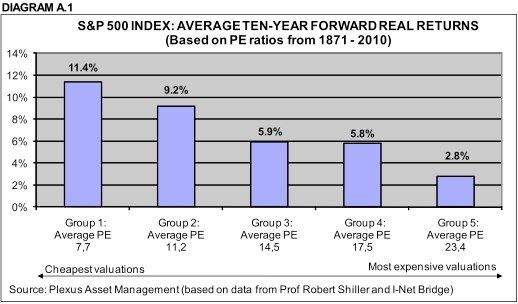

In the first analysis the PEs and the corresponding ten-year forward real returns were grouped in five quintiles (i.e. 20% intervals) (Diagram A.1).

The cheapest quintile had an average PE of 7.7 with an average ten-year forward real return of 11.4% per annum, whereas the most expensive quintile had an average PE of 23.4 with an average ten-year forward real return of only 3.8% per annum.

This analysis clearly shows the strong long-term relationship between real returns and the level of valuation at which the investment was made.

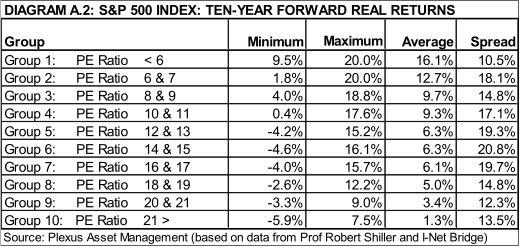

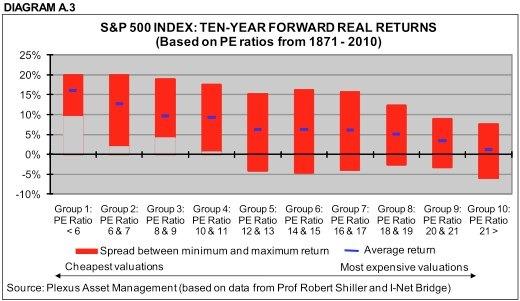

The study was then repeated with the PEs divided into smaller groups, i.e. deciles or 10% intervals (see Diagrams A.2 and A.3).

This analysis strongly confirms the downward trend of the average ten-year forward real returns from the cheapest grouping (PEs of less than six) to the most expensive grouping (PEs of more than 21). The second study also shows that any investment at PEs of less than 12 always had positive ten-year real returns, while investments at PE ratios of 12 and higher experienced negative real returns at some stage.

A third observation from this analysis is that the ten-year forward real returns of investments made at PEs between 12 and 17 had the biggest spread between minimum and maximum returns and were therefore more volatile and less predictable.

As a further refinement, holding periods of one, three, five and 20 years were also analyzed. The research results (not reported in this article) for the one-year period showed a poor relationship with expected returns, but the findings for all the other periods were consistent with the findings for the ten-year periods.

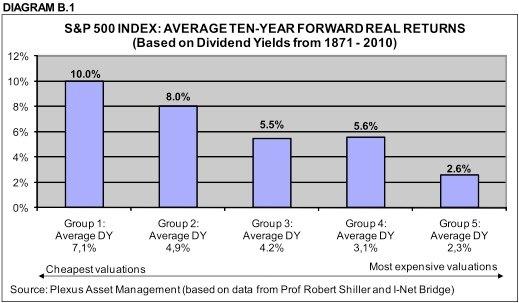

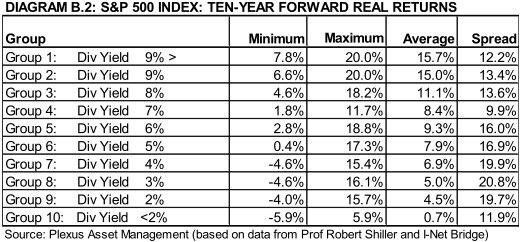

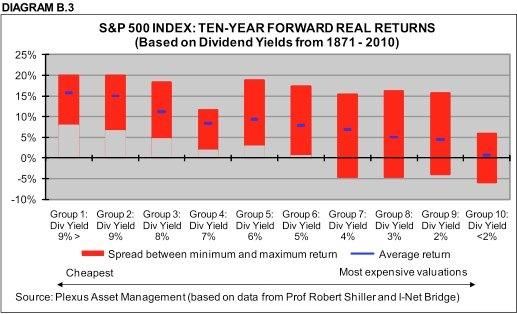

Although the above analysis represents an update to and extension of an earlier study by Jeremy Grantham's GMO, it was also considered appropriate to replicate the study using dividend yields rather than PEs as valuation yardstick. The results are reported in Diagrams B.1, B.2 and B.3 and, as can be expected, are very similar to those based on PEs.

Based on the above research findings, with the S&P 500 Index's current ten-year normalized PE of 20.3 and ten-year normalized dividend yield of 2.1%, investors should be aware of the fact that the market is by historical standards expensive. As far as the market in general is concerned, this argues for unexciting long-term returns, possibly a "muddle-through" trading range for quite a number of years to come.

Although the research results offer no guidance as to calling market tops and bottoms, they do indicate that it would not be consistent with the findings to bank on above-average returns based on the current ten-year normalized valuation levels. As a matter of fact, there is a distinct possibility of some negative returns off current price levels.

* Dr Prieur du Plessis is chairman of Cape Town-based Plexus Asset Management and author of the Investment Postcards from Cape Town blog: http://www.investmentpostcards.com (Subscribe to e-mail updates of new articles by clicking on "Subscribe to Updates" in the top right-hand corner of the blog site and providing an e-mail address.)

John Mauldin

Editor, Outside the Box

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.