Why You CANNOT Re-Flate an Economy or Stock Market

Stock-Markets / Stocks Bear Market Apr 01, 2010 - 03:07 AM GMTBy: Graham_Summers

I constantly receive emails asking me why I’m bearish with stocks breaking to new highs. The simple answer to this question is that I’m not bearish, I’m a realist. Stocks haven’t made a cent of money in over ten years.

I constantly receive emails asking me why I’m bearish with stocks breaking to new highs. The simple answer to this question is that I’m not bearish, I’m a realist. Stocks haven’t made a cent of money in over ten years.

I know what you’re thinking, “Graham’s just pointing out that the S&P 500 is still down from its 1999 levels.”

True, stocks haven’t made money in a decade in nominal terms. But the above chart is only half the story. Check out what happens to stocks when you measure the S&P 500’s performance in Gold:

What you’re looking at is an 80%+ loss in purchasing power if you kept your money in stocks since 2000. Now, I know that many investors will see this chart and say “So WHAT? I price my wealth in Dollars, not Gold. So stocks priced in Gold mean nothing to me.”

This viewpoint is flat out wrong. Whether or not you want to admit it, in order to calculate the WEALTH you’ve generated from investing in stocks, you HAVE to account for the Dollar’s moves as a currency.

Think of it this way. Let’s say you measured your height with a standard ruler one morning and found out that you were six feet tall. Now let’s say that during the following night your ruler magically shrank to only 10 inches (though it still claimed it measured a full 12-inch foot). The next day you’d measure yourself and discover that according to your ruler you were now over seven feet tall.

Did you REALLY grow taller in one day? Of course, not, you are merely measuring your height with a small ruler.

Well, measuring your stock portfolio in US Dollars is like claiming you’ve grown because your ruler shrinks: it is an illusion. After all, the Dollar has lost roughly 30% of its value since 2000.

This currency devaluation, when combined with the generalized flight from paper money that has occurred as illustrated by Gold’s incredible performance over the last ten years, shows quite clearly that those who remain heavily invested in the stock market have not only missed out on the best performing asset of the decade (Gold), but have actually lost some 80%+ of their wealth in terms of actual purchasing power.

This is the set-up for a serious “check-mate” to ALL of Alan Greenspan/ Ben Bernanke’s efforts to re-flate the economy/ stock market after the Tech Bubble burst. After all, if you could really create wealth by printing money and keeping interest rates below the rate of inflation, everyone in the US would be rich instead of barely scraping by.

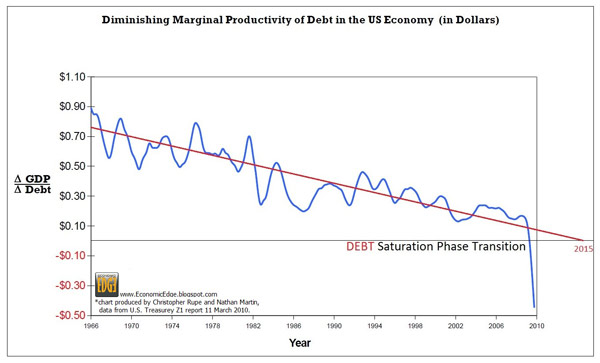

However, the finishing move that “checkmate’s” the Fed’s policies is shown in the below chart courtesy of Nathan’s Economic Edge:

Nate explains:

This is a very simple chart. It takes the change in GDP and divides it by the change in Debt. What it shows is how much productivity is gained by infusing $1 of debt into our debt backed money system.

Back in the early 1960s a dollar of new debt added almost a dollar to the nation’s output of goods and services. As more debt enters the system the productivity gained by new debt diminishes. This produced a path that was following a diminishing line targeting ZERO in the year 2015. This meant that we could expect that each new dollar of debt added in the year 2015 would add NOTHING to our productivity.

However, as you’ll note, a funny thing has occurred in the last year: the blue line revealing ACTUAL increase in productivity per each new $1 in debt issuance suddenly tanks. The reason?

Because incomes are falling while debt issuance is soaring, we’ve officially reached the point where we cannot support our existing debt. Thus, each new $1 in debt issuance now acts as a net DRAG on the productivity of the US.

Folks, I’ve said it a thousands times, but printing money and issuing more debt CANNOT solve a debt problem. It doesn’t matter how clever your explanations or theories are: wealth CANNOT be made with the printing press.

On that note, not only has Greenspan/Bernanke’s money printing actually DESTROYED any and all wealth generation from stocks in the last ten years (again, we’re down 80% when you price stocks in a non-fiat currency), but we have now reached the point where each new dollar in debt issuance is acting as a net DRAG on the US economy.

At this point, any talk of Economic Recovery or Bull Markets is completely meaningless. I repeat, stocks are NOT UP in over ten years time. In fact, in tomorrow’s essay I’m going to show you that despite a 60-70% rally, stocks are actually LOWER in value now than they were during the Crash of 2008.

Until Then…

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.