The Long Wave (aka The K Wave) “Jubilee” Cycle

Stock-Markets / Cycles Analysis Apr 01, 2010 - 11:06 AM GMT A Special Update for Market Oracle Readers

A Special Update for Market Oracle Readers

Announcing the Updated and Expanded edition of The K Wave (1995) as Jubilee on Wall Street (2009)

The long wave debate rages on. Meanwhile, the global debt berg, the chief product of crony state capitalism, has begun to block the profligate paths of listing ships of state. The confident captains of crony state capitalism are at the helm, sailing into the foggy financial abyss of cascading sovereign debt defaults. The growing black hole of sovereign debt threatens to pull the global economy into its collapsing vortex, the quintessential black swan event. Coming out the other side of the black hole of collapsing debt beyond 2012, we suspect the world will be a very different place. A new golden age will dawn.

In various articles published here at The Market Oracle, the writings and interpretations of the work of Russian economist Kondratieff (1892-1938) have received both praise and excoriation. The fact is that long wave’s advocates and enemies rarely understand the complex forces of the great global long wave cycle. This article will suggest that the remarkable clarity and value that a correct understanding of the long wave brings to global market analysis, and even technical market analysis, is more relevant today than ever before.

At its deepest level, the long wave is a cycle of the ebb and flow of global corporate efficiency. Trends that go too far and then reverse in innovation, scarcity, overcapacity and debt produce the ebb and flow of inflation and deflation in producer and consumer prices that drive the cycle. The study of cycles is the study of trends. The global stock market trends on top of these deeper economic trends are simply market manifestations of the underlying economic reality of the long wave.

When you strip out the noise, and look at a real data chart that presents the ebb and flow of corporate efficiency on a major equity index chart, adjusted for inflation, with the long wave start date labeled correctly, your jaw drops. You suddenly see the Kondratieff long wave in stunning and sometimes terrifying detail, with all its implications.

Without a clear understanding of the start date of the current long wave, relevant analysis is a hopeless and lost cause, as recent pundits have demonstrated. Credit goes to Robert Prechter for first identifying the start date of the current long wave as 1949. We agree with his analysis since real data charts make this case with such clarity. A recent article on The Market Oracle from a respected analyst attempted to debunk the value of the long wave perspective. However, by using an inaccurate start date, such naysayer’s arguments against the long wave are less than meaningless.

Market analysis is really about pattern and trend recognition. Criticism of long wave analysts when they only use “idealized” charts that do not present real data are justified. In our work at LongWaveDynamics.com we prefer to use real data charts, along with an accurate understanding of the true nature of the long wave. As evidence, we offer Exhibit A below.

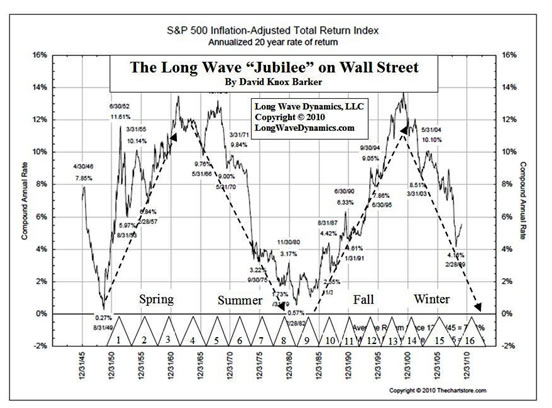

A few real data charts rise above the others to illustrate the most compelling evidence for the long wave. The inflation adjusted 20-Year rate of return on the S&P 500 is just such a chart. The ebb and flow of the long wave and its seasons jump off the page. This chart is the total return chart, i.e. dividends are included. This chart strips out much of the short-term economic and market noise, providing an undistorted view of how stock investments actually perform over the ebb and flow of the long wave. The patterns are overwhelming. Not only do the long wave and the long wave seasons pop out of this chart, but also if you look close enough, you can even see the Kitchin cycles (aka business cycles).

Harvard’s economist Joseph Schumpeter, author of Business Cycles, stumped market analysts, including yours truly, for years with his model of 18 Kitchin cycles in every long wave. It was not until PQ Wall corrected Schumpeter’s error and presented new analysis showing there are actually only 16 business cycles in a long wave that the smaller cycle confusion began to clear up, specifically as they relate to the long wave. Once you understand the accurate long wave Kitchin cycle count and the relevance of the distinction for the smaller cycles, a new world of technical analysis opens up to you.

There have been a number of references to my earlier book, The K Wave (1995), in articles posted on The Market Oracle. This book represented the last public writing on the Kondratieff long wave by this author. In that edition, written some 15 years before the current global financial crisis, charts demonstrated business cycle #16 and the current long wave ending its global decline into 2009. The book also forecast that accompanying the end of the long wave would be collapsing global stock markets, deflation, an international banking crisis, a global real estate bust, a global debt bust, and a crisis of capitalism, with advocates of socialist solutions reemerging during the crisis. The book has generated renewed interest in our methods of long wave and smaller cycle analysis due to the accuracy of such forecasts. When used prices topped $1,000 last year, work on a new edition accelerated, since it appeared to be offering some value to readers. A new edition of the book has been released as, Jubilee on Wall Street (2009). Advance copies were available in late 2009, and the final new edition is now available. The new book updates interested readers on our approach to long wave dynamics and cycle analysis.

Global financial markets are now at the point where the cycles are getting interesting, and highly relevant to your financial survival and returns as an investor or trader. No one would be happier with having nailed the bottom of the long wave in 2009 than this author; it would have been a great call from 15 years out to tell the grandchildren about. Except that I don’t have any grandchildren yet, and unfortunately, you must now be informed that close analysis of the smaller cycles, suggests a different and disturbing debt driven scenario.

Instead of the end of the long wave winter in 2009 which would have sufficiently purged old debt and produced a new long wave beginning, driven by emerging markets, it appears as if aggressive government intervention and central bank policies greatly expanded the last Kitchin cycle. Artificially low interest rates, zero money down and other such foolish pollical buffoonery produced the housing bubble, and turned Kithchin cycle #15 into the bubble cycle. Government foisted aggressive policies on the global economy and markets, trying to stop the natural long wave forces at work in a disinflationary and deflationary long wave winter season. They have only made it worse; kicking the long wave debt reckoning can down the road a bit. Jay Forrester, MIT professor and founder of System Dynamics, in a speech in 2003, laid out this outcome. By the way, for long wave naysayers System Dynamics at MIT has validated the long wave’s existence and the power of its impact on the global economy.

Government intervention and stimulus served to expand the smaller cycles in the long wave. We could have already been entering a new long wave spring season by now, powered by innovation and billions of new participants in the emerging markets of the BRICs and other emerging countries. We do expect emerging markets to blunt this final down leg of the long wave winter. However, instead of a new global long wave boom, we now suspect we are presently only on the front of the final Kitchin cycle of the long wave winter. This is not a good. The current regular business cycle is primarily an inventory build cycle. Government piled trillions of dollars, euros, yuan, yen, etc. in new debt on top of the old debt to juice the system one last time. The sovereign debt strategy will fail, and only further suppress and weigh down the global economy at the worst possible point in a long wave winter season.

In short, we suspect Kitchin cycle #16 will end badly. Its ending will finally bring and end to this long wave. However, if we are reading the long wave winds correctly, a colossal long wave global debt collapse is in the offing as the long wave grand finale into 2012. Our analysis suggests global equity markets will top here in 2010, in the final Kitchin cycle of this long wave, as the global black hole of debt exerts its deflationary gravitation pull, further destroying corporate efficiency. Consider yourself warned.

Forget the Mayans, the politicians in Washington, Brussels and Beijing, by trying to protect the world from financial folly, have foisted upon the global economy a debt bubble encompassing sovereign, state, municipal, corporate and individual debt and filled the world with delusional investors. The graft and greed on Wall Street, which packaged all the bad debt and sold it to unsuspecting investors is not helping. The amount of debt actually does threaten the survival of civilization and international capitalism, as we know it. However, be of good cheer, every trend will go too far and evoke its own reversal.

Washington and other capitals around the globe have no clue of the true depth of the anger that is building against the debt binge they are piling onto taxpayers. The seeds of the global political firestorms they have sown are sprouting and growing rapidly. The emerging political backlash will swing the pendulum back further than it otherwise would have. The rising political anger will be a more effective force now. The tea party regulars are only the cutting edge of a tsunami of political rage that we will anticipate will change the world radically. Even the German socialists are telling the Greeks they cannot consume more than the produce, who would have ever thought a German Chancellor would quote Ayn Rand on the cusp of a global debt collapse.

Just a word on Austrian school economists and thinkers that are often critics of long wave theory is appropriate. The reason for this is likely that Austrians want to attribute business cycles exclusively to government intervention, fiat money and central bank monetary policy. These forces deserve a great deal of the blame and carry much of the responsibility for the extremes of business cycles, large and small. However, what we suspect is that business cycles and long waves are natural phenomena to a large degree. There are natural feedback loops that produce time lags in human action, including economic and market action. Cycles are fields of human action in space-time. Even children demonstrate this simple principle on the playground.

System Dynamics at MIT and the work of Jay Forrester have validated the existence of the long wave due to simple feedback loops. In short, cycles would exist without government intervention and central banking. Government folly gets credit for making business cycles worse than they have to be, but not for creating the fields of human action that produce them. To ignore the overwhelming evidence for long waves and smaller cycles, which is not due to government intervention and monetary policy, shows a lack of a basic understanding of human action.

Enough of monetary theory, long wave analysis that is financial and therefore more practical than the views of monetary schools of long wave thought may be particularly relevant for investors at this stage. Studying the inflation adjusted S&P chart above, investors should recognize that we could get to zero return in 2012 on the 20-year average rate of return in a number of creative ways. Falling stock prices combined with a little deflation can get you there. Stock prices that stagnate or tread water during a major bout of deflation can get you there. Inflation that increases faster than stock prices rise can get you there. Hyperinflation that increases rapidly while stock prices go nowhere can get you there in a flash.

Our analysis calls for deflation and falling stock markets, but we always give Mr. Market room make the last call. There is a large degree of confidence that the 20-year rate of total return on the S&P 500 adjusted for inflation will effectively ring the bell for a long wave market low below 1% return, or come very close around 2012, before the current long wave exits stage right.

Investors need to review the chart above of long wave returns. Observe the degree to which corporate efficiency was destroyed, as reflected in stock prices at the 1949 winter season low. Does this chart suggest we have reached bottom in 2009, or does the long wave pattern tell us we have further to go? Do you feel lucky? This real data long wave chart suggests that most investment capital should remain holstered, but traders can still make hay with the smaller cycles until a new long wave spring season dawns.

Using the long wave family of cycles, Fibonacci in price and time, and stochastics, a new method of technical analysis, what we term Theory 144 Analytics, is a remarkably powerful tool for technical analysis. There is valuable application for both long-term investors and short-term traders. In the Theory 144 approach, the Wall cycle is a miniature long wave. Most traders will recognize this as the 20-week cycle. What traders typically do not know is that this cycle appears to fluctuate in Fibonacci ratios in time around an ideal length. The Quarter Wall cycle is, as its name implies, ¼ of the Wall cycle and is effectively a miniature long wave season. The focus for traders at LongWaveDynamics.com is providing actionable market intelligence using cycle research, Fibonacci in price and time, and stochastics to provide for identification of the tops and bottoms of the Quarter Wall cycle, along with the Wall cycle. For investors we focus on the long wave seasons and the regular business cycle.

We wish this article were heralding the arrival of a new long wave spring season. However, observing the trends in the global economy and the action in the global financial markets, we are not in a new long wave spring. A review of the generalized trends in place in a long wave winter, from the new edition Jubilee on Wall Street (2009) may be helpful. The winter season trends list in The K Wave (1995) edition of the book was discussed on the Internet in recent years. Some of these trends will reverse for extended periods during a long wave winter, but the basic trends are clear. This new list only required minor updates for the new edition:

- Stocks Down, Bonds Up, Commodities Down

- Global Stock Markets Enter Extended Bear Markets

- Interest Rates Spike In Early Winter, then Decline Throughout

- New Stock Offerings End

- Economic Growth Slow or Negative During Much of Winter

- Some Runaway Deflation and Falling Prices

- Commercial and Residential Real Estate Prices Fall

- Trade Conflicts Worsen

- Social Upheaval and Society Becomes Negative

- Bankruptcies Accelerate and High Debt Eliminated by Bankruptcy

- Stock Markets Reach Bottom and Begin New Bulls in Winter

- Overcapacity/Overproduction Purged by Obsolescence and Failure

- Greed is Purged from System

- Recessions Long and Recoveries Brief

- Free Market System Blamed and Socialist Solutions Offered

- Banking System Shaky and Fails

- A New or Restructured Banking System Introduced

- New Technology and Inventions Developed and Implemented

- Real Estate Prices Find Bottom

- New Work Ethics Develop Since Jobs are Scarce

- Interest Rates and Prices Bottom

- Debt Levels Very Low after Defaults, Bankruptcy and Forgiveness

- View of Future at Low Ebb

- Bright Spots Appear and Social Mood Improves

- There is a Clean Economic Slate to Build On

- Investors are Very Conservative and Risk Averse

- A New Economy Begins to Emerge

In conclusion, the three most important trends in winter should be highlighted that are the essential drivers of all the above trends; 1) debt deleveraging at all levels, 2) corporate failure due to production overcapacity that was funded with expensive debt, and 3) debt collapse driven price deflation. In surveying the U.S. and global markets and statistics, all three are under way, but government intervention has briefly delayed the day of reckoning-and the final leg down. The call at LongWaveDynamics.com is for compression of the remaining long wave winter trends in the period between now and 2012.

A global debt collapse, producing a modern day Biblical Jubilee of debt elimination will be the final act of this long wave. The ancient Biblical Jubilee was a time of public and private debt cancellation and celebration. There are remarkable parallels in the debt, production and the inflation and deflation trends of the long wave and the Jubilee. It is clear that unchecked ambition, greed, hopes and fears of the human heart play a role in the modern long wave “Jubilee” cycle. The Jubilee was to serve as a new beginning, which is exactly what the long wave will achieve for international capitalism. In light of the fascinating connection between the long wave and Biblical debt Jubilee, the new book contains a foreword by Billy Graham who wrote, “There is a great deal of uncertainty, and even fear, on the part of almost everybody when we think of the global economy, especially as it affects us personally. …I would recommend people of all walks of life who are concerned about their finances and the finances of their country to not only read, but study this book.”

We are genuinely optimistic. The debt collapse into 2012 will provide the global economy with a new beginning. A new golden age for international free market capitalism will dawn. Necessity is the mother of invention, even in global financial, economic and political affairs. What we are forecasting to rise from the ashes of the political and financial firestorm ahead is what we have termed The Great Republic. In The Great Republic, citizens will understand both fiat money and the value of digital gold currency, and the fact that you cannot consume more than you produce. Enjoy the new edition of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, it was a genuine pleasure to write it for you.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2010 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.