Gold Prices Move Higher As The European Union Dithers on Greece Debt Crisis Bailout

Commodities / Gold and Silver 2010 Apr 12, 2010 - 02:42 AM GMTBy: Bob_Kirtley

We’ll kick off with a snippet from The Economist in an article they published entitled: ‘The Wax Melts’ dated 8thApril 2010:

We’ll kick off with a snippet from The Economist in an article they published entitled: ‘The Wax Melts’ dated 8thApril 2010:

GEORGE PAPANDREOU may have spoken too soon. On April 6th, just three days after the Greek prime minister claimed “the worst is over,” the yield on Greek ten-year government bonds leapt from 6.5% to above 7%. Yields remain at alarming levels, rising above 7.5% at one point on April 8th.

The president of the European Central Bank, Jean-Claude Trichet, told a press conference that “default is not an issue for Greece.” But the D-word is increasingly on the lips of analysts. The cost of insuring Greece’s bonds surpassed that of Iceland’s this week; Greek banks have asked to tap a government liquidity scheme. Far from coming to an end, the Greek debt crisis seems scarcely to have begun.

On the face of it, this week’s renewed bond-market jitters were caused by growing doubts that an emergency-aid package patched together by European Union leaders last month offers Greece much help. Under the terms of the EU deal, any short-term support would have to be approved by all of the 16 countries in the euro zone. German anger at Greece’s profligacy could easily delay the cash it would need should bond markets close.

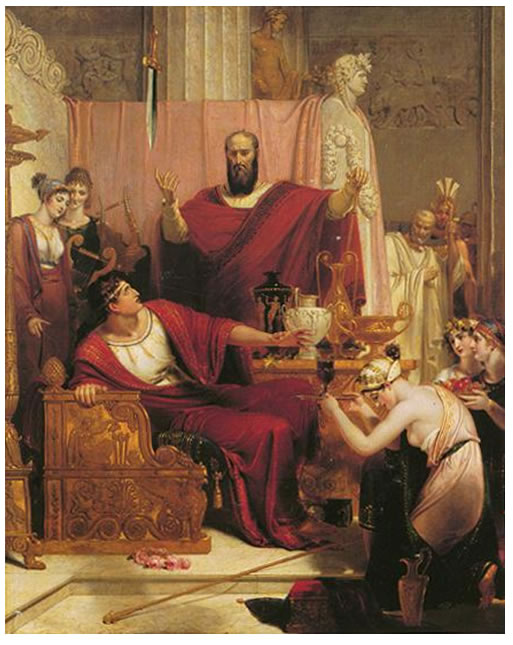

The Sword of Damocles

On the Business Hour yesterday, a radio programme down here in New Zealand, they were discussing the plight of the four top banks in Greece where it is rumoured that as much as 5% of the cash has been withdrawn over the last week and is believed to have left the country. The worry for the Greeks is that Greece defaults on its debt and leaves the euro, with all the euros in Greece being converted back to their traditional currency, the Drachma. The end result being a dramatic loss in terms of spending power for those still holding the baby when the music stops.

We just cant see this being allowed to happen but they are sailing rather close to the abyss for our comfort. The lack of action creates uncertainty which hangs like the Sword of Damocles over the euro. So worried investors look for safety and as we have witnessed this week the beneficiaries have been the the US dollar and gold prices.

As we can see from the above chart gold prices have made steady progress as the financial plight of Greece has unfolded. We must also note at this point that the US dollar is holding up well and trading at 80.94 on the USD Index. The RSI suggests that gold prices may be getting a head of itself and take a breather after this $80/oz increase in price, however, we would not bet on it at the moment.

What this issue is doing is catching and focusing the attention of investors on the precarious state of a number of the currencies. Apart from the usual suspects of of Spain, Italy, Ireland, Iceland, Portugal, etc, the United Kingdom is not far behind and the United States Dollar is holding up well, for now.

However, the Greeks are facing the music here and now as they cannot print more money to get themselves out of this mess, but the United States can and is printing as though tomorrow will never come. Sooner or later the euro will resolve these issues of a fashion and when it does the focus will once again land firmly on the buck sending it lower. Gold prices will then challenge and surpass its previous highs as it cannot be printed or electronically produced out of thin air.

All gold bugs need now is patience and the guts to keep increasing their exposure to the precious metals sector via the vehicle that best suits their needs, be it gold and silver or their associated mining stocks.

Our premium options trading service, SK Options Trading, has closed the last 7 trades, with an average gain of 51.17% in an average of 37 days per trade, why not drop by and take a peak.

For those interested in getting a bit more bang for your buck and adding a touch more excitement to your portfolio, then check out our Options Trading Service please click here.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.