US Interest Rate Cut - Bernanke Blinks First

Interest-Rates / Credit Crunch Aug 20, 2007 - 01:27 PM GMTBy: Andy_Sutton

Occasionally, on dark, secluded back streets, adolescents and other not so tightly wrapped folks engage in a classic American rite of passage known as 'Chicken'. The idea behind the game is for two cars to drive directly towards each other at a high rate of speed and see who swerves first. That person is dubbed the chicken. Obviously, it is easy to envision what happens if neither driver blinks.

For approximately the past two weeks financial commentators and observers have been watching a variant of this classic game. The markets, roiled in certainly the biggest blow-off since the end of the tech bubble, and perhaps of all time were screaming madly for the Fed to step in and open the discount window. CNBC host and industry shill Jim Cramer almost brought on a stroke screaming that Bernanke "doesn't know how bad it is out there!" On the other side was the Fed, stalwart, poised and resolute. Something had to give...

Tough Talk and Wobbly Legs...

Ben Bernanke and his fellow Fed governors have been talking tough. St. Louis Fed President William Poole made several references to the crisis and warned the markets that the Fed would not come to the rescue unless it became obvious that the risk to the financial system was severe. The Fed began backpedaling last week by injecting funds into the financial system in an effort to maintain the target for the Fed Funds Rate at 5.25%.

This morning, the Fed went into full swerve mode cutting the Discount Rate 50 basis to 5.75% from 6.25% This threw a floor under the markets which responded by opening nearly 300 points higher. This came after a suspiciously miraculous rescue from a 343 point intraday drop yesterday. Immediately, the market cheerleaders went into full pom-pom mode, calling a bottom and predicting new records by the end of the year.

Not so Fast...

So I have to ask - what has changed? We know that there are a couple main reasons for the recent bout of volatility:

1) Complacency with regards to risk and the proper pricing thereof;

2) All but absent lending standards on mortgages;

3) Inflationary monetary policies by world governments

Unfortunately, you don't just 'undo' the bad policies of the past seven years and expect everything to be better. Not without a price; things just don't work that way. Sure, banks have tightened their lending standards. Sure risk is being repriced. All things left equal, in time, things would correct nastily, but they would correct. But that is not politically acceptable, nor is individual responsibility. We all knew that eventually the Fed would give in and respond with large infusions of fresh money. There are certain institutions that have been deemed 'too big to fail' and need to be bailed out. However, this now goes well beyond the money center banks as the Fed's first injections never got the intended recipients. Putting cash in the hands of big money center banks was a lousy idea since they just hoarded it. Putting money directly in the hands of ailing hedge funds and lenders might be the next step. Today just made it cheaper for those who ail to borrow more. The Fed's logic being that a problem that was caused by too much easy money can somehow be fixed by more of the same.

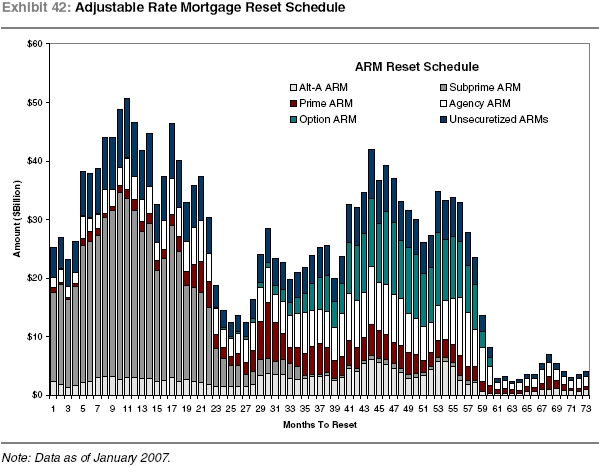

We know that the mortgage market is nowhere near out of the woods. Resets will continue (and accelerate) through the end of this year and well into next. The glut of homes coming onto the market through foreclosure and forced selling will cause home prices to deteriorate even further eroding consumer confidence.

The above chart depicts in dollars and by category the mortgages resetting going forward from January 2007. Right now, we are in the early stages of the spike with the bulk of those mortgages being of the subprime flavor. Throw in the alt-a's and option-ARM's and you're looking at the vast majority of these resets being of the type that sport the highest incidence of foreclosure. We still have a long, long way to go in this regard.

The repricing of risk has already led to the failure of 2 Bear Stearns hedge funds and the near-failure of a number of others. The downgrading in subprime mortgage tranches has only begun. Unless a good deal of illegal financial chicanery is used, more losses will occur going forward. More defaults and foreclosures in the mortgage arena will only exacerbate that problem. Clearly, nothing has changed.

The biggest problem I continue to see with this entire situation is that it is now very obvious that the tough love I spoke about in a recent commentary will only apply to those parties deemed insignificant and unimportant. The big boys now know they will be protected. The Bernanke Put is in full play. Such a statement will undoubtedly cause many investors to exclaim 'That's great! They should be protecting my money!' But at what cost will this protection come? Who will bear the expense? I have a sneaking suspicion those same investors will not like my answer. To get it all they have to do is find the nearest mirror.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. He currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.